Demand flexibility in Spain's renewable energy puzzle

As dawn breaks over Spain's solar farms, an ironic challenge emerges. The very success of the country's energy transition—renewables now supplying 59% of generation, up from 40% in 2018—has created a new set of complexities that threaten to undermine its sustainability. The record 196 hours of negative electricity prices witnessed in 2024, coupled with 527 hours at zero pricing, represents not just a market anomaly but a fundamental mismatch between Spain's generation profile and its consumption patterns. This paradox lies at the heart of Spain's next energy transition phase—one where demand flexibility must evolve from theoretical concept to operational reality.

The anatomy of Spain's price paradox

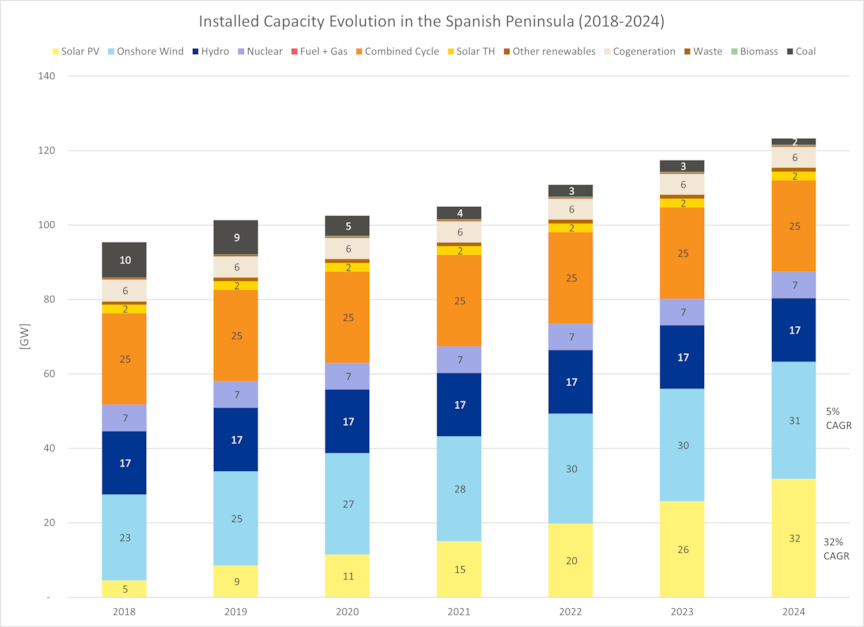

Spain's renewable energy boom has followed a predictable yet disruptive trajectory. Solar PV capacity, growing at a remarkable 32% compound annual rate, now accounts for 23% of the total generation—a figure that would have seemed implausible just seven years ago when it stood at just 5%. Wind power maintains its steady expansion at 5% annual growth. Together, these technologies have transformed Spain's generation mix, but their success comes with unintended consequences that ripple through the entire energy system.

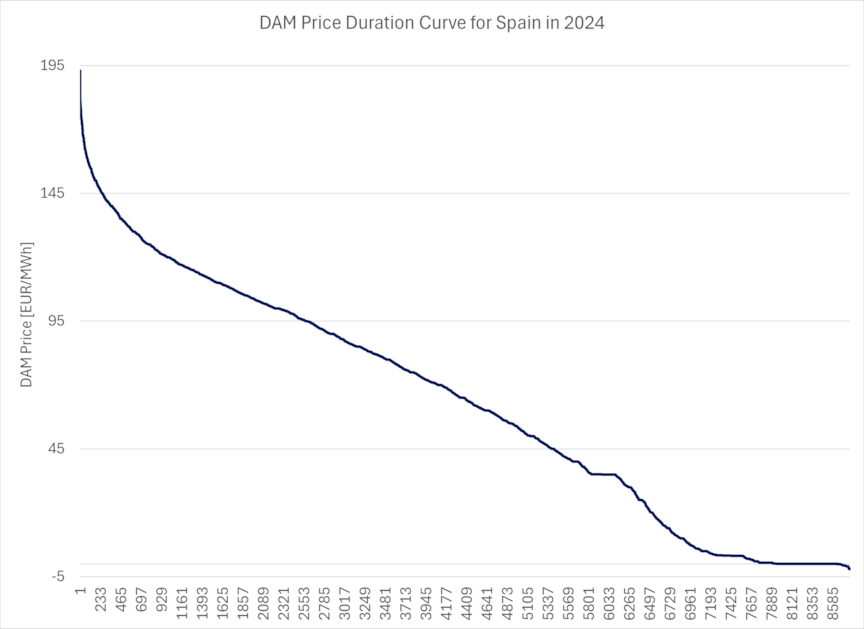

The most visible symptoms appear in market pricing. During spring 2024, wholesale electricity prices dipped below zero for the first time in Spanish history. While these initial occurrences were modest, barely crossing into negative territory, they revealed a structural issue that would persist throughout the year. By December, the market had recorded 196 hours of negative pricing and 527 additional hours where prices flatlined at zero—totaling nearly a month's worth of non-remunerative operating conditions for generators.

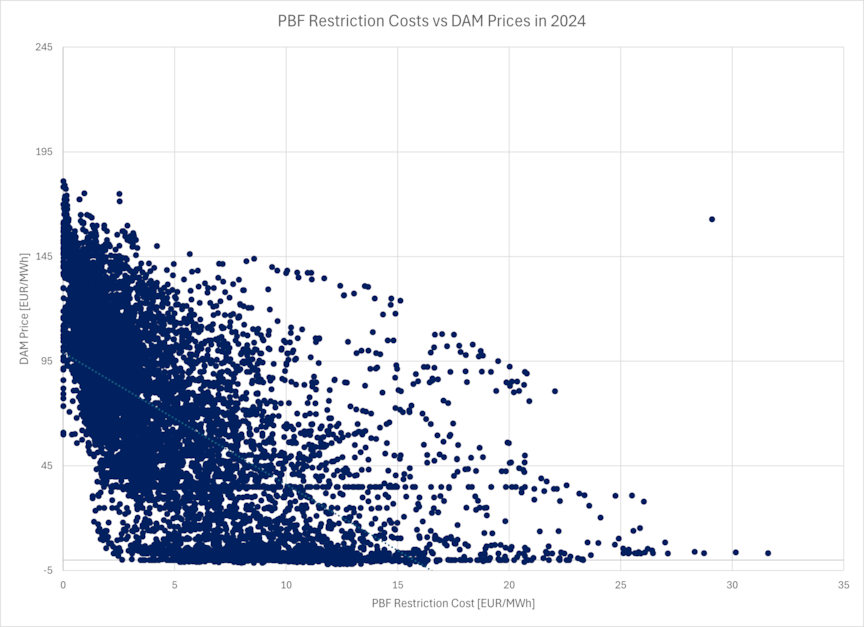

These pricing dynamics create a double bind for market participants. Generators face eroded profit margins that could deter future investment, particularly for merchant renewable projects without power purchase agreements. Meanwhile, consumers see little benefit from these low prices because technical restriction costs—the expenses incurred to manage grid congestion—rise inversely with market prices. Our analysis reveals a striking -0.63 correlation between day-ahead market prices and PBF restriction costs, meaning consumers often pay higher system charges precisely when wholesale prices are lowest.

Rethinking demand for a renewable era

Spain's current market design reflects an earlier energy paradigm—one where demand was predictable, and generation was dispatchable. The incentives baked into this system, such as preferential nighttime tariffs for industrial consumers, made sense when baseload nuclear and coal plants dominated the mix. Today, they actively work against efficient system operation by encouraging consumption when renewable availability is lowest.

This misalignment becomes particularly apparent when examining Spain's demand response capabilities. Compared to European peers like Germany (4.2 GW of flexible industrial load) and France (with its established demand-response auction mechanisms), Spain's 2.1 GW of flexible demand represents untapped potential. The gap isn't technological but structural—stemming from regulatory frameworks that haven't kept pace with the energy transition's speed.

Flexibility capacity comparison (Spain vs Germany vs France)

| Country | Flexible capacity | Key mechanism |

| Spain | 2.1 GW | Bilateral agreements |

| Germany | 4.2 GW | Industrial programs |

| France | 3.8 GW | Demand-response auctions |

Emerging solutions point toward a more flexible future. In Galicia, aluminum smelters have demonstrated the art of the possible by dynamically adjusting their operations to avoid peak restriction pricing periods, achieving €2.3 million in annual savings. Meanwhile, innovative startups are aggregating residential demand at scale, with pilot projects successfully bidding clusters of 50,000 households into ancillary services markets. These examples, while promising, remain exceptions rather than the rule.

DNV's holistic approach to market transformation

At DNV, we recognize that solving Spain's flexibility challenge requires equal parts technical innovation and market redesign. Our Energy Market Analytics team has developed sophisticated modeling tools that capture the complex interplay between renewable generation patterns, storage economics, and demand behavior. The Power Price Forecasting (PPF) service, for instance, now incorporates curtailment risks and demand response potential to provide more accurate long-term price projections.

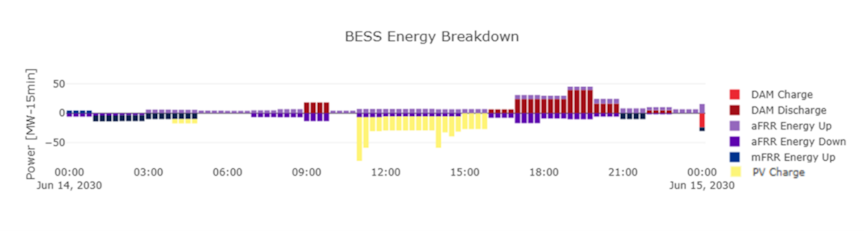

For storage investors, our Hybrid Energy Resource Optimizer (HERO) represents a breakthrough in revenue optimization. By simultaneously evaluating day-ahead market opportunities, ancillary service requirements, and congestion management value streams, HERO has demonstrated the ability to improve battery storage returns by 15-20% in real-world applications. These tools form part of our broader Power Analytics platform, which provides stakeholders with continuously updated market intelligence.

Perhaps most crucially, our policy advisory team works at the intersection of technology and regulation. As the European Commission and ACER develop new network codes to govern demand participation and distributed energy resources, we're helping shape frameworks that recognize flexibility as a critical resource—one that deserves appropriate compensation and market access.

Charting the course ahead

Spain stands at an energy crossroads. The remarkable progress in renewable deployment has brought the country to the threshold of a new challenge—building an electricity system where supply and demand interact in dynamic harmony. This next phase of the energy transition will require equal measures of technical innovation, market redesign, and regulatory evolution.

Three priorities stand out as particularly urgent. First, Spain must complete the modernization of its tariff structures to reflect the realities of a solar-dominated grid. Second, the market needs mechanisms that properly value all forms of flexibility—whether from industrial loads, aggregated residential demand, or battery storage systems. Finally, regulators must accelerate the implementation of European network codes to create a level playing field for demand-side resources.

The path forward is clear. By treating demand flexibility with the same strategic importance as renewable generation capacity, Spain can transform its current challenges into competitive advantages. The result will be an electricity system that's not just cleaner, but more resilient, more efficient, and ultimately more affordable for all consumers.

At DNV, we're committed to helping stakeholders navigate this transition. Our team stands ready to provide the insights, tools, and strategic guidance needed to turn Spain's flexibility potential into reality—because the future of energy isn't just about what we generate, but how intelligently we use it.