FuelEU Maritime – flexibility mechanisms and pool verification

In July 2025, DNV published the statutory news “FuelEU Maritime: Key updates on fuel certification, methane slip, and exemptions”. Building on this, and considering customer engagement, this statutory news provides further clarification regarding the application of flexibility mechanisms such as banking, borrowing and pooling.

Information for: Ship owners and managers with vessels subject to FuelEU Maritime.

Three FuelEU Maritime flexibility mechanisms

Companies may voluntarily apply flexibility mechanisms to a vessel’s compliance balance (CB) as outlined in Articles 20 and 21 of Regulation 2023/1805. Companies can:

- Bank compliance surplus

- Borrow an advance compliance surplus

- Pool a compliance balance.

Prerequisites for applying flexibility mechanisms

There are two requirements a vessel must meet before applying flexibility mechanisms:

- The vessel must fall within the scope defined in Article 2(1), meaning it has a gross tonnage above 5,000 and is used for transporting passengers and/or cargo for commercial purposes to or from an EEA port [1]

- The FuelEU report must have been verified as “Satisfactory”.

Compliance balance (CB)

The CB reflects a ship’s measure of over or under-compliance regarding the limits for the yearly average GHG intensity of the energy used on board.

The CB is determined by calculating the difference between the GHG intensity target for the given reporting year and the ship’s actual GHG intensity of the energy used on board, and then multiplying that difference by the sum of total energy consumption from fuels and shore-side electricity within the scope of the FuelEU regulation.

The calculation formula:

For more details, a breakdown of the formula is provided in the DNV white paper on the FuelEU Maritime.

The flexibility mechanism process

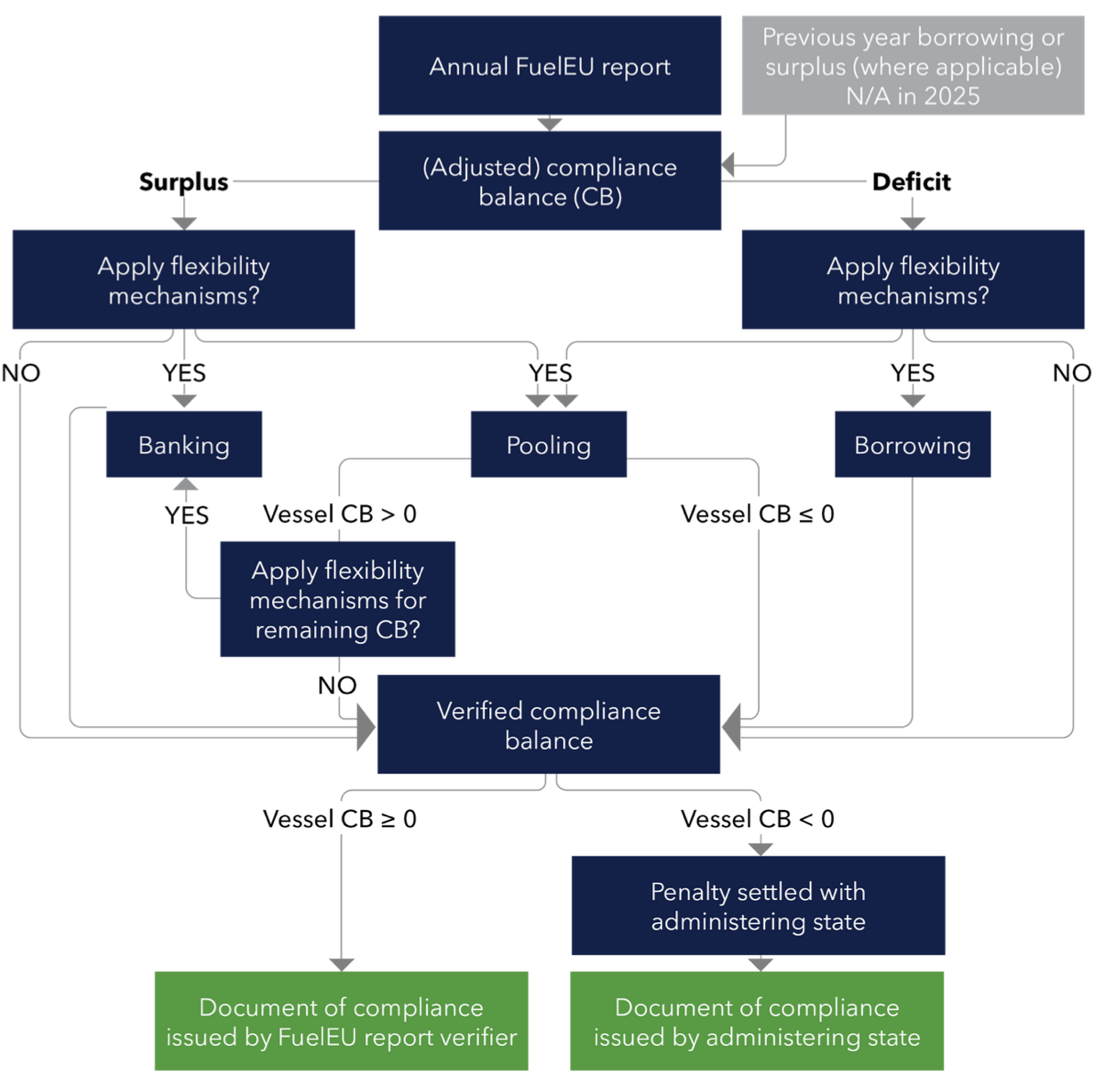

The following figure explains the three main flexibility mechanism options:

The Initial Compliance Balance (ICB) is shown in the verified annual FuelEU report, and it represents the CB prior to applying any flexibility mechanisms or Adjusted Compliance Balance (ACB). The ICB can be positive, negative or zero.

The ACB is calculated when the compliance balance has been banked or borrowed in the previous reporting period (this means it does not apply to 2025 reports because 2025 is the first reporting period for FuelEU). It can be positive, negative or zero.

The Verified Compliance Balance (VCB) is the final CB, calculated after the application of flexibility mechanism(s). If it is positive or zero, the verifier (such as DNV) can issue a Document of Compliance for the ship. If it is negative, the associated administering state calculates the related penalty and issues the Document of Compliance once the penalties are paid.

Advance Compliance Surplus (ACS) is the amount a company borrows under the “borrowing” compliance option from the next period, ensuring the VCB is zero.

See Appendix 1 below for more information on the CB process.

FuelEU Maritime regulatory timeline

The FuelEU regulatory timeline for the upcoming submission/verification period is shown below.

The process begins with the submission of the annual FuelEU report by the company to an accredited verifier by 31 January of each year.

By 31 March, at the latest, the verifier records the annual FuelEU report in the FuelEU database (THETIS-MRV), consisting of relevant information and the ICB, which is automatically generated in the report. At this point, the previous year’s use of flexibility mechanisms is taken into consideration (except in 2025). The ACB will automatically be calculated in THETIS.

By 30 April, the verifier must confirm the compliance balance in THETIS. Therefore, by this deadline, the company must ensure that any applied flexibility mechanisms have been reviewed and approved by the verifier, and that each ship has a verified compliance balance before the end of April.

Note: If a vessel enters a pool and exits with a surplus, that surplus can then be banked. This scenario requires two separate verifications – pooling and banking – both of which must be completed before 30 April.

Rules for applying flexibility mechanisms

Banking rules

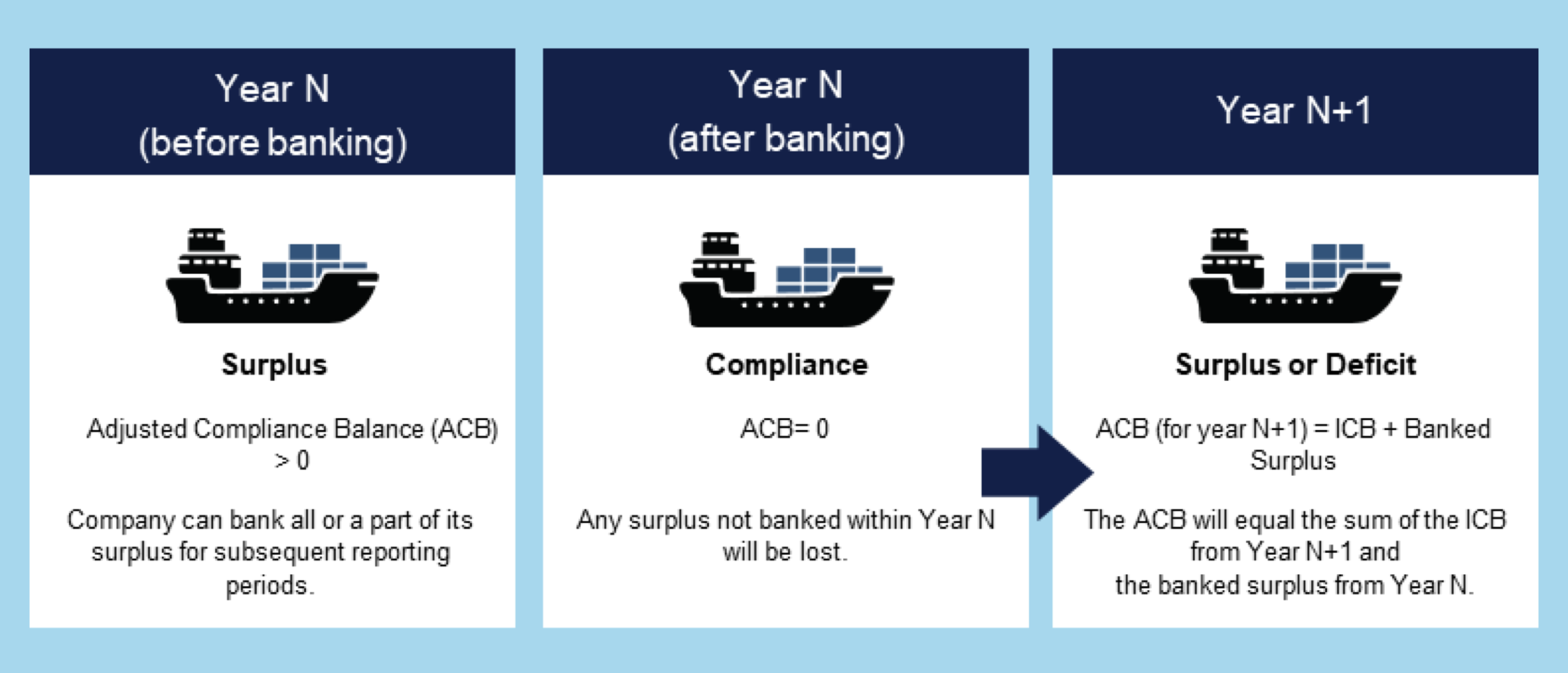

A vessel with a positive compliance balance in a reporting period can bank all or part of its surplus for subsequent reporting periods in THETIS. Banking is ship-specific, so in subsequent years it can be used to offset deficits of the same vessel. However, surpluses banked from previous reporting periods can also be utilized in future compliance pools, as they are incorporated into the ACB calculations.

The surplus does not expire and follows the ship in case of a change of company. If it is not banked in that year, the not-banked portion is lost – as illustrated below:

Borrowing rules

If the CB is negative, the vessel can request in THETIS to borrow an Advance Compliance Surplus (ACS) from the following year (reporting period year N+1). The borrowed amount is limited to 2% of the GHG intensity target for the reporting period year N, multiplied by the ship’s total energy consumption. Additionally, the borrowed amount is subject to a 10% increase the following year. The company may not borrow only part of the deficit; it must either borrow the entire deficit or not borrow at all.

Borrowing cannot take place in two consecutive reporting periods and cannot be done simultaneously with pooling in the same reporting period. If a ship did not call at an EU [2] port during the reporting period, but had borrowed an ACS in the previous period, then the administering state must notify the company by 1 June of the verification period. The notification will include the FuelEU penalty amount that the ship initially avoided by borrowing the ACS. This amount is then multiplied by 1.1 to account for the borrowing interest, as illustrated below:

[2] Note: A ship with an advance compliance surplus (ACS) from a previous reporting period can participate in a pool.

Pooling rules

After the ACB has been calculated, ships can choose to enter a pool to reduce or offset their deficits or to allocate their surplus. For a vessel to be eligible to enter a pool:

- The ship must be within the scope of the FuelEU Maritime regulation

- The ship did not borrow compliance in the current verification period

- The ship is included in only one pool of CB for GHG intensity in one reporting period

- The ship has a valid FuelEU Document of Compliance from the most recent verification period

Two or more vessels, including from different companies, can join a pool and allocate the CB between them. The allocation principles:

- Ships which enter a pool with a deficit cannot have a higher deficit after allocation.

- Ships which enter a pool with a surplus cannot have a deficit after the allocation.

Regarding the allocation of compliance within a pool, ships may exit with a deficit if the overall pool compliance balance remains zero or positive. It is also possible to join a pool where all ships are already compliant, solely to redistribute surplus compliance among the vessels.

Pooling verification

After a company registers its pooling intention in the THETIS database, specifying the ships involved, the allocation of the total pool compliance balance, and the selected verifier. All participating companies (if more than one is involved) must then validate the pool set-up. Once this validation is complete, the pooling rules, such as ensuring a positive total compliance balance and proper allocation of surpluses and deficits, must then be verified by the verifier. If all regulatory conditions are fulfilled, the pool can be verified.

After the pool has been verified, each vessel exiting the pool still needs to have the CB verified.

Note: As mentioned earlier, if a vessel enters a pool and exits with a surplus, that surplus can then be banked. This scenario requires two separate verifications: pooling and banking.

Penalties

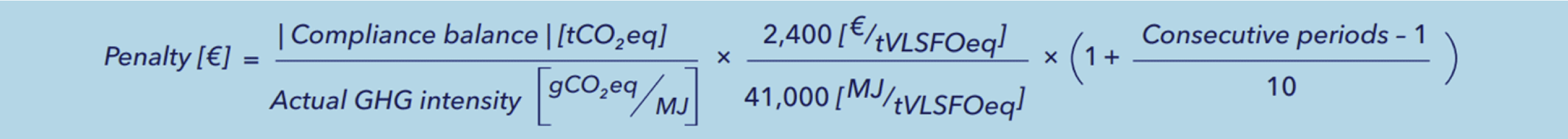

Penalties are imposed when a ship fails to meet a compliance balance of at least zero. When a penalty is payable, it progressively increases by 10% for each consecutive reporting period for which a penalty applies. The penalty is set at €2,400 per tonne of VLSFO energy equivalent, or approximately €58.54 per GJ of non-compliant energy use.

The calculation formula:

For more details, a breakdown of the formula is provided in this DNV white paper.

Recommendations

- Ensure preparedness within the short timeline by planning both the submission process and the handling of flexibility mechanisms across your fleet and those of your pooling partners

- Clearly define your compliance strategy with potential business partners, whether you hold a surplus or a deficit.

- Establish and communicate roles and responsibilities within the pool (e.g. pool administrator, pool members).

- Stay informed and check for regular updates, as additional guidance documents and implementation acts are currently being revised and developed.

References

- Technical and Regulatory News from 17 July 2025: FuelEU Maritime: Key updates on fuel certification, methane slip, and exemptions

- DNV white paper: FuelEU Maritime – Requirements, compliance strategies, and commercial impacts

- DNV topic page: FuelEU Maritime: Regulation insights and support

- Chapter 4 of the ESSF SAPS WS1 Report on FuelEU calculation methodologies

- FuelEU webinars: Reducing GHG emissions, EMSA – European Maritime Safety Agency

- The Commission’s website: Decarbonising maritime transport – FuelEU Maritime – Mobility and Transport