This region comprises all European countries, including the Baltics but excluding Russia, all the other former Soviet Union Republics, and Turkey.

Austria, Belgium, the Czech Republic, Finland, France, Germany, Italy, the Netherlands, Norway, Poland, Spain, Sweden, and the UK account for 80% of region energy use.

| 2024 | 2060 | |

| Population | 545 million | 538 million |

| GDP* | USD 30.1 trillion | USD 42.4 trillion |

| GDP/person | USD 55 300 | USD 78 700 |

| Energy use | 67 EJ | 56 EJ |

| Energy use/person | 123 GJ | 104 GJ |

| CO2 emissions** | 3.2 Gt | 0.1 Gt |

| CO2 emissions/person | 5.8 tonnes | 0.2 tonnes |

*All GDP figures in the report are based on 2017 purchasing power parity and in 2023 international USD.

**Energy- and process-related CO2 emissions, after CCS and DAC.

Europe’s ambitious Green Deal policy framework advancing energy security, renewable energy, and climate action faces a complex balancing act of mobilizing funding, strategizing technology development and supply-chain competitiveness, and keeping energy affordable for business and citizens.

Current situation

Fossil fuels

in primary energy supply

Imports

Fossil fuel imports cover >90% of EU oil and gas consumption

Higher energy prices

above pre-crisis levels

Losses (USD)

from the three costliest extreme weather events in 2024

- Fossil fuels account for 67% of primary energy supply. In power, renewables contributed 50% in 2024, with around 16% from hydropower.

- Fossil fuel imports cover >90% of EU oil and gas consumption (EC, 2025a) with an import bill accounting for 2.5% of the EU’s GDP in 2023. The share of Russian gas imports has dropped from 45% in 2021 to 19% in 2024 (EC, 2025b) with diversification of suppliers and sources.

- Energy prices remain significantly above pre-crisis levels. After 2021–2023, industrial gas and electricity prices are two to four times higher than in key EU trading partners. Household retail electricity and gas prices also remain elevated, with the energy component exceeding historical averages before Russia’s war on Ukraine (EC, 2025a).

- Climate risks range from rainfall and flooding to heat, droughts, and wildfires (EEA, 2025). Economic losses from the three costliest extreme events in 2024 were close to USD 14bn (Ware et al., 2024). The European Central Bank estimates water scarcity will put 15% of the euro area’s economic output at risk (ECB, 2025).

Pointers to the future

- EU regulatory stability amid geopolitical volatility remains a competitive advantage, reflected in a 63% rise in renewables investment in H1 2025 compared to H2 2024. (BloombergNEF, 2025).

- Negotiations on the EU’s 2040 emissions target are testing climate ambition under competitive pressures. The proposed 90% GHG reduction includes flexibility – up to 3% via international credits from 2036 and domestic removals integrated into the EU ETS (EC, 2025a). However, reservations from major Member States and the European Parliament (Genovese, 2025) have delayed decision-making (as of 22 September 2025) and the EU’s joint updated nationally determined contribution (NDC).

- European courts are shaping energy and transition finance with the Court of Justice of the EU upholding the European Commission’s classification of nuclear and gas as ‘environmentally sustainable’ under the taxonomy regulation (CJEU, 2025), and the EFTA Court opinion that EU law prohibits fossil-fuel project approvals without assessing Scope 3 emissions (EFTA Court, 2025).

- The EU’s Clean Industrial Deal (February 2025) and its State Aid Framework, CIDSAF (from June 2), mark a shift in industrial support policy, offering CAPEX and OPEX support for cleantech manufacturing and decarbonization objectives, including electricity price relief for energy-intensive industries (EC, 2025c).

- The European Commission’s multiannual (2028-2034) budget proposal (nearing EUR 2 trillion) prioritizes strategic autonomy. It targets 35% of total spending towards climate and environmental objectives. Streamlined funding includes the European Competitiveness Fund (EUR 409 billion), the Innovation Fund (EUR 41 billion), both notably focusing on industrial transformation, infrastructure upgrading and cleantech, and USD 32 billion (EUR 30 billion) to the Connecting Europe Facility for cross-border transport and energy networks/infrastructure.

- Europe’s energy security will rely mostly on renewables and energy integration. Electrifying mobility, heating and industry enhances independence. Continued support is expected for commercialization of critical technologies and infrastructure, offshore grids, hydrogen, and carbon capture and storage (CCS).

The energy transition indicators

Primary energy consumption (EJ/yr)

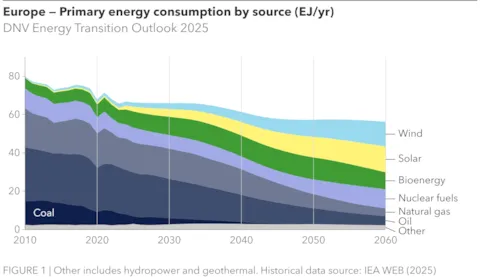

The primary energy mix has been dominated by fossil fuels, but their share will drop from 67% today to 33% in 2047 – coal will then be at 0.5% and oil use will have been falling, on average, by 100 million barrels a year. The fossil energy will be replaced by wind and solar energy, whose combined share reaches 33% in 2049. Bioenergy and nuclear energy will remain more stable, together growing by about 10% per decade.

Final energy demand (EJ/yr)

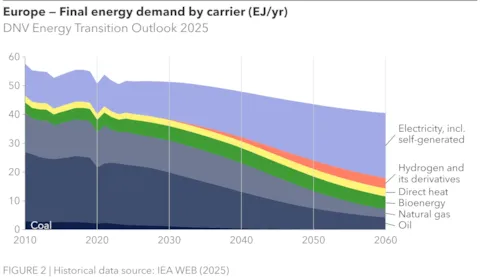

Electricity build-out is continuing and ramping up. After edging up from a 17% to a 21% share in the past 25 years, its share will double in the next 25. This electrification brings higher efficiencies, helping to make final energy demand decline from 2030. Hydrogen and its derivatives will start to tackle hard-to-abate sectors, reaching 1% of final energy demand in 2033 and 5% in 2045.

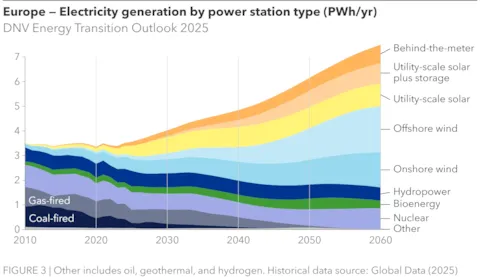

Electricity generation (PWh/yr)

Electricity generation will double by 2056. The power sector itself is seeing a true transition – solar and wind are not only replacing fossil power but also adding more on top. In 2038, wind and solar will generate 50% of power on the grid. Consequently, starting in 2031, more solar PV will be installed with storage than without. Offshore wind will grow beyond onshore wind, nearly quadrupling total wind capacity by mid-century.

CO2 emissions after CCS (GtCO2/yr)

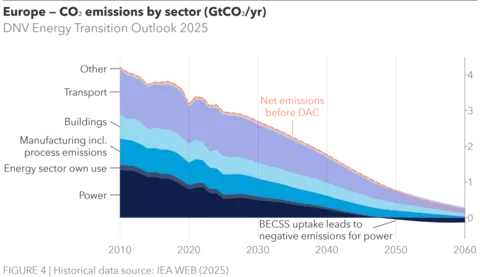

Europe’s emissions will continue to decline quickly, but not fast enough to reach net zero by 2050. Transport and building emissions will drop through widespread electrification of their energy demand. Through carbon capture of bioenergy, the power sector will be net-negative by 2048. Factoring in 65 MtCO2 of direct air capture, Europe reaches net zero in 2064.

Households: The last frontier of European decarbonization

Households are Europe’s most complex decarbonization challenge, harder to shift than power generation and manufacturing. The difference lies in structure and incentives. Power and manufacturing are concentrated in the hands of a small number of large emitters whose plants and factories operate from fixed sites with measurable outputs. Their centralized infrastructure makes monitoring and compliance easier, enforced through systems such as the EU Emissions Trading System (ETS-2).

Power and manufacturing also plan and invest on long cycles, often spanning decades. Energy companies and steelmakers respond to carbon prices, subsidies and tax credits, integrating technologies such as electrification or carbon capture into existing investment plans. Governments, in turn, can support these shifts with confidence that grants or loans will produce measurable reductions. That is why Europe has been able to reorganize entire systems through France’s nuclear programme or Germany’s Energiewende : once political direction was clear, a handful of actors could be mobilized to deliver change at scale.

Households sit at the opposite end of the spectrum: millions of fragmented decision-makers, each with different incomes, housing situations and priorities. Their choices are shaped by immediate concerns such as the rent, the mortgage, or the cost of a new boiler. Politics is more sensitive, the levers weaker, the inertia stronger. Policies that directly touch households can trigger resistance, exemplified by France’s gilets jaunes protests against fuel taxes. Shifting household energy use requires not just new technology but also subsidies, building codes, and behavioural nudges – interventions that are diffuse, slower to deliver results, and politically more delicate.

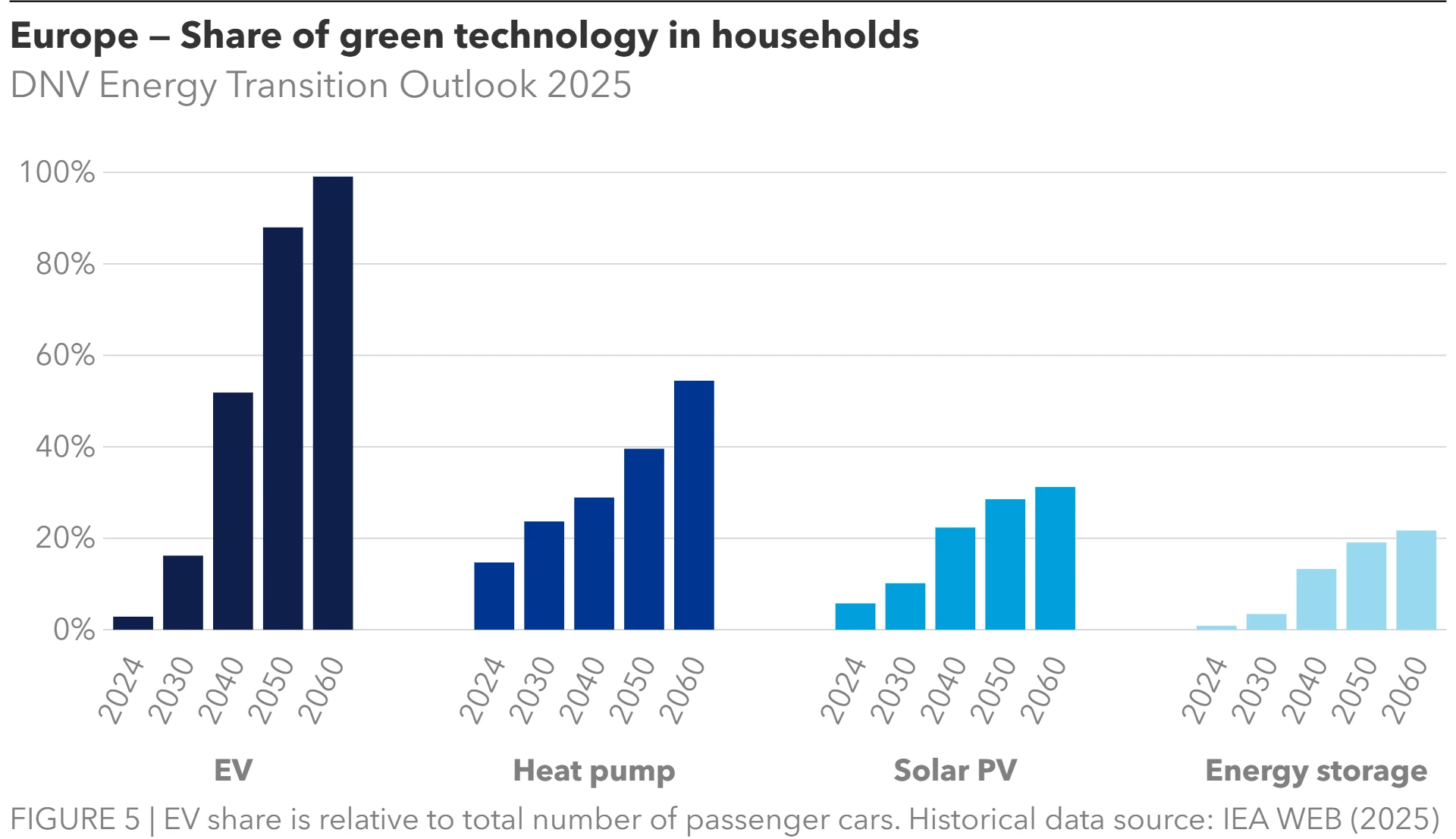

Europe is emerging as the testing ground for household decarbonization. Heat pumps, rooftop solar, home batteries, and electric vehicles (EVs) are moving out of the margins and into the mainstream (Figure 5). By 2040, more than half of Europe’s households are projected to have a heat pump, while solar panels rise from single digit percentages of households today to roughly one in three homes. EVs will dominate new car sales in the 2030s, with the vehicle stock approaching parity with petrol cars by 2040. Batteries spread more slowly but gain momentum as solar capacity grows. No other region, apart from China, is moving at this pace. Europe will therefore be the first to confront households as the new frontier of decarbonization, with all the lessons and tensions that entails.

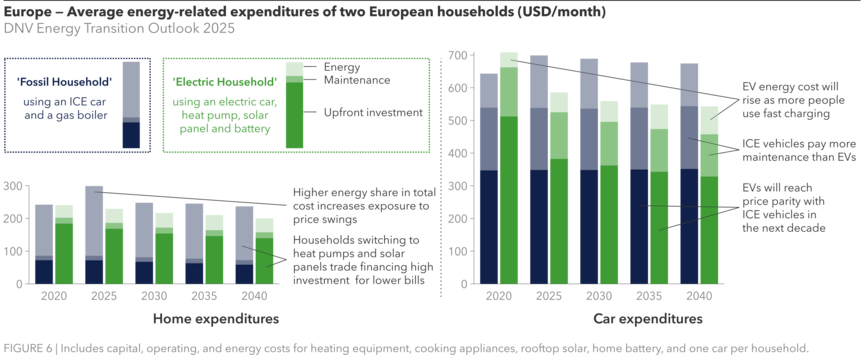

The financial picture underlines both the scale of the challenge and the prize. Figure 6 contrasts a fossil household – with a petrol car and gas boiler – against an electric one combining EV, heat pump, rooftop solar, and a battery. In 2024, capital outlays for the electric home are about 60% higher but savings on fuel and heating already trim monthly bills. Over the 2030s and 2040s, total spending is roughly a third lower than in the fossil case, with the balance of costs shifting from fuel to capital over time. That shift not only delivers lasting savings but also shields households from the kind of fuel-price shocks Europe experienced during the gas crisis of 2022. Europe’s high energy prices, and its wide spark spread – the cost of electricity minus the cost of natural gas needed to produce it – magnify these dynamics, making electrification more attractive in this region than elsewhere. Costs will fall further, but deferring policies that make electrification more attractive risks locking households into fossil equipment. The transition delivers gains, but only for those able to shoulder the upfront cost.

These savings are not shared equally. Low-income households face the obvious constraint of limited disposable income, which makes it harder to finance the upfront costs of a heat pump or an EV, even when long-term savings are clear. Renters confront a different problem: landlords decide on boilers, insulation, and rooftop solar, but tenants pay the energy bills, creating a split incentive that slows investment. Those in multi-unit buildings face further hurdles, from the lack of roof space for solar panels to the technical complexity of retrofitting shared heating systems. In practice, this means that the households most exposed to high energy prices are often the least able to act on them – a divide that maps unevenly across Europe.

Financing tools are meant to close this gap. Germany’s KfW (KfW, 2024) has long provided low-interest loans for home retrofits, while France subsidizes heat pumps through its MaPrimeRénov’ scheme (IEA, 2023). Nevertheless, coverage is uneven and often regressive: better-off households with easier access to credit and professional installers are more likely to benefit, while those most in need either fail to qualify or are deterred by bureaucracy. Experiments with on-bill financing or green mortgages remain small in scale. Without broader reach, Europe risks reinforcing an inequitable split between early adopters who enjoy falling bills and those left locked into fossil fuels.

Delaying adoption carries another cost: lock-in. Boilers, cars and heating systems typically last a decade or more, meaning that if a household replaces like-for-like with fossil equipment today, it may not face another decision point until the 2030s or 2040s. Each missed cycle prolongs reliance on fossil fuels and locks households into higher and more volatile energy bills. That is particularly acute in Europe where prices are already among the world’s highest. Some governments have begun to tackle this with rules that steer replacements: Germany is phasing out new oil and gas boilers from 2024, the Netherlands has set a ban on standalone gas boilers in new homes by 2026, and Denmark already requires heat pumps or district heating in most new buildings (EC, 2023). But policies are inconsistent. Belgium and Germany still grant generous company car tax breaks for petrol and diesel, and many southern and eastern European states continue to permit fossil heating systems in new dwellings. The result is a transition that accelerates in some places while stalling in others.

Regional divides sharpen the picture. Northern and western Europe, with higher incomes, larger homes, and more established subsidy schemes, are already ahead on heat pump (EHPA, 2024) and EV adoption. In southern Europe, older building stock, smaller dwellings and hotter climates limit the scope for heat pumps and batteries, while lower incomes slow uptake even where subsidies exist. Central and Eastern Europe faces the toughest combination: low purchasing power, weaker fiscal capacity for government support, and in many cases a legacy dependence on coal or district heating networks that are costly to convert. These contrasts show why Europe’s household transition is not a single story but a patchwork, with some regions racing ahead and others struggling to clear the first barriers. Closing the gap will require tailored support – subsidies, financing tools, and tariff reform – underpinned by sustained political commitment.

The decisive factor in crossing this last frontier of decarbonization is not technology or cost, but political will. Heat pumps, EVs, and rooftop solar are already viable and increasingly competitive, yet the policies that would make them universal are repeatedly delayed or diluted. Governments retreat not because solutions are lacking, but because they fear the electoral price of imposing them. That fear is sharpened by the risk of inequity: subsidies claimed by middle-class homeowners can look like handouts to the well-off, while the poorest continue to pay higher energy bills. If household decarbonization is perceived as unfair, it can erode support for climate policy more broadly.

This caution leaves the household transition as Europe’s most fragile, but also its most decisive test. Unlike power plants or factories, the politics of the home are intimate, visible, and contested – which is precisely why leadership matters. The future of Europe’s energy transition will be decided not in Brussels boardrooms or factory floors, but in its kitchens, basements, and driveways.

Security concerns guide the energy policy

Energy policy in Europe is no longer driven only by climate objectives and affordability concerns; energy security has emerged as an equally critical pillar (Directorate-General for Energy, 2025a). Energy security is the reliable availability of energy at all times. There is a growing recognition that energy security has been and will be challenged by a wide range of scenarios – geopolitical disruptions, extreme weather enhanced by climate changes, and depletion of non-renewable and rare resources. Ensuring reliable availability of energy requires a system capable of absorbing shocks, adapting to change, and maintaining supply without compromising long-term sustainability and economic stability.

Diversity naturally enhances energy security by reducing systemic risk. By avoiding overreliance on any single energy source, supplier, or physical energy infrastructure , Europe will better withstand disruptions and adapt to changing conditions. This principle has gained renewed importance after first shutting down nuclear power plants followed by struggling to reduce dependence on Russian gas. By continuing the energy transition, Europe is diversifying into multiple energy sources (see Figures 1-3). However, there are voiced concerns against transitioning to an overreliance on solar and wind power. Diversifying in a secure manner includes increasing LNG import capacity, investing in nuclear and hydrogen, and strengthening cross-border interconnections.

Towards energy autonomy

Europe is currently importing 56% of its primary energy as fossil and nuclear fuels. The security risk associated with being dependent on importing oil and gas, which must be continuously imported and are subject to volatile prices and geopolitical influence, became clear with the Russian invasion of Ukraine in 2022. However, it will take time for Europe to transition away from fossil fuels. To secure access to natural gas, the EU is diversifying its gas supply sources, both through pipeline and LNG. In addition, the EU has reinforced its rules to filling natural gas storages up to 90% before winter to absorb shocks (European Parliament, 2025).

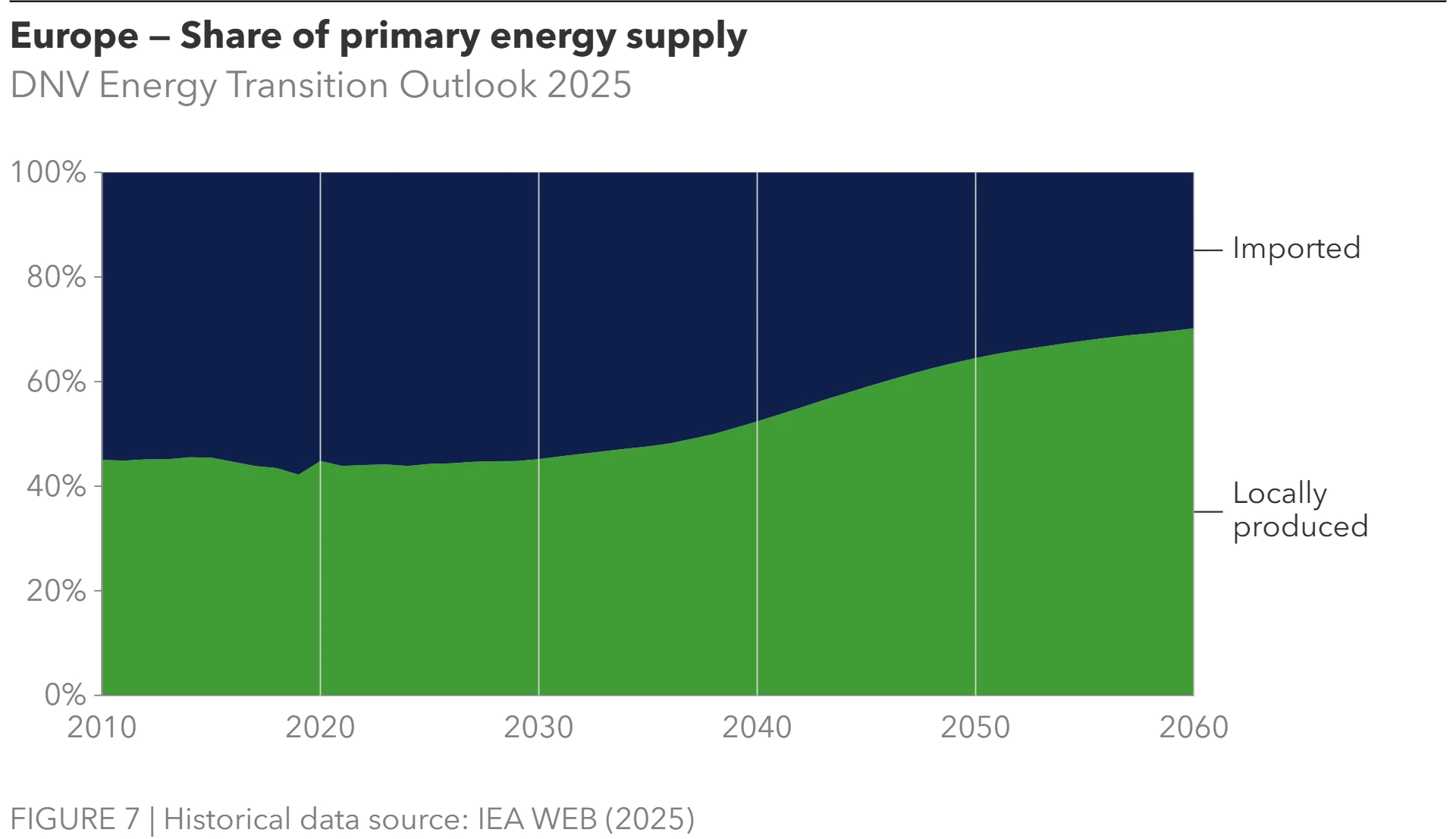

Long term, the sharpening focus on energy security will see energy import dependence fall from 56% today to 30% by 2060 (see Figure 7). This is achieved by diversification and transitioning from fossil fuels to solar and wind. Unlike oil and gas, solar panels and wind turbines generate energy locally once installed, even if the parts are imported. This shift fundamentally changes the nature of energy security: by producing more energy within the region, Europe becomes less exposed to the shifting fuel prices and dynamical geopolitics of external suppliers.

Scattered infrastructure is less critical

Europe’s energy system is both spread out and clustered – and that mix shapes its security risks. Offshore wind farms, rooftop solar, and distributed storage disperse generation and add redundancy, but they also multiply entry points for cyber and physical intrusion. By contrast, concentrated nodes such as offshore oil and gas platforms, LNG terminals, cross-border interconnectors, and pipelines create single points of failure.

Recent incidents underline the exposure: the Nord Stream blasts on 26 September 2022 disabled key gas routes in the Baltic; Denmark and Sweden closed investigations in February 2024 without naming culprits, and a suspect extradition case continues in Germany and Italy. In October 2023, the Balticconnector gas line between Finland and Estonia was damaged, causing it to be closed for six months. Beijing acknowledged in August 2024 that a Chinese-owned vessel’s anchor accidentally caused the damage – an explanation many European officials view with caution. Repeated disruptions to Baltic subsea cables since late 2024 have reinforced concerns about hybrid activity around seabed assets.

Security is now as much about software as about fences. Grid protection devices and digital substations expand the attack surface; lessons from Ukraine show how remote access and compromised human-machine interfaces can trip breakers. Practical safeguards are well known, from segmenting networks to ensuring timely updates and rehearsed response plans, but their adoption remains uneven, leaving critical assets exposed. DNV’s latest industry research (2025 a) finds operational technology (OT) still trails information technology (IT) in resilience, even as investment rises, and stresses supply-chain and workforce gaps that matter for platforms, pipelines, and grids alike. The EU and NATO meanwhile warn that energy assets are “soft targets” for hybrid tactics; the CER Directive (in force since 23 October 2024) and NIS2 raise the bar for risk management across critical entities. The policy thrust is clear: design for resilience, assume contested seas and networks, and professionalize cyber-physical security as core operations rather than compliance add-ons.

The transition itself alters Europe’s risk profile. Fossil infrastructure will remain critical well into the 2030s – offshore oil and gas platforms and cross-border pipelines continue to underpin energy supply – and these assets will stay attractive targets for sabotage or coercion. At the same time, the rise of renewables and electrification shifts attention towards digital control systems, power electronics, and transmission backbones. Europe’s future energy mix is therefore neither inherently safer nor more exposed; it is simply exposed in different ways. Cybersecurity, physical protection, and collective defence become inseparable dimensions of energy security, with resilience depending on how effectively governments and operators manage this changing balance.

Flexible grid power generation and demand needed

As Europe is expected to depend more on electricity (Figure 3), the reliability of the power on the grid becomes increasingly central to energy security. This shift coincides with a growing share of solar and wind power. While these energy sources are key to decarbonization, their variable nature introduces new challenges in maintaining consistent supply.

- There can be extended periods of low solar and wind output – called a Dunkelflaute. These events can last several days and severely strain the system, particularly during cold winter days when the demand is high. See more details in our ETO for Germany (DNV, 2025b).

- The Iberian Peninsula blackout of April 2025 occurred in an opposite situation, where more than half the delivered power was solar. Although the precise cause remains uncertain, the incident has reignited the debate around grid stability, and the need for system inertia traditionally provided by fossil and nuclear plants. See Chapter 3 of the main report for more details.

To address these risks, Europe is tackling the grid, storage, demand, and supply. The grid was originally designed for firm power, not variable renewables. The European Commission has launched guidance on ensuring that electricity grids are fit for the future (Directorate-General for Energy, 2025b). This initiative aims to accelerate grid expansion, improve planning processes, and ensure that infrastructure is ready for future demand and renewable integration. Part of this effort is also to improve cross-border interconnections. However, real progress is delayed at the national level, by not transposing these regulations from the EU to the member states quickly enough.

To smooth out the production, storage will be needed. The EU is preparing a dedicated energy storage package to drive deployment and remove regulatory barriers. Spain has already taken concrete steps by mandating battery storage in all projects funded under its near EUR 150 million innovative renewables program (Pedrosa, 2025). These co-located systems are designed to stabilize output and improve grid reliability, especially during periods of high solar generation or low renewable availability. In parallel, demand-side flexibility can help smooth consumption and reduce stress during critical periods, as was done with success to reduce the gas demand following the Russian invasion in 2022.

In addition, diversity in power generation will be needed. To ensure reliable availability, Europe will invest in dispatchable power sources such as hydropower, bioenergy, and gas with CCS. This also includes investing in hydrogen generation, which can both be used in hydrogen power plants to generate power and act as a flexible load.

Competitiveness of industrial power prices in focus

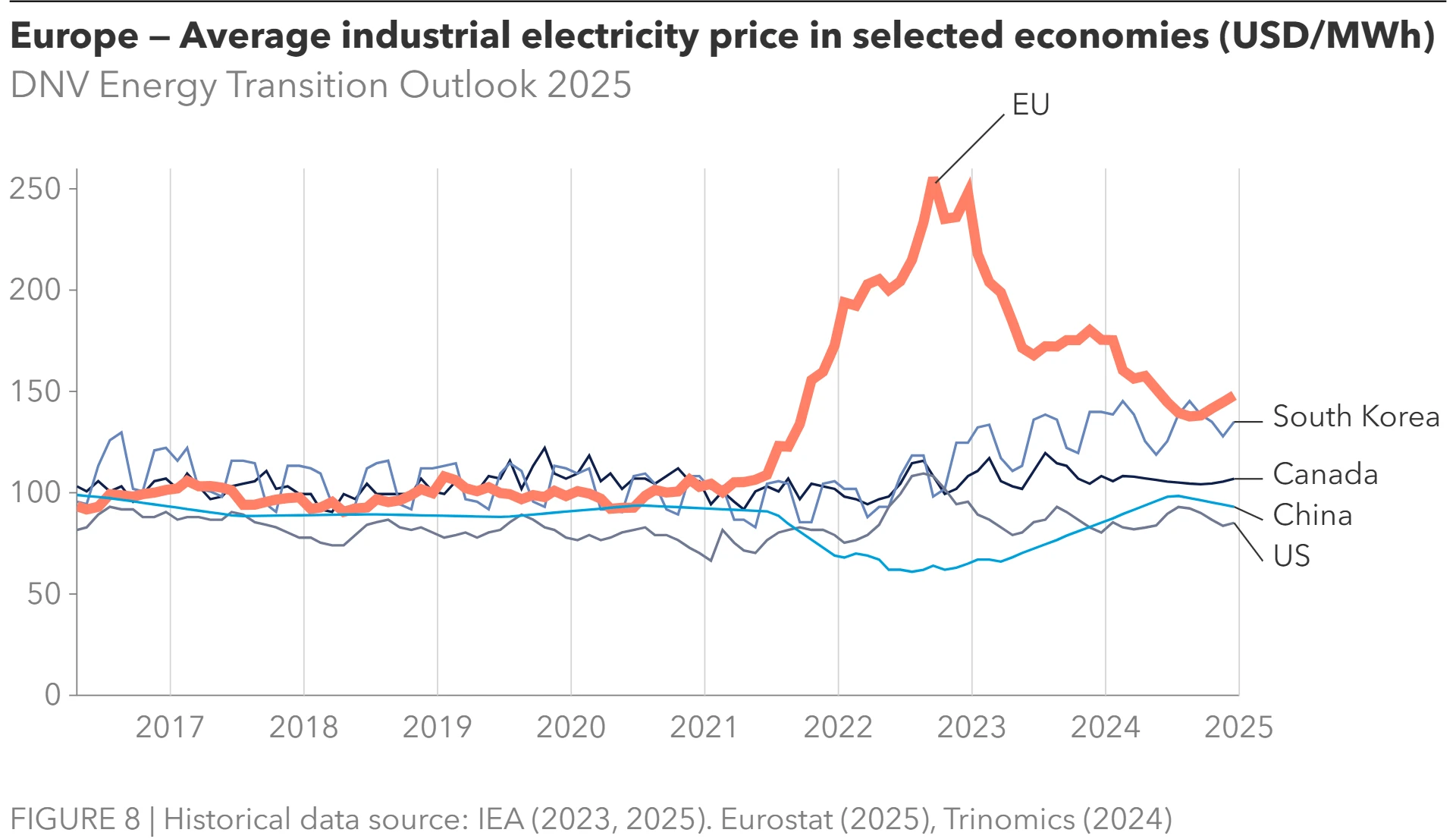

Europe’s industrial competitiveness is under mounting pressure from high and volatile electricity costs. The spike in prices during the 2021–2022 gas crisis, shown in Figure 8, exposed the vulnerability of European industry to global fuel markets. While prices have since moderated, they remain well above levels in North America and Asia.

Structural factors underpin this divergence. Europe’s heavy reliance on imported natural gas, limited domestic fossil resources, and fragmented market design amplify exposure to global shocks. Renewables are growing rapidly, but their variability creates integration costs and leaves wholesale prices sensitive to fluctuations in gas and carbon markets. In contrast, the US benefits from abundant domestic shale gas, Canada from hydropower resources, Korea from regulated seasonal tariffs, and China from state-controlled pricing. This divergence in electricity price dynamics means European manufacturers face not only higher costs but also greater uncertainty compared to their global competitors.

Energy-intensive sectors such as steel, chemicals, and non-ferrous metals are most exposed to this cost gap. When energy bills are both high and unpredictable, margins shrink and investment decisions tilt towards jurisdictions offering cheaper, more stable power. Evidence suggests that firms are already shifting production or considering scaling back operations in Europe (DNV, 2025b). Temporary measures, such as subsidies and caps, provide some relief, but they do not close the structural cost gap. The challenge lies

Looking ahead, electricity prices in Europe are unlikely to fall significantly in the short term. Gas will remain on neration, carbon costs will rise, and the expansion of renewables will continue to strain grids and require costly balancing. Over the longer horizon, however, Europe could regain a competitive edge if it succeeds in scaling green technologies such as offshore wind, hydrogen, and advanced storage. These could provide abundant low-carbon power and anchor new industrial value chains, turning today’s cost disadvantage into a strategic opportunity. Realizing this potential will require a delicate balance: accelerating investment in renewable capacity and grid infrastructure, creating predictable frameworks for long-term contracts, and managing the political economy of high energy costs. Only by addressing both the price and stability of electricity supply can Europe sustain its industrial base while delivering on its decarbonization ambitions.

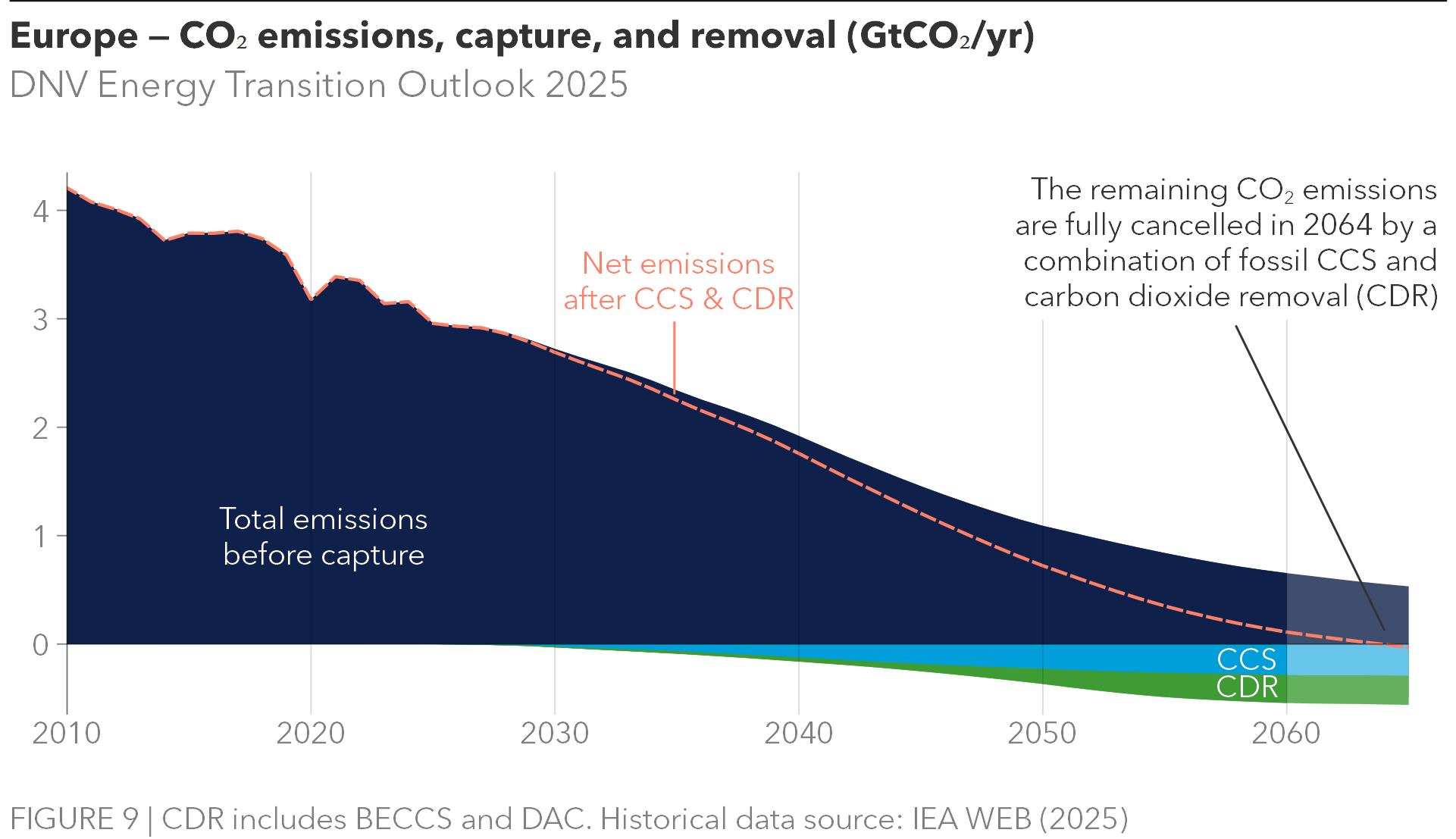

Europe reaches net-zero carbon emissions in 2064

Europe becomes the first region to reach net-zero energy-and process-related CO2 emissions. This milestone will be reached in 2064 through a combination of reduced fossil-fuel dependency in all sectors, CCS in hard-to-abate sectors, and additional carbon dioxide removal (CDR) on top. While impressive, this is 14 years later than the goal of net zero in 2050 (EC, 2019 ).

On the way to net zero, our forecast suggests a 41% reduction in Europe's energy- and process-related CO2 emissions (after CCS and after DAC) by 2030 from the 1990 benchmark, suggesting a shortfall on the EUs 55% reduction target. Regarding the much debated EU interim target of a 90% emissions reduction by 2040 from 1990 levels (equivalent to 85% when excluding LULUCF), our forecast indicates a 61% reduction in CO₂ emissions from energy and process sectors in 2040.

Reducing CO2 emissions before capture even further becomes gradually harder as the easier-to-abate sectors are tackled. In particularly, decarbonizing all households is a considerable challenge for reasons described above. This leads to the S-shaped curve in Figure 9. Consequently, both CCS and CDR are needed to reach net zero. Fossil CCS dominates at first but is naturally limited as the use of fossil fuels declines. In 2064, the split is almost even when reaching net zero, 290 MtCO2 are captured and 270 MtCO2 are removed.

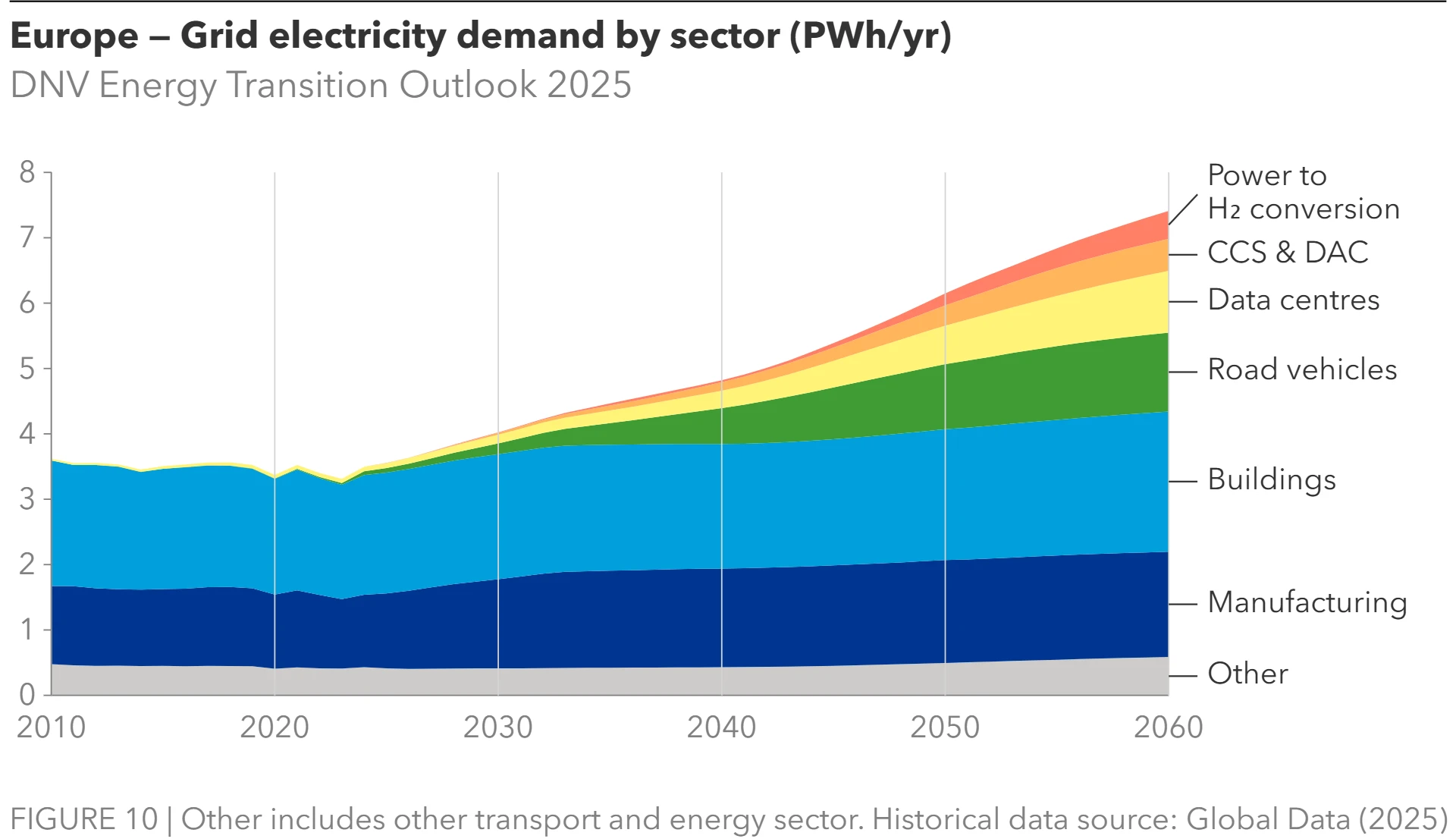

Electricity demand skyrockets

Increased electrification is an important pillar in Europe’s trajectory to net-zero CO2 emissions. After having been stable for 20 years, electricity demand is expected to grow by 110 TWh/yr each year, doubling by 2056. This electricity will largely be generated by wind and solar.

The demand for electricity is largely growing in sectors that are either new or currently heavily dependent on fossil fuels (see Figure 10). The combination of road vehicles, data centres, CCS, direct air capture (DAC), and electrolysis (for hydrogen production) have demanded less than 2% of European electricity on average over the last decade. However, their combined demand will grow 82 TWh/yr each year until 2060, three quarters of the total growth. That is extreme, considering that it is more than they demanded in total in 2022. The sectors which historically have consumed the most electricity, such as buildings and manufacturing, will in contrast see a limited growth in demand of less than 1% per year.

The increased demand for electricity represents a transition from other energy carriers rather than a general increase in energy demand. From 2027, Europe’s population will enter slow decline, limiting growth of useful energy demand to 4% per decade. Electricity will supply 69% of this slightly elevated useful energy in 2060, up from 35% today.

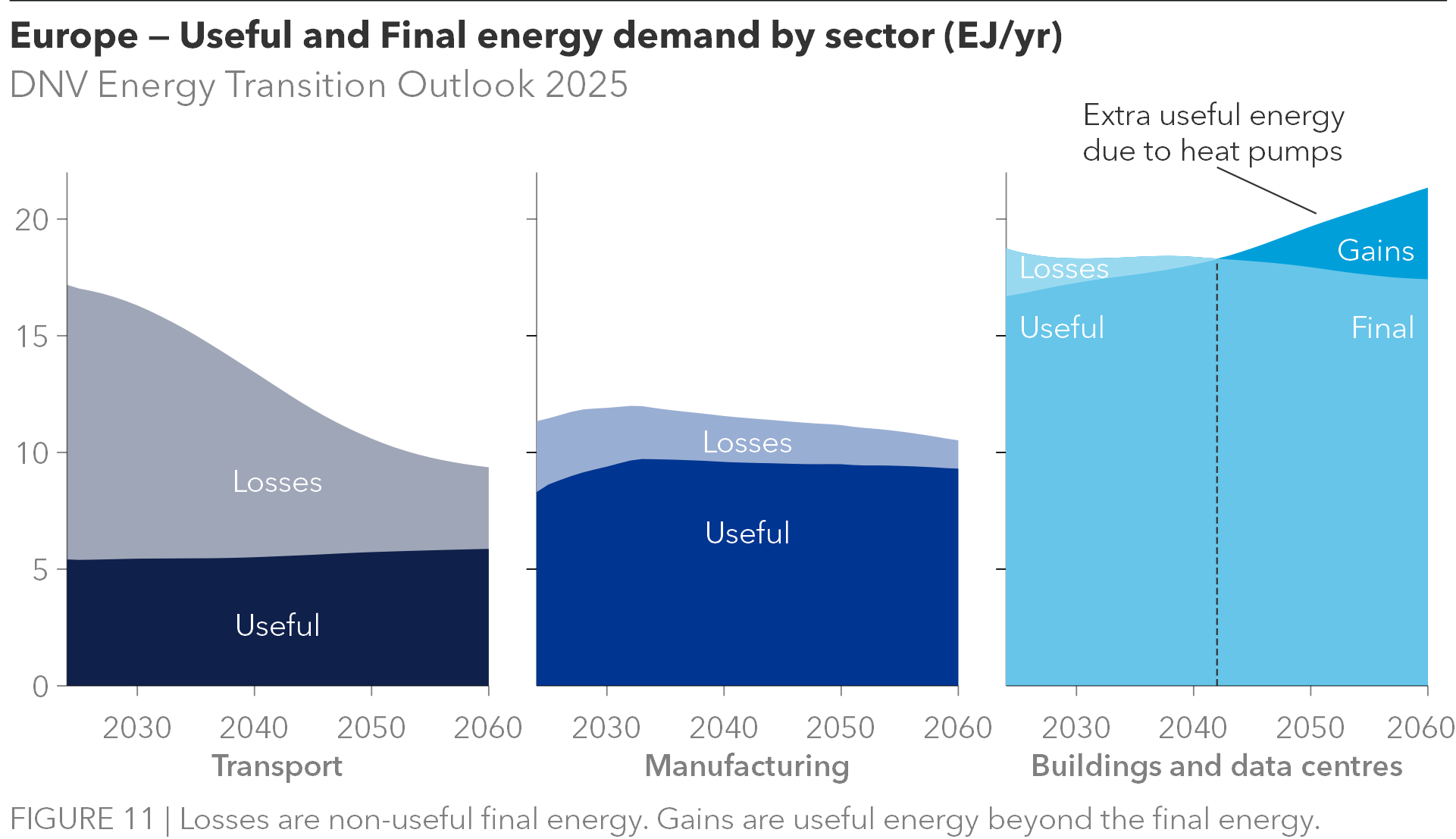

The transition to electricity brings more efficient energy use. That is why, even though demand for useful energy is growing, the final energy demand, which includes energy losses, is declining (see Figure 2). This is particularly true for the road sector, transitioning from combustion engines to batteries, and for space heating, transitioning to heat pumps (see Figure11). In fact, since heat pumps deliver more heat energy than the consumed electric energy, the buildings sector in total (including data centres) will gain extra useful energy instead of having losses, starting in 2043.

The bulk of the added electricity generation capacity will come from the price competitive variable renewables: wind and solar (see Figure 3). In short, there will be more solar power generation in southern Europe, and more wind power generation in northern Europe. The scalability of solar PV allows households and other consumers to contribute to power generation behind-the-meter: in 2054, they will generate 590 TWh/yr, surpassing hydropower. However, the highest untapped potential is found in the strong offshore winds. Despite currently having higher costs, offshore wind’s vast potential will be exploited to deliver 25% of Europe’s electricity in 2060.

More is required of the grid when the electricity demand doubles and an increased share of grid-connected power generation is renewable. Therefore, the power line capacity, which has increased only 30% in the past 20 years, will double in the next two decades. In addition, grid-connected storage capacity is expected to grow 10-fold to 7.2 TWh by 2048, more than half of which is in combination with solar PV.

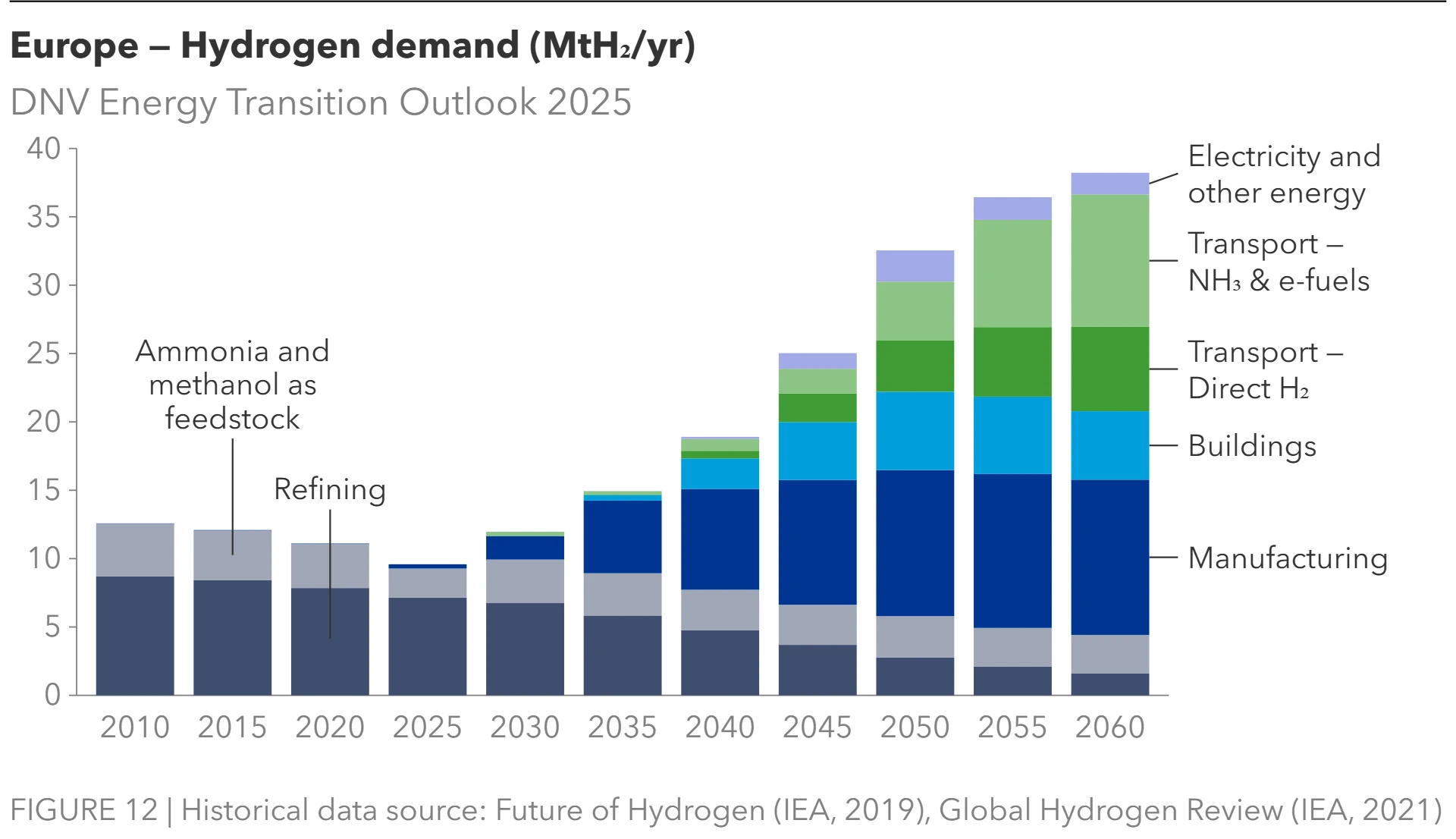

Hydrogen does what electricity cannot

Hydrogen will play an important role in Europe’s energy transition in the sectors where electricity is not a viable option. It is an energy source fit for heavy industry and continued use of gas-fired power plants, without relying on natural gas from Russia. Acting as a feedstock in the production of low-carbon methanol, ammonia, and other e-fuels, hydrogen will also play a significant role in decarbonizing long-distance transport.

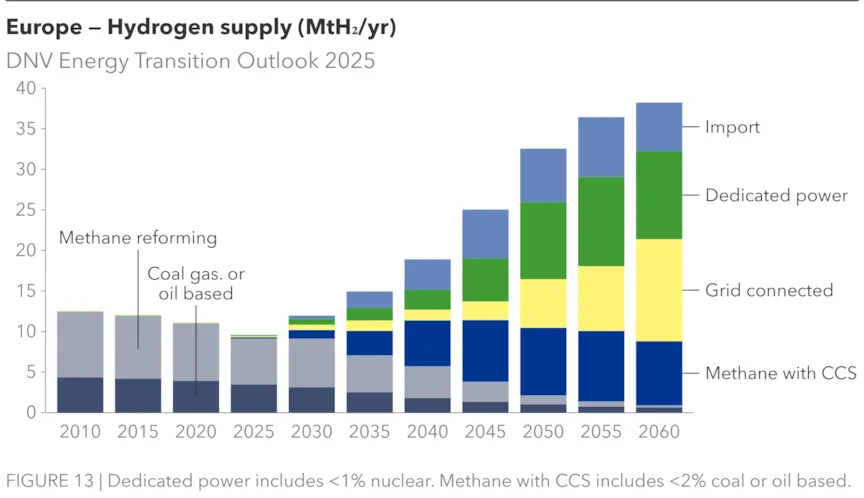

Hydrogen demand and supply are shown in Figure 12 and 13. The total demand will grow quickly in the 2030s, doubling from today’s level to 19 MtH2 by 2040 and doubling again to 38 MtH2 by 2059. The growth happens in new sectors, first manufacturing, followed by buildings and later transport. The traditional hydrogen demand sectors, refining and production of ammonia and methanol for non-transport purposes, will see a steady decline, halving by 2058.

While the uptake is significant, it is slower than desired. The levelized cost of hydrogen is currently high, lacking ensured demand, limiting the uptake until 2030. While the growth then accelerates, only 7% of Europe’s energy will be delivered by hydrogen and its derivatives in 2050 (see Figure 2). That is two-thirds of the share the EU wants from renewable hydrogen alone, according to its REPowerEU strategy (EC, 2022).

To supply this hydrogen, Europe is planning to both produce and import more hydrogen with a lower carbon footprint. Currently, 96% of the mix is grey hydrogen, but this will quickly decline. In 2030, 2.9 Mt (24% of the mix) of non-grey hydrogen will be supplied. By 2050, this has grown to 31 Mt, or 95% of the mix. While impressive, this is noticeably behind the REPowerEU Strategy of 2022, which aimed to both produce 10 Mt and import 10 Mt of renewable hydrogen by 2030.

More details on the hydrogen production routes and market will be given in a forthcoming DNV report, to be published first half of 2026.

Policy Summary

A non-exhaustive list of sector policy initiatives, emphasizing the 2024 to 2025 period

|

Climate targets - Key countries The EU has a mid-century net-zero ambition shared by the UK and Norway. The EU targets a 55% reduction by 2030 below on 1990 levels, while Germany and the UK aims for 65% and 68%, respectively, by 2030. Germany aims for net zero for all greenhouse gases by 2045. |

||

|

Sector |

Policy details and example initiatives |

Mechanism(s) |

|

Power

|

The REPowerEU plan aims for a 69% renewable electricity share in 2030. The EU Electricity Market Design regulation allows future support through two-way CfDs. The EU Commission estimates that the EU target of at least 42.5 % renewable energy in energy consumption by 2030 will require installed capacity at over 500 GW by 2030. > UK’s Action Plan: A new era of clean electricity (December 2024) outlines expansions in renewables and nuclear to 2030 as the backbone of its net-zero transition, underpinning electrification and supported through the Contracts for Difference scheme. The Modern Industrial Strategy 2025 (June 2025) includes innovation and supply chain investment support in frontier clean power technologies. Internationally, the UK spearheads the Global Clean Power Alliance, launched with Brazil, at G20 Summit November 2024. |

Tenders / auctions

Government funding

|

|

Nuclear policy is at a turning point and generation capacity is set to expand. > Germany will no longer block nuclear supportive EU policy initiatives. At member state-level, countries with expansion plans include France, Poland, the Czech Republic, and Finland, also with SMR investments. > The UK has announced plans to quadruple nuclear capacity to 24 GW by 2050 from about 6.5 GW today. |

Public budget

Regulated revenue |

|

|

> Offshore wind targets include the EU's updated, non-binding target for 111 GW by 2030 and 317 GW by 2050. Specific national targets are being developed through initiatives like the North Seas Energy Cooperation. > The 2023 Wind Power Package includes initiatives to speed up the permitting process for new offshore wind projects. > Horizon Europe programme funds research and development for offshore wind technologies, including less-mature areas like floating wind. |

Tenders/auctions

R&D support |

|

|

> Coal power phase out is planned, however, several countries with coal exits after 2030, including Czech Republic, Germany and Poland. |

Mandates |

|

|

> Energy storage and flexibility policies focus on expanding batteries, consumer demand response, and interconnection. Countries like Belgium France, Ireland, Italy, Poland, Portugal, Spain and the UK have established or are in the process of establishing capacity mechanisms under EU State Aid rules. Germany plans a technology-neutral capacity market by 2027 to support its goal of 80% renewable electricity by 2030. > In 2024 and early 2025, Germany and France awarded over EUR 950 million in battery manufacturing subsidies. |

Market design Capacity markets State aid

|

|

|

Grids

|

> The ENTSO-E Ten-Year Network Development Plan, TYNDP 2024 (January 2025), plans cross-border grid expansions, including additional 108 GW capacity by 2040, 177 transmission and 33 storage projects, and in particular increasing offshore grids and hydrogen infrastructure. > EU Commission issues 3 guidance documents (July 2025) to support implementation of the Renewable Energy Directive, Electricity Market Design, the Action Plan for Affordable Energy to reduce energy costs, also helping the advancement of the Action Plan for Grids with EUR 584 billion investments to 2030. > Germany and the Netherlands are among the EU member states with the largest grid investment plans including TenneT with EUR 200 billion by 2034 |

Funding through end-user network tariffs Government funding |

|

Hydrogen

|

> The European Hydrogen Bank offers 10 – 15-year CfDs to support production costs. The July 2025 draft auction terms expand eligibility to low-carbon electrolytic hydrogen (70% lower lifecycle emissions than fossil fuels), though these terms are not included in the current forecast. National schemes complement EU efforts. In February 2025, H2Global (Hintco) launched its second green hydrogen auction (RFNBOs), backed by Germany and the Netherlands, with a budget of at least EUR 2.5 billion. > In November 2024, the European Commission published the second candidate list of PCI/PMI cross-border infrastructure projects aligned with Green Deal goals, with final selection expected by November 2025, and eligible projects have co-funding rates of 50 to 75% of eligible project costs in grants from Connecting Europe Facility (CEF Energy). Inclusion in the TYNDP 2024 hydrogen infrastructure list is required. |

Tenders / auctions

EU funding Government funding (national) Carbon pricing

|

|

CCS/DAC

|

> The Net Zero Industry Act (2024) sees CCS technologies as essential to achieve net-zero goals, targeting annual CO2 storage of 50 Mt by 2030. The Industrial Carbon Management Strategy (2024) envisions up to 450 Mt by 2050. The EU Innovation Fund will provide USD 43 billion from 2020 to 2030, with up to 60% funding for regular grants and up to 100% for competitive bidding. CEF Energy has co-funding rates of 50 to 75% to cross-border infrastructure PCIs. The EU ETS-1 scheme will expand to include removal credits as per the EU Commission’s 2040 emissions reduction proposal of 90%. National support schemes complement those of the EU. See DNVs Energy Transition Outlook: CCS to 2050 for further details. |

EU funding Government funding (national) Carbon pricing |

|

Transport |

> The Renewable Energy Directive (REDIII) targets a 29% RE share in transport final energy use by 2030, including a binding sub-target of 5.5% for advanced biofuels with a minimum of 1% renewable fuels of non-biological origin (RFNBOs). > In road incentives, all 27 EU member states have biofuel mandates. There are longstanding incentives for EV acquisition or ownership, complemented by increasingly stringent vehicle emission limits (Euro 7 in 2024) on ICEs. There is legislation aiming for all new cars and vans sold in the EU to be zero CO2 emissions by 2035. An EU ETS2 scheme for buildings and road transport is scheduled to start in 2027 and will bring 75% of EU emissions under a carbon pricing scheme. > In aviation, Europe has the most comprehensive policy framework globally. SAF is required to comply with sustainability and GHG savings criteria as defined by RED. ReFuelEU Aviation Regulation targets are binding, enacted on jet fuel suppliers for a minimum supply of SAF, starting at 2% in 2025 and increasing to 70% by 2050, and includes sub-mandate for synthetic e-fuels. The European Union Aviation Safety Agency launched (February 2025) reference prices that will serve as benchmarks for EU states determining non-compliance penalties. A Hydrogen Bank e-SAF mechanism is discussed. > FuelEU Maritime Regulation sets GHG intensity reduction requirements and accelerates demand for renewable or low-carbon fuels. Effective January 2024, the EU ETS include the maritime sector, expanding to include methane and nitrous oxide emissions from 2026. |

Standards Mandates Carbon pricing

Non-compliance penalties |

|

Manufacturing |

> RED III’s sets binding targets for renewable hydrogen use: 42% by 2030 and 60% by 2035. > In June 2025, the EU launched a EUR 1 billion Innovation Fund auction under the Clean Industrial Deal to decarbonize process heat, split evenly between low and high temperatures (>400°C). Fixed-premium subsidies will be awarded for five years, with ceiling prices of €250/tCO2 (low temp) and €500/tCO2 (high temp). > Demand-side measures for green goods like steel remain limited, with policy focus on supply-side solutions such as electrification and CCS. > CCS is supported via carbon contracts for difference (CCfDs), offering OPEX payments to hedge EU ETS price volatility. Expansion is expected beyond early adopters, following Draghi report recommendations. Germany’s $5.6 billion scheme will award 15-year contracts via competitive bidding. > The Net-Zero Industry Act mandates producers to provide storage capacity proportional to their 2020 to 2023 EU oil and gas production share. In May 2025, the Commission set 2030 contribution obligations on 44 entities. |

Government funding Carbon pricing Tenders / auctions Fixed premium subsidy

CCfDs

Mandate |

|

Buildings |

> REPowerEU and the Energy Efficiency Directive target a 11.7% reduction by 2030. RED III sets an indicative target for renewable energy use in buildings (49% 2030) and mandates annual RE increases. The EU requires all new buildings to be zero-emission buildings from 2030, and new public buildings by January 1, 2028The EU ETS-2 introduces CP on transport and buildings, 2027. > The EUs Affordable Energy Action Plan (February 2025) support measures include boosts to energy efficiency through financial incentives. > National policies increasingly target decarbonization of heating and cooling through mandated local plans (for municipalities > 45,000 people, evolving national heat acts, and district heating requirements for cleaner sources and waste-heat reuse. National bans on gas boilers in new buildings are growing, with early adopters including the Netherlands (2018), Norway (2020) and Austria (2025). |

Standards Mandates Incentives Bans

|

References

BloombergNEF (2025). Global Renewable Energy Investment Still Reaches New Record as Investors Reassess Risks. August 26.

CJEU ─ Court of Justice of the European Union (2025). Austria’s action against the inclusion of nuclear energy and fossil gas in the sustainable investment scheme dismissed. September 10.

Directorate-General for Energy (2025a) ‘Action Plan for Affordable Energy: Unlocking the true value of our Energy Union to secure affordable, efficient and clean energy for all Europeans’, European Commission, 2025-02-26.

Directorate-General for Energy (2025b) ‘EU guidance on ensuring electricity grids are fit for the future’. European Commission, 2025-06-02.

DNV (2025a). Energy Cyber Priority 2025: Addressing Evolving Risks, Enabling Transformation. Oslo: DNV.

DNV (2025b), ‘Energy Transition Outlook Germany 2025’.

EC ─ European Commission (2025a). Report on energy prices and costs in Europe. COM(2025) 72 final. February 26.

EC ─ European Commission (2025b). Roadmap to fully end EU dependency on Russian energy. May 6.

EC ─ European Commission (2025c). Framework for State Aid measures to support the Clean Industrial Deal. July 4.

EC ─ European Commission (2023). EU Heat Pump Action Plan. Brussels: European Commission.

European Commission (2022). REPowerEU Strategy.

EC ─ European Commission (2019) The European Green Deal.

ECB ─ European Central Bank (2025). The European economy is not drought-proof. May 25.

EEA ─ European Environment Agency (2025). Economic losses and fatalities from weather- and climate-related extremes. July 2.

EFTA Court (2025). In Case E-18/24 Judgment of the Court, The Norwegian State, represented by the Ministry of Energy, and Greenpeace Nordic and Nature and Youth Norway. May 21.

EHPA ─ European Heat Pump Association (2024). European Heat Pump Market and Statistics Report 2024. Brussels: EHPA.

European Parliament (2025) ‘REGULATION (EU) 2025/1733 on the role of gas storage for securing gas supplies ahead of the winter season’.

Genovese, Vincenzo (2025). ‘Lead MEP says EU should skip 2040 emissions targets’. EuroNews. July 29.

IEA (2023). France’s MaPrimeRénov’ programme.

KfW (2024). KfW supports energy-efficient construction and renovation with promotional loans and grants. Frankfurt: Kreditanstalt für Wiederaufbau.

Pedrosa, J. (2025) 'Spain mandates storage in €148.5M funding round for innovative renewables'. PV magazine, 6 August 2025.

Ware, J., Pearce, O. (2024). ‘Counting the Cost 2024 A year of climate breakdown’. Christian Aid.