This region consists of Russia, Mongolia, North Korea, and all the former Soviet Union states, including Ukraine but not the Baltics.

Russia, Ukraine, and Kazakhstan account for 80% of region energy use.

| 2024 | 2060 | |

| Population | 320 million | 330 million |

| GDP* | USD 7.8 trillion | USD 12.6 trillion |

| GDP/person | USD 24 330 | USD 37 750 |

| Energy use | 46.9 EJ | 42.0 EJ |

| Energy use/person | 146.6 GJ | 127.3 GJ |

| CO2 emissions** | 2.7 Gt | 1.6 Gt |

| CO2 emissions/person | 8.4 tonnes | 4.8 tonnes |

*All GDP figures in the report are based on 2017 purchasing power parity and in 2023 international USD.

**Energy- and process-related CO2 emissions, after CCS and DAC.

The region remains largely focused on sustaining legacy fossil-dominated energy systems and exports. However, reconstruction in war-ridden Ukraine will likely support modernization and decarbonization, and across the region, renewable eletricity is developing based on economics and energy diversification strategies.

Current situation

Fossil fuels

in primary energy supply in 2024

Of fossil revenue

came from China (USD 84bn), India (USD 53bn), and Turkey (USD 37bn) in 2024

Fossil fuel subsidies

as a percentage share of GDP

Annual climate cost (USD)

Climate risks include drought, wildfires, floods and permafrost thaw

- Fossil fuels account for almost 90% of primary energy supply today. In power generation, 34% comes from nuclear and hydropower and new renewables account for just above 1%.

- Hydrocarbon exports are vital to Russia’s war economy. In 2024, China (USD 84bn), India (USD 53bn), and Turkey (USD 37bn) accounted for 74% of fossil fuel revenues. The EU remains a major importer, but with payments halved compared to pre-invasion levels (CREA, 2025)

- Fossil-fuel subsidies as a percentage share of GDP (2022) range from 7% in Russia, 15% in Kazakhstan, 16% in Azerbaijan, to 32% in Uzbekistan (IEA, 2025). An average of 9% among these countries.

- Climate risks include drought, wildfires, floods and permafrost thaw – for example, inflicting USD 6.3bn in damages annually in Russia in 2023 (Interfax, 2023) and Kazakhstan spending USD 557m in mitigating flood damage in 2024 (Wawiernia, 2024).

Pointers to the future

- The Energy Strategy of the Russian Federation until 2050 (April 2025) aims to accelerate developments in oil and gas refining, and emphasizes investments in critical infrastructures, including the Northern Sea Route and pipelines. Measures aim for market diversification by redirecting supplies of oil, gas, and refined products to friendly countries (AK&M, 2025). Russia will also position itself as a dominant player in turnkey nuclear technology exports. The strategy also guarantees affordable prices (petroleum products) for domestic consumers.

- Strategic energy ties are deepening between Russia and China. The two countries recently signed a legally binding Memorandum of Understanding to build the Power of Siberia 2 pipeline that would transport up to 50 billion cubic metres (Bcm) of gas per year (although precise timeline for construction and operation and many key details are still under negotiation). The pipeline would increase pipelined gas exports to China up to about 106 Bcm/yr (Leahy et al., 2025). The EU is progressing its planned phase-out of Russian gas imports by 2027.

- Russia’s far eastern Sakhalin region was chosen as a pilot in 2022 for climate policy and carbon-neutrality, with experiments such as carbon pricing (cap-and-trade), wind power, and switching heating from coal to gas. The project achieved carbon neutrality in 2025, but it is not fit for expanding to a national level, due to unclear CO2 trading regimes. Unconnected, remote regions have potential for renewables adoption to replace diesel.

- Kazakhstan will expand non-fossil power capacity, announcing plans for new nuclear in partnership with China’s National Nuclear Corporation (Pokidaeiv, 2025) and an almost doubling of new renewable capacity by 2030, but also plans modernization of coal-fired plants. Ties under the EU-Kazakhstan partnership emphasize energy, climate, minerals investments, and connectivity.

- Ukraine’s energy infrastructure (heating, power, oil, and gas) has been demolished from attacks with damage estimated at USD 20.5bn, while the cost to rebuild according to EU standards amounts to USD 67.8bn (Bandura and Romanishyn, 2025). There is opportunity to build a modern energy system relying on a more balanced and efficient mix.

The energy transition indicators

Primary energy consumption (EJ/yr)

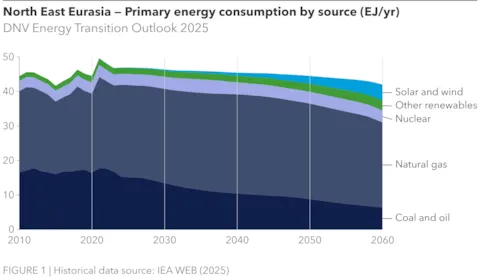

North East Eurasia’s energy mix will remain heavily fossil-dependent. Natural gas is the dominant source and will rise slightly from 57% of the mix in 2024 to 59% by 2060. Coal and oil will decline steadily – coal’s share halving by the early 2040s and oil’s share dropping from 17% to 12% by 2060. Meanwhile, the share of solar and wind combined will expand from 0.25% to 12%, surpassing nuclear, though fossil fuels will continue to shape the region’s energy landscape for decades.

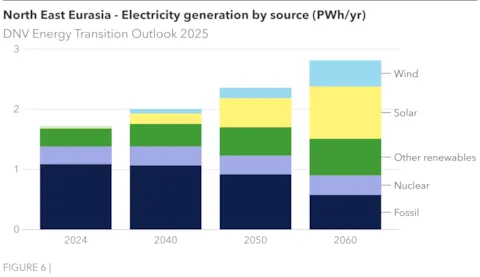

Electricity generation (PWh/yr)

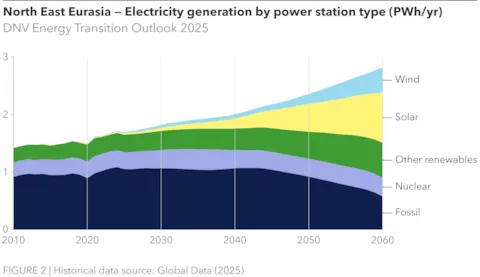

By 2060, electricity demand in North East Eurasia will increase by about 60%, and the generation mix will shift sharply from 64% fossil fuels today to only 21%. Hydropower’s share in generation will rise slightly from 17% to 21%, while nuclear will fall from 17% to 11%. The most striking change will come from renewables: solar will surge from 1% to 31% and wind from 1% to 15%, making them central pillars of the region’s non-fossil electricity supply by 2060.

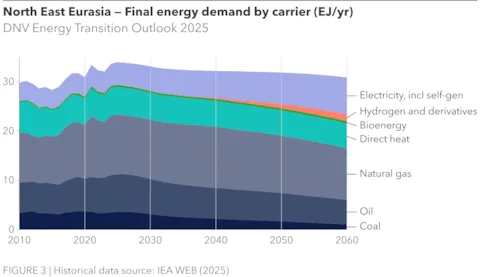

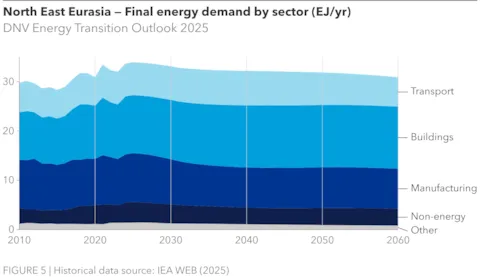

Final energy demand (EJ/yr)

Fossil fuels will continue to dominate the region’s final energy mix, but will decline from 69% to 53% by 2060. Electricity will grow steadily, rising from 13% today to about a quarter of final demand. Direct heat will remain important (16%), supported by legacy district heating systems and long, cold winters. However, most of this heat will still be generated from fossil fuels, highlighting the region’s slow progress toward diversification of energy sources.

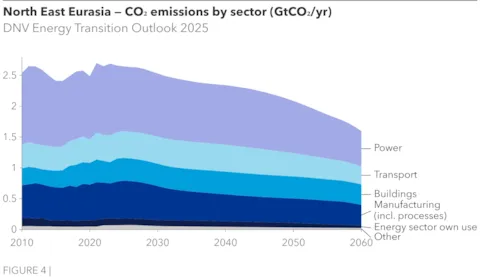

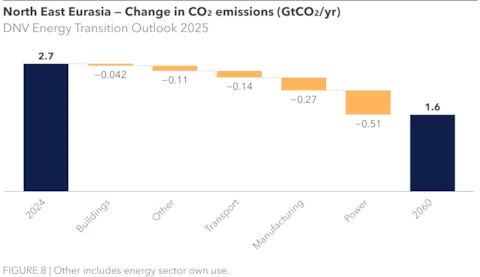

CO2 emissions by sector (GtCO2/yr)

Carbon dioxide emissions in North East Eurasia will fall only 40% between now and 2060, the smallest such decline among the industrialized regions in our Outlook. The power sector will achieve the largest reduction, about 47%, reflecting moderate progress in decarbonization. Manufacturing emissions will decrease slightly less (45%), supported by greater electrification of processes. In contrast, the buildings sector will see only an 11% reduction, as natural gas remains heavily used for space and water heating.

Pragmatic decarbonization and a slow transition

The energy transition in the North East Eurasia region – Russia, Ukraine, Kazakhstan, and other post-Soviet states – is moving slowly. Decarbonization is generally not prioritized, except where it aligns with reconstruction, security, or economic objectives.

Although some signs of energy transition are emerging, the region remains largely focused on sustaining its traditional fossil-dominated energy systems. Decarbonization tends to support broader strategic goals – geopolitical positioning, economic resilience, or infrastructure renewal – rather than serving as a core objective. In Ukraine, for example, the destruction of energy infrastructure caused by war presents an opportunity for modernization that may also support decarbonization. International aid and EU-oriented reforms are fostering some alignment with climate goals, yet reconstruction remains the immediate priority.

Russia is exposed to a different set of constraints and drivers. Continuing sanctions and declining fossil fuel exports to Europe have left the domestic market with cheap energy and reduced incentives to pivot away from carbon-intensive sources. At the same time, oil and gas revenues remain central to funding the ongoing war, reinforcing their strategic importance. Gazprom is expanding domestic pipeline infrastructure, LNG export capacity, and gas-to-chemicals projects, preserving the long-term role of natural gas in both industrial and residential energy use beyond 2060. These trends reinforce hydrocarbon entrenchment, while nuclear projects extend international influence.

As a result, fossil fuels are projected to remain dominant, accounting for nearly three-quarters of the region’s primary energy consumption in 2060. Natural gas, cheap and abundant, will make up the largest share, rising slightly from 57% in 2024 to 59% by 2060. By contrast, coal use will halve by the early 2040s, and oil will fall from 17% to 12% over the same period. Renewables will gain ground: solar and wind together are expected to grow from just 0.25% today to 12% by 2060, overtaking nuclear in the power mix.

Structural inertia of energy consumption

Our forecast suggests that final energy use in North East Eurasia will remain broadly stagnant, with little indication of the structural transformations underway elsewhere. Demand continues to be dominated by heating and industry, which together will account for about two-thirds (67%) of total consumption (Figure 5). Heavy industries such as metallurgy, aluminium smelting, and chemicals will continue playing a particularly large role, underscoring the region’s reliance on resource extraction and energy-intensive manufacturing.

Progress on end-use electrification is limited. Electric vehicle (EV) adoption will remain negligible compared to global peers until the late 2040s, constrained by weak charging infrastructure, high costs, and minimal policy support. Even by 2060, the share of EVs in the region’s fleet will reach only about 49%. Likewise, heat pumps and other modern building technologies will see little uptake (share of heat pumps in space heating will reach less than 1% by 2060), with households still dependent on aging gas boilers and inefficient district heating systems.

The region’s energy trajectory will continue to be shaped mainly by supply-side dynamics – abundant fossil resources, centralized infrastructure planning, and, at times, geopolitical factors. Where advanced technologies are being deployed, they are mostly linked to industrial modernization (e.g. efficiency upgrades in metallurgy and chemicals) or to pilot projects aimed at export markets, rather than broad domestic adoption.

Renewable power: modest growth driven by strategic alignment

Power is the only sector in the region’s energy system that will see visible transformation along decarbonization trajectory. We expect electricity production in North East Eurasia to increase by 68% by 2060, driven primarily by renewables. Gas will remain an important source, supplying 34% of power in 2050 and 19% by 2060 (Figure 6). Low domestic gas prices – partly reflecting lost export opportunities due to the Ukraine war and continuing sanctions – make coal less competitive, reducing its share from 15% today to 7% by 2050 and just 1% by the end of the forecast period. Hydropower generation will double by 2060, increasing its share from 17% to 21%.

Solar and wind, currently negligible, will increase their role in the power mix: together they will provide 14% of electricity by 2040, 30% by 2050, and 46% by 2060, far surpassing hydropower. In addition to standalone solar, roughly 8% of total electricity generation in 2050 will come from solar paired with battery storage. Early deployment of storage reflects the region’s limited transmission and distribution infrastructure, ensuring grid reliability even at relatively low renewables penetration by mid-century.

The overall regional developments, however, should not hide the differences between individual countries. Although Russia, for example, has made some headway in solar power, the progress remains modest. Among noticeable developments are small-scale PV plants in Siberia and hybrid solar-diesel energy systems in Arctic regions, where cold weather has yielded unexpectedly favourable operating conditions. Such systems could help reduce reliance on diesel generators in remote settlements, but large-scale solar deployment in Siberia and the Far North continues to face significant logistical, economic, and institutional barriers. Solar and wind together still contribute less than 1% of Russia’s electricity generation, far below the global average. The Ministry of Energy’s 2042 plan anticipates installed total installed capacity for all types of generation growing to 300 GW, but most of that growth is expected to come from thermal power (coal and gas), casting doubt on the scale of solar deployment.

On the other hand, Kazakhstan and Ukraine place greater emphasis on renewables, though motivated less by climate concerns than by the need for modernization, resilience, and alignment with external partners. Kazakhstan has made significant strides in expanding its solar energy capacity. In 2024, the country commissioned two renewable energy facilities with a combined capacity of 34.5 MW, including a 20 MW solar power plant in the Almaty Region (Akhmetkali, 2024). Looking ahead, Kazakhstan plans to bring online nine renewable energy facilities totaling 455 MW in 2025 (QazaqGreen, 2025). Additionally, the Ministry of Energy has scheduled four solar auctions in June 2025, offering a combined capacity of 90 MW (pv magazine, 2025). The competitive auction system has been instrumental in attracting investments, leading to the award of 440 MW in renewable energy projects in 2022, with solar energy playing a central role. International support, particularly from the European Bank for Reconstruction and Development (EBRD), has been pivotal in these developments. The country aims to increase the share of renewable energy in its total electricity generation mix to 15% by 2030 (Astana Times, 2025), with solar energy playing a pivotal role in this transition.

Ukraine’s energy sector has been heavily damaged by the war, with over 40% of the power system – including thermal plants, hydropower facilities, and transmission infrastructure – destroyed or impaired (IEA, 2024). Reconstruction funding from international partners is closely linked to EU integration, and the country’s synchronization with the European grid (ENTSO-E) in March 2022 has enhanced energy security while enabling market reforms. The EU’s REPowerEU framework provides incentives to expand renewables and modernize the grid. Ukraine possesses substantial renewable potential, with estimates of up to 50 GW of solar and 30 GW of wind capacity by 2050 (DIW Econ, 2024), alongside opportunities for hydropower refurbishment. Distributed renewable systems are particularly valuable in the reconstruction context, as they are less vulnerable to wartime targeting than centralized coal or nuclear facilities. In the near term, reconstruction and energy security remain the priorities: coal phase-out may accelerate due to war damage, gas-fired generation continues to stabilize the system, and small-to-medium-scale renewable projects have resumed in liberated areas in 2024–2025, laying the groundwork for longer-term decarbonization.

Nuclear: strategy beneath the surface

Nuclear energy will remain a significant component of the North East Eurasia’s power mix through 2060. While its share of electricity generation is expected to fall from 17% today to 11% by 2060, total output will still rise by around 10%. Yet nuclear’s role in the region extends well beyond domestic supply. Russia’s Rosatom has established itself as a global leader in nuclear exports, offering turnkey projects that lock client states into long-term fuel and service contracts – creating structural dependencies on Russian technology and expertise. This strategy is reinforced by innovations such as floating nuclear power plants for remote or lower-income countries, and the development of fast reactors capable of recycling waste and potentially reducing spent fuel volumes by up to 90% (World Nuclear News, 2023).

Kazakhstan, for its part, holds over 40% of global uranium reserves, cementing its strategic role in nuclear supply chains (World Nuclear Association, 2022). It has also explored partnerships with Rosatom and other international companies to advance domestic nuclear capacity. While nuclear development across the region is officially framed as supporting carbon-neutrality, its underlying drivers are distinct: sustaining geopolitical influence, securing export revenues, and maintaining technological leadership.

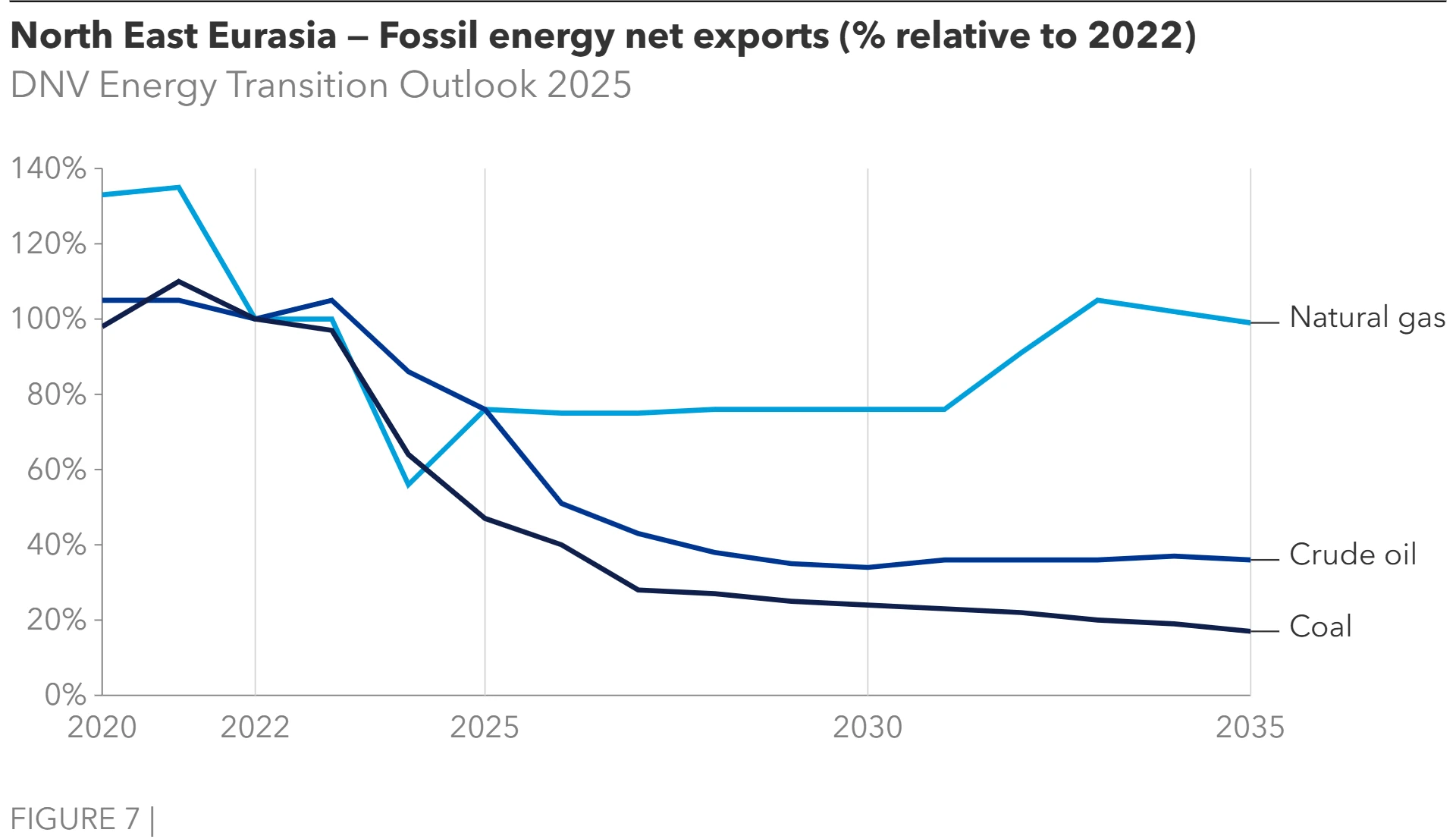

Hydrocarbons in the shadow of sanctions

The region’s energy outlook remains closely tied to oil, gas, and coal exports, which together account for roughly one-third of total fossil fuel production – around 32% of coal, 42% of oil, and 12% of gas. For decades, Europe was the primary destination for Russian gas, supplied mainly through pipelines. This changed dramatically after the invasion of Ukraine: pipeline exports to the EU collapsed from 140 Bcm in 2021 to 63 Bcm in 2022, then about 27 Bcm in 2023. A decisive turning point came at the end of 2024, when Ukraine opted not to renew its five-year transit agreement, bringing Russian gas transit through the country to a complete halt as of 1 January 2025. This marked a structural shift, forcing Central and Eastern European markets to adjust by tapping alternative suppliers and routes, while Russia began reorienting its gas strategy toward new pipeline connections in Asia and expanded LNG export capacity.

In response, Russia is increasingly reshaping its gas strategy around two main pillars: pipeline exports to non-EU markets and expanded liquefied natural gas (LNG) capacity. Pipeline flows to China surged in 2024, rising by around 37% year-on-year through the Power of Siberia 1 pipeline, with higher volumes expected in 2025, underscoring the structural pivot toward Asia. Exports to Turkey and Central Asian states (notably Kazakhstan and Uzbekistan) also increased, signalling efforts at diversification beyond Europe.

At the same time, Russia has accelerated LNG development to offset lost pipeline revenue. Shipments from Sakhalin-2 and Arctic projects such as Yamal LNG and Arctic LNG-2 grew in 2024–25, despite sanctions and buyer hesitation, with increasing volumes redirected to China and other Asian markets (Natural Gas Intelligence, 2025). Looking ahead, Russia is banking on redirected LNG flows and possible new pipeline capacity – notably the proposed Power of Siberia 2, though construction has yet to begin – to stabilize gas exports. Under this trajectory, we expect exports to recover to pre-invasion levels by the early 2030s, but gradually decline thereafter, settling at around 130 Bcm annually by 2050 (Figure 7). Domestic demand will only partially absorb this drop, with regional gas production expected to contract by about 6% by 2060. Export revenues are unlikely to fully rebound, weighed down by longer transport routes and persistentprice discounts.

Russia’s oil exports have proven more adaptable. In 2024, crude and product flows were rapidly rerouted from Europe to Asia – particularly India and China – through discounted sales, spot tanker voyages, and an expanding 'shadow fleet’ that enabled ship-to-ship transfers to evade sanctions and price caps. These measures preserved volumes but at higher costs and with greater exposure to legal and financial risk. Even so, combined crude and product exports in 2024 fell below 2022 levels (Maguire, 2025). With the EU committed to phasing out Russian oil by 2028, and with sanctions continuing to tighten, we expect export volumes to erode further toward 2030 before stabilizing at lower levels thereafter.

Coal faces the steepest decline. Exports are projected to fall by 77% from 2022 levels by 2030, with only a modest rebound in the late 2030s to early 2050s, before collapsing to about 3% of 2022 levels by 2060. This trajectory reflects the long-term contraction of coal demand in China, India, and South East Asia, Russia’s principal buyers.

Hydrogen and derivatives

Hydrogen offers long-term potential for the region, though near-term progress is likely to remain limited. Among North East Eurasia countries, Russia stands out for its substantial hydrogen potential, underpinned by vast natural gas reserves, ample land for renewables, and a declared ambition to become a major exporter. Its official strategy prioritizes blue hydrogen from natural gas with carbon capture and storage (CCS) and, to a lesser degree, nuclear-based hydrogen (Barlow and Tsafos, 2023). Early pilots include Gazprom’s studies on hydrogen blending in pipelines and Rosatom’s work on nuclear-powered electrolysis. Yet short-term growth faces strong headwinds: financing constraints, sanctions, the uncertain scalability of CCS, and challenges in meeting buyer certification requirements.

Beyond Russia, Kazakhstan combines strong wind and solar resources with political momentum and early partnerships. European investors have already signed Memoranda of Understanding for large-scale green hydrogen projects. Uzbekistan has also announced bilateral agreements with foreign developers, with limited-scale green hydrogen production expected to begin in 2025 (Fuel Cells Works, 2025). Ukraine’s potential lies in its alignment with EU hydrogen markets, though the ongoing war has delayed substantive investment.

Overall, hydrogen development across North East Eurasia remains at a nascent stage. Policy frameworks, international cooperation, and pilot projects currently outpace actual deployment. The sector’s trajectory will depend on external demand, financing, and whether low-carbon hydrogen can achieve cost competitiveness against unabated fossil fuels.

Our forecast suggests North East Eurasia could account for around 9% of global hydrogen demand and a similar share of production by 2060. Hydrogen’s role as an energy carrier is expected to remain minor until 2040, after which output will accelerate to roughly 20 MtH₂/yr by 2060, produced almost entirely through methane steam reforming with CCS. Most of this hydrogen will be exported: around 10 MtH₂/yr via pipeline and about 0.8 MtH₂/yr as seaborne cargoes. Beyond 2050, ammonia exports for energy use are projected to rise sharply, reaching about 50 MtNH₃/yr by 2060. China – already deepening hydrogen cooperation with Russia – together with South East Asia, is likely to become the main market for low-carbon hydrogen and ammonia exports from North East Eurasia. Japan and South Korea could also emerge as buyers, but only if pricing is competitive and low-emission credentials are credibly demonstrated.

Emissions

Our projections indicate that the regional average carbon price will be USD 6 per tonne of CO2 by 2030, rising to USD 14/tCO2 per year by 2050 and USD 16/tCO2 by 2060. The slow pace of adoption and the region's low carbon prices – the lowest among all ETO regions – are key factors behind these estimates.

As a result, energy- and process-related CO2 emissions (after CCS and direct air capture) in North East Eurasia are expected to decrease by only 22% to mid-century and 40% by 2060, compared to current levels, making it the industrialized region with the smallest reduction in emissions. This decline will be uneven across sectors (Figure 8). The largest reduction (47%) is expected in the power sector, reflecting the increasing share of renewables in the region’s power mix. This is followed by a 40% decrease in manufacturing due to an increasing share of electricity and a moderate increase in hydrogen use in the sector’s energy mix. The transport sector will see only a 32% reduction in emissions, due to the increasing share of EVs in the total vehicle fleet (from zero now to nearly 49% by 2060). However, EV uptake and the corresponding emissions reductions in the sector will accelerate only from the late 2040s. The buildings sector will see the lowest reductions of only 11%, reflecting a persistently high share of natural gas in space and water heating even in the last decade of our forecast period. By 2060, the region’s total CO2 emissions, including non-energy process emissions, are projected to reach 1.6 Gt, resulting in the highest per capita level of any region.

While other regions are experiencing strong electrification and a significant greening of their electricity sectors, such progress is relatively weak in North East Eurasia. Electricity demand will increase compared to other energy carriers but will still only account for 24% of total energy demand in 2060, up from 13% today. The use of natural gas in power generation will decline from 50% to 21% but will still represent a substantial share of the energy mix. Coal will remain part of the power generation mix, but its share will drop significantly, from 15% today to just 1% by 2060.

Carbon capture and storage is gaining some policy traction in Russia, with new laws and compensation schemes under consideration (Herbert Smith Freehills Kramer, 2025). Projects by Lukoil and Gazprom Neft focus on capturing emissions from upstream operations and reinjecting CO2 to enhance oil recovery. However, these projects remain small in scale and do not constitute a systemic decarbonization strategy. Kazakhstan has also expressed interest in CCS, particularly in connection with its oil and gas sector and its long-term carbon-neutrality pledge. However, unlike in the EU, where CCS is tied to industrial decarbonization and net-zero pathways, North East Eurasia countries see CCS more as a way to prolong the life of fossil exports and secure a foothold in markets that may impose carbon border adjustments (IEA, 2023). Combined with low carbon prices, the adoption of CCS in the region will be very limited until 2040, and even after that will only take off in relation to production of low-carbon hydrogen and ammonia. We forecast that by 2060, the region will capture and remove 330 MtCO2/yr, representing 13% of the global total. Carbon dioxide removal will be represented only by direct air capture (DAC), which will reach 33 MtCO2/yr or 8% of total emissions removed via DAC.

Most countries in North East Eurasia have adopted or floated 2060 carbon-neutrality/net-zero targets, but short-to-medium term emission reduction commitments (e.g. by 2030 or 2035) are often weak, non-binding, or poorly enforced. Russia’s net-zero target has been widely criticized for relying heavily on land use, land-use change, and forestry (LULUCF) carbon uptake rather than actual emission reductions, and for its lack of an actionable reduction trajectory (Climate Action Tracker, 2022). Kazakhstan has codified its 2060 net-zero target into law but still lacks sufficiently ambitious or binding 2030 commitments, making near-term outcomes uncertain. Ukraine’s climate targets were updated before the war, and actual emissions have fallen significantly due to the conflict. However, future reconstruction and economic recovery could drive emissions upward unless mitigation efforts are aggressively pursued. Our forecast further indicates that 2060 carbon-neutrality commitments in North East Eurasia have low likelihood of being met.

Policy summary

A non-exhaustive list of sector policy initiatives, emphasizing the 2024 to 2025 period

|

Climate targets - Key countries Kazakhstan, Russia, Ukraine net-zero by 2060 |

||

|

Sector |

Policy details and example initiatives |

Mechanism(s) |

|

Power |

> Renewable energy is prioritized in national strategies increasingly supported by competitive bidding processes for large scale projects. > Kazakhstan targets a 15% share in electricity generation (at around 6% in 2024) by 2030, it has a roadmap for 8.4 GW of renewable capacity by 2035 (from about 2.9 GW in 2024) and pursues 50% non-fossil power (including nuclear) by 2050. > Uzbekistan targets 27 GW capacity, 40% of power generation (at below 30% in 2024) by 2030, and looks to wind and solar with the United Arab Emirates as a key strategic partner. > Development banks are major contributors to investments, such as the EBRD, ADB. > Russia’s Energy Strategy to 2050 specifies limited growth in renewables. The planned support scheme for renewables via a capacity market mechanism (2025–2035) was affirmed before the war, but its implementation (auctions) is delayed. > Ukraine is seeing an energy decentralization shift to distributed power facilities (5-100 MW), primarily based on renewable energy sources and energy storage systems, to ensure greater resilience and security of supply. The National Energy and Climate Plan (NECP) 2025-2030 aligns with European Commission guidelines. It aims for renewables to cover 27% of total energy consumption by 2030. |

Tenders / auctions PPAs with state entities

International partnerships and finance

|

|

> Nuclear will expand as per Russia’s Energy Strategy to 2050, aiming to increase capacity to over 331 GW by 2050, targeting 25% of the generation mix. Development of new energy types, include advanced nuclear technologies, and Russia cultivates partnerships for nuclear technology exports. > Kazakhstan launched the construction of its first plant in 2025 with Rosatom and is planning a second and third plant in strategic partnership with China. |

Public budget

|

|

|

> Natural gas-fired generation is increasingly part of strategies including in Kazakhstan, still reliant on coal for 70% of its electricity. The transition to gas is set in the context of aging coal plants. Ukraine joined the Powering Past Coal Alliance (COP26) announcing it goal of phasing out coal in electricity generation by 2035. |

|

|

|

Grids |

> Modernizing electrical grids is a priority to handle new energy sources. > In Kazakhstan , the Unified Power System plans to enhance transmission capacity, integrate gas resources, and improve international connectivity. > Ukraine's electricity grid was synchronized with the EU's Continental European grid in March 2022. Smart grid development is a priority area in the NECP to support a decentralized system. |

|

|

Hydrogen |

> Kazakhstan’s Strategy on Achieving Carbon Neutrality by 2060 (February 2023) specifies low-carbon fuels (biofuels and hydrogen) as needed where electricity is challenging. There is renewable hydrogen diplomacy with the EU and Germany and the Svevind project (Hyrasia One), with 40 GW renewable and 20 GW electrolyzer capacity, plans construction by 2027 and target to 2 million tonnes hydrogen or 11 million tonnes ammonia per year. > In the Ukraine–EU Hydrogen Corridor initiative to transport hydrogen to Central Europe, an MoU was signed January 2025. |

International partnerships and finance

|

|

CCS/DAC |

> Kazakhstan’s carbon neutrality strategy mentions CCS but lacks specific targets. > Ukraine’s National Energy and Climate Plan for 2025 to 2030 includes long-term CCS plans but notes the research, knowledge, and technological base is still in its early stages. > Russia shows no real commitment to reducing emissions, but Russia’s Energy Strategy to 2050 signals investments in carbon capture R&D to secure influence on future export industries and markets. Enforcement of carbon reporting for large emitters, started in 2021, is lax and a draft law to expand emissions trading nationwide is on hold. |

Low, limited carbon pricing |

|

Transport |

> Fossil fuels used in road transport have negative taxation on fuel use, i.e. fossil-fuel subsidies. > In road transport, there is no widespread adoption of biofuel blending mandates. > The Energy Strategy of Ukraine until 2050 (ESU) projects an increase in transport sector electricity consumption from the electrification of transport. > In aviation, Russia has no formal mandate for SAF and its approach to SAF development and adoption remain limited |

Consumer-side subsidies |

|

Manufacturing |

> Transition focus is predominantly on efficiency improvements, such the ESU of Ukraine stating the goal of reducing energy intensity of GDP by 50% and its National Economic Strategy to 2030 establishing a sector-specific target of a 30% energy intensity reduction in extractive industry by 2030. |

Standards

|

|

Buildings |

> Social regulation dominate tariff-setting policies, seeing electricity and heating as a public good. Widespread consumer-side subsidies keep electricity and heat charges low, resulting in lack of incentive for energy efficiency, fuel and technology shifts. > Ukraine’s NECP prioritizes energy efficiency, building modernization with nearly zero-energy building standards and supports decarbonization by modernising the heat energy sector. > Russia’s Energy Strategy to 2050 specifies introduction of energy conservation measures. > Azerbaijan Energy Efficiency Fund provides support for projects. |

Consumer-side subsidies Standards

|

References

AK&M – AK&M News Agency (2025). 'The Cabinet of Ministers Approved the Energy Strategy of the Russian Federation until 2050.' AK&M News Agency. 25 September.

Akhmetkali, A. (2024). ‘Kazakhstan’s Renewable Energy Sees Steady Growth in 2024. Energy Storage Challenges Persist’. The Astana Times. 13 December.

Astana Times (2025). Kazakhstan Plans Major Boost in Renewable Energy by 2030. 23 May.

Barlow I., Tsafos N. (2023). ‘Russia’s Hydrogen Energy Strategy.' Center for Strategic and International Studies. 14 October.

Climate Action Tracker (2022). Russian Federation: Net Zero Targets. 9 November.

CREA – Centre for Research on Energy and Clean Air (2025). EU Imports of Russian Fossil Fuels in Third Year of Invasion Surpass Financial Aid Sent to Ukraine. February 24.

DIW Econ (2024). Renewable Energy in Ukraine: Current Institutional Environment, Investment Barriers and Prospects.

Fuel Cells Works (2025). Uzbekistan to Launch Green Hydrogen Production in June 2025. 11 June.

Herbert Smith Freehills Kramer (2022). Decarbonisation Round-Up – Russia Moves to Position Energy Sector for the Net-Zero Age. 2 February.

IEA – International Energy Agency (2025). Fossil Fuel Subsidies. Accessed 25 august. 2025.

IEA – International Energy Agency (2024). Ukraine’s Energy Security and the Coming Winter.

Interfax (2023). Climate Change Damage in Russia Put at 580 Bln Rubles Annually – Sberbank. 11 December.

Leahy, J., Stognei, A., Moore, M., Hille, K. (2025). 'Russia Says China Has Agreed Vast New Siberia Gas Pipeline.' Financial Times, 2 September.

Maguire, G. (2025). ‘A refresher on Russia’s commodities clout ahead of Trump talks.’ Reuters. 15 August.

Natural Gas Intelligence (2025). In Sanctions’ Shadow, Russian Arctic LNG 2 Pushes More Cargoes into Global Markets.14 August.

Pokidaev, D. (2025). 'China’s CNNC to Build Third Nuclear Power Plant in Kazakhstan.' The Times of Central Asia, 1 August.

PV magazine (2025). Kazakhstan to auction 90 MW of solar this year. 13 February.

QazaqGreen (2025). Kazakhstan to Commission Nine Renewable Energy Facilities Totaling 455 MW in 2025. 21 August.

Romina B, and Romanishyn A. (2025). 'Striving for Access, Security, and Sustainability: Ukraine’s Transition to a Modern and Decentralized Energy System.' Center for Strategic and International Studies (CSIS). 2 July.

Wawiernia, K. (2024). 'Kazakhstan Steps Up to the Plate on Climate Change – Creating a Road Map for a More Sustainable Future.' United Nations Development Programme (UNDP) Kazakhstan. 28 October.