Italian FER-X: A firewall against revenue cannibalization for renewable operators

‘Cannibalization’ describes how, as market penetration of variable renewables increases, the capture price for these sources tends to decrease, potentially reducing their investment potential. It is not a significant issue today for most RES operators in Italy, but the future is uncertain and complex. The FER-X auction system aims to limit such uncertainties now and in the future: but will it work?

Current price signals are positive for renewables investment

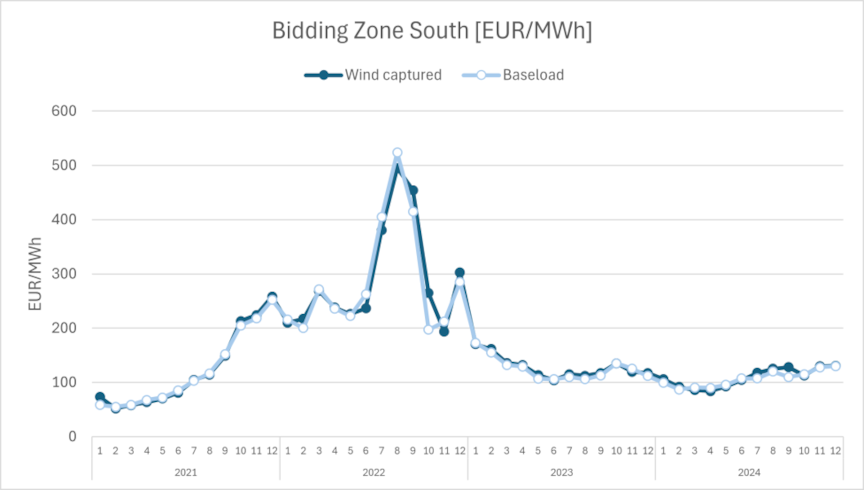

Italy's electricity market is currently experiencing higher prices than similar EU competitors. Strong price signals for renewable energy operators include, for example, historical captured prices for wind technology (Figure 1). The significant clearing pressure from gas generators creates a compelling price incentive for renewables investment across the peninsula.

In 2024, state-owned company GSE, which promotes and supports energy sources, calculated a levelized cost of electricity (LCOE) for mature utility-scale renewable technologies at approximately 65 EUR/MWh.

This competitive LCOE underscores the potential for profitable renewables projects, despite challenges posed by market variability and the evolving energy landscape. Figure 1 shows wind capture prices for Italy’s Bidding Zone South electricity market area from 2021 to 2024.

Longer-term uncertainties cloud decisions

However, the long-term price signals in the Italian energy market are highly variable, influenced by factors such as demand evolution, network expansion, and generation deployment.

While prices today are high in a EU context, RES developers in Italy are still grappling with declining long-term captured prices on the spot market.

Adding to market uncertainty, gas-fuelled power generation sets the electricity price more than two-thirds of the time, and the 2022 energy crisis sparked significant political debate about decoupling the price of renewable energy during periods of extreme gas price stress.

Then there is the risk of eventual price cannibalization, though integrating storage solutions with renewable generation can mitigate this effect, as storage allows for better price management by taking advantage of price fluctuations.

Addressing price risks

The risk of fluctuating prices impacts the financing costs of RES initiatives, making the energy transition more expensive for the country.

The introduction of the FER-X contracts for difference (CfD) system in early 2025 by the Ministry for the Environment and Energy Security (MASE) aims to bring more certainty to revenue modelling for the final investment decisions (FiDs) of wind and solar photovoltaic (PV) developers, who will shape Italy’s energy future.

Through competitive auctions, FER-X offers CfDs that ensure that if the spot price in the day-ahead market exceeds the reference price set during an auction, the difference is returned to the system. Conversely, if the spot price is lower, the RES operator is compensated, stabilizing the captured price to match the reference price.

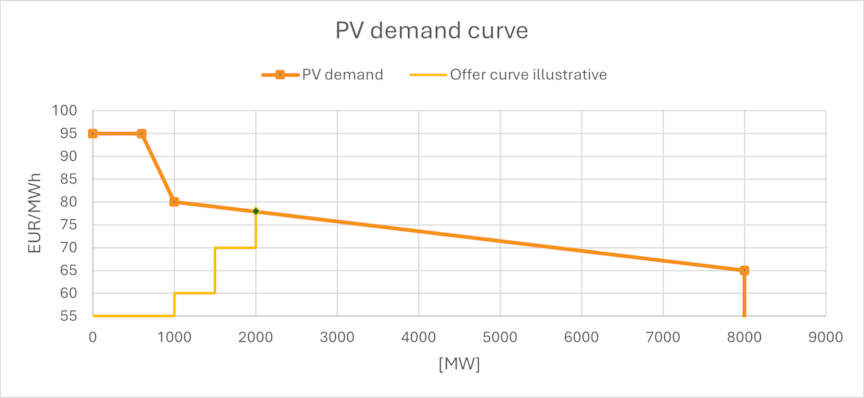

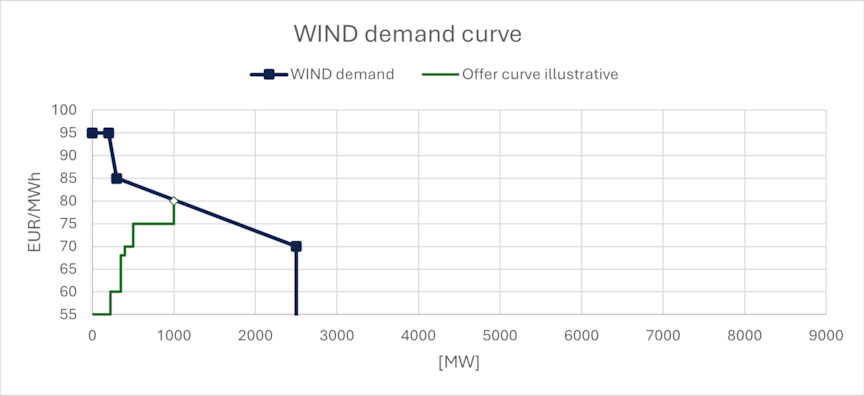

The required capacity to be contracted varies based on the strike price offered by participants and follows the demand curve. This mechanism helps balance supply of CfD with competitiveness of demand, while providing a stable investment environment for RES developers who most need this hedge. Figures 2 and 3 show solar PV and wind demand curves.

Navigating the FER-X auction is complex

It is crucial to decide whether to bid for FER-X or to embrace market price uncertainty. Developers must evaluate their risk tolerance, as price stabilization can aid financing. However, it is essential to consider potential markdowns relative to market expectations for the specific technology.

Another key point is that with a fixed auction capacity, regardless of location, southern initiatives with higher full-load hours may have a competitive edge, leaving others more vulnerable to market volatility.

For those customizing their FER-X bids or who remain exposed to price risk, it is key to estimate the day-ahead long-term captured price. Given these complexities, having a robust, professional and comprehensive power price forecast is essential to optimize your bid and minimize the risk of over or undershooting.

Support for decision-making in Italy’s energy market

Amid such uncertainties, it is crucial for developers to stay informed and adaptable to market changes.

DNV’s Energy Market Analytics team excels in understanding and capturing energy market dynamics, offering invaluable insights for the FER-X auction.

We specialize in power price forecasting (PPF), battery energy storage system (BESS) valuations, market intelligence, and business model analysis, providing both tailored and standardized advisory services to help clients navigate this complex landscape and make informed decisions. Our proprietary Power Analytics platform offers continuous access to updated power price and potential revenue stream forecasts, enabling sound investment decisions through thorough market analysis.

Summing up, renewables are the future of Italy's electricity system but still face significant challenges. Navigating market complexity can be daunting, but DNV is fully equipped to provide the guidance needed to maximize opportunities and achieve net-zero goals. Are you ready to take on this challenge?