Why Romania is emerging as a prime battery storage market in Europe

Romania is emerging as one of the more attractive battery energy storage (BESS) markets in Europe, supported by elevated wholesale price volatility, robust ancillary service revenues and improved regulation.

Regulatory landscape

Romania has recently improved the regulatory framework for energy storage, materially strengthening the investment case for BESS. In 2025, the regulator eliminated the double taxation of stored electricity, exempting charging and discharging volumes from network tariffs and related fees, thereby directly improving project economics. In parallel, Romania has set ambitious BESS deployment targets toward 2030, supported by public funding mechanisms and investment programs aimed at accelerating large-scale storage rollout, signalling clear policy support for market growth.

In 2025, the Romanian day-ahead market recorded an average electricity price of €110/MWh. More importantly for storage economics, the Maximum Daily Price Spread (MDPS) reached €168/MWh. The MDPS, defined as the difference between the maximum and minimum hourly prices within a single day, is a key indicator of wholesale arbitrage potential. In a European context, this level of volatility is exceptionally high and provides a strong foundation for merchant BESS revenues through wholesale market trading.

Alongside wholesale arbitrage, ancillary services, balancing services renumerated by the TSO, contribute materially to the revenue stack. Average automatic Frequency Restoration Reserve (aFRR) up and down prices were close to €9/MW per hour, offering wholesale revenues supported by relatively deep market volumes. The prices for FCR services, at around €70/MW per hour, stand out as the most lucrative ancillary service, – although with more limited market depth. Typical hourly demand ranges between 165–200 MW for aFRR (up and down) and 80–130 MW for FCR, implying that while FCR volumes are constrained, price levels remain highly attractive for BESS operators.

BESS revenue assessment based on historical optimization

To assess revenue potential, DNV applied a PLEXOS based asset valuation tool to model and optimize the hourly dispatch of a 2-hour BESS across wholesale and ancillary service markets. The optimization captures value stacking between wholesale market trading, FCR, and aFRR, reflecting realistic operational constraints.

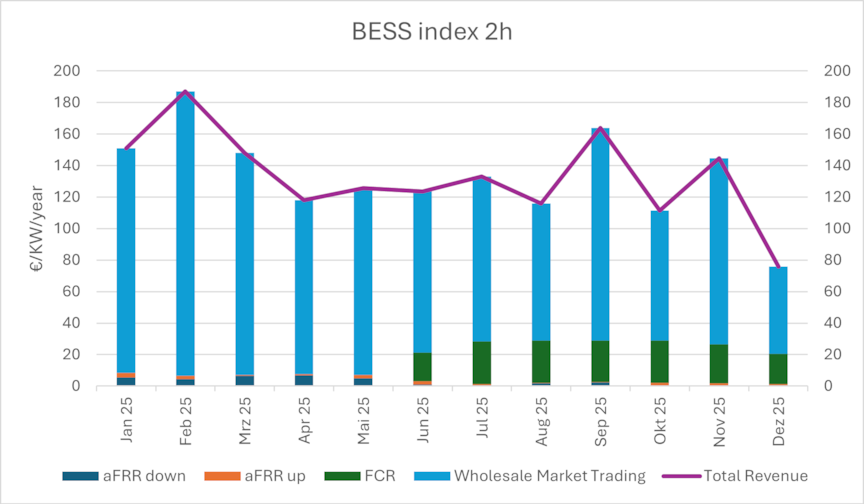

The chart below presents a BESS revenue index for 2025, constructed by running the optimization on historical market data. Each monthly bar illustrates the annualized revenue outcome assuming that the respective month’s price environment persisted for a full year. This approach highlights the sensitivity of BESS revenues to prevailing volatility and price signals rather than serving as a point forecast.

Across the observed price dynamics, total annualized BESS revenues range between approximately €120 and €180 per kW installed. A significant share of these revenues is driven by wholesale market trading, reflecting the high MDPS and pronounced day-ahead volatility in the Romanian power market. Ancillary services, particularly FCR, provide an important revenue anchor and further enhance overall project economics.

Key risks to consider

Despite the attractive outlook, investors should consider several key risks:

- Volatility risk: The sustainability of high MDPS levels over time is critical for wholesale trading revenues.

- Currency risk: Exposure to RON-denominated revenues versus largely EUR-denominated capex and financing.

- Market saturation risk: Growing BESS deployment may pressure FCR and aFRR prices and achievable volumes given limited market depth.

Conclusion

Romania combines high wholesale price volatility, strong FCR pricing, and solid ancillary market depth, positioning it among the attractive near-term BESS markets in Europe, with revenues of around €140/kW/year. While risks remain, current market fundamentals are indicator for a robust investment case for well-structured storage projects.

For additional details, please visit DNV’s Market valuation for the energy transition page.

2/16/2026 3:00:00 PM