New research reveals: ESG regulation creates strategic advantage for businesses globally

Companies are leveraging ESG regulations to strengthen business performance, despite regulatory uncertainty, study by University of Cambridge students and DNV finds.

Businesses are increasingly realizing the strategic value of ESG regulations in providing closer engagement with investors, shareholders, customers and employees, while reducing costs by driving operational efficiency, new global research reveals today.

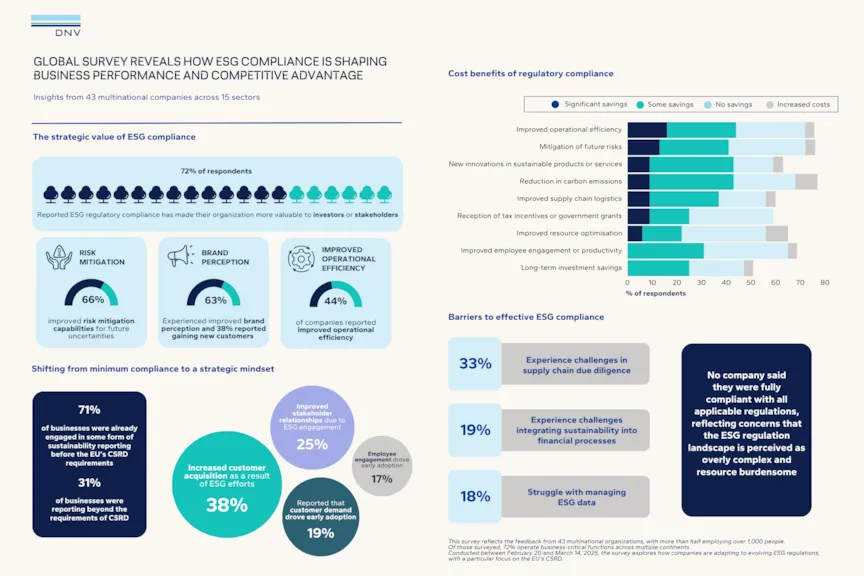

The study, conducted by students from the University of Cambridge’s MPhil in Engineering for Sustainable Development programme, in partnership with DNV, an independent assurance and risk management provider, found that 72% of businesses believe improving ESG regulatory compliance has increased their value to investors and shareholders. This shift reflects growing recognition that transparency and accountability are no longer just regulatory demands, they are also drivers of market confidence and long-term business value.

While many governments are scaling back regulatory ambitions, businesses are moving forward. Six in ten businesses report finding value in sustainability regulation, with a third actively and voluntarily participating in anticipation of benefits, including improved stakeholder relationships (25%) and increased customer acquisition (38%).

But the benefits extend well beyond external recognition. In the study, 44% of respondents said ESG reporting enhances operational efficiency and 43% stated it reduces costs associated with carbon emissions. Additionally, 66% of businesses said ESG reporting has helped them better manage operational risks, including supply chain disruptions.

Elizabeth Appel, Student at University of Cambridge MPhil student in Engineering for Sustainable Development programme at the University of Cambridge, said: “ESG regulation isn’t just about compliance, it’s about strategic advantage. Our findings show that businesses that are embracing ESG regulations are seeing concrete benefits across operations and stakeholder engagement; benefits that make them more resilient in the face of shifting markets, dynamic regulatory landscapes, and a changing climate. We find that businesses that invest in ESG see wider engagement on internal sustainability initiatives and innovation, which creates a forward-thinking culture that sets them apart from competitors.”

The research also explored the implications of major frameworks like the EU’s Corporate Sustainability Reporting Directive (CSRD), introduced in 2023. Remarkably, 71% of businesses were already engaged in some form of sustainability reporting before the CSRD’s mandatory requirements were implemented and 7% were going above and beyond the Directive’s requirements. Key drivers for this early adoption included customer demand (19%) and employee engagement (17%).

However, the study also highlighted significant barriers to effective ESG regulatory compliance. No company surveyed was yet fully compliant with all applicable regulations, reflecting concerns that the ESG regulation landscape is perceived as overly complex and resource burdensome.

The research was conducted in mid-February and early March 2025, just as the EU announced it was bringing forward its Omnibus Simplification Package to streamline and reduce the regulatory burden on businesses.

Further findings reveal:

Respondents said they would benefit from:

- Clearer regulatory guidance (26%)

- More financial support or subsidies (26%)

- Better digital reporting tools (23%)

- Stronger best-practice benchmarks (22%)

Internally, businesses identified further operational challenges, including:

- Integrating sustainability into financial processes (19%)

- Managing ESG data (18%)

- Supply chain due diligence (33%)

- Embedding ESG in management systems and corporate strategy (15%)

These challenges seem to be common across all industry sectors, irrespective of the headcount or turnover of the company.

Lars Sørum, Regional Manager, Europe, Supply Chain and Product Assurance, DNV, said: “Regulation such as the CSRD is accelerating a fundamental shift in how businesses think about sustainability. Even in markets where regulation is light, businesses are proactively building transparency and trust through ESG reporting. But while the ambition is high, capability often lags. To realize the full operational and strategic value of ESG, businesses need the right tools, resources and expertise.”

DNV urges businesses to see the extended CSRD timeline as an opportunity to act, not delay.

“The additional time is a gift,” Sørum added. “Use it to integrate ESG into your financial, governance and supply chain systems. Businesses that move early will be better positioned to meet stakeholder expectations and outperform competitors in a more transparent, sustainable economy.”

Click to enlarge