This region stretches from Mexico to the southern tip of South America, including the Caribbean island nations.

| 2024 | 2060 | |

| Population | 672 million | 747 million |

| GDP* | USD 12.9 trillion | USD 26.1 trillion |

| GDP per person | USD 19 200 | USD 35 000 |

| Energy use | 36 EJ | 41 EJ |

| Energy use per person | 54 GJ | 56 GJ |

| CO2 emissions** | 1.7 Gt | 0.9 Gt |

| CO2 emissions per person | 2.6 tonnes | 1.2 tonnes |

*All GDP figures in the report are based on 2017 purchasing power parity and in 2023 international USD

**Energy- and process-related CO2 emissions, after CCS and DAC.

Rapid solar and wind expansions build on the bedrock of hydropower, and mineral wealth anchors the region in cleantech supply chains. But hydrocarbon extraction and exports remain vital for several countries, and overall, the region is striving to decarbonize end-use sectors.

Current situation

Renewables

in power generation

Oil

has the highest oil share in primary energy supply

of world lithium reserves

in the region

Annual GDP loss

from floods, storms, and drought

- Renewable energy sources have high penetration in power, accounting for more than 60% of generation, more than the global average. Fossil fuels account for about two-thirds of primary energy supply, below the global average.

- Latin America has the highest oil share in primary energy supply (40%) among ETO regions. In transport demand, it meets 91% of energy needs. The region accounts for about 10% of global oil supply.

- Mineral wealth is vast (Monteiro, 2025) with 60% of world lithium reserves (top producers: Bolivia, Argentina, Chile) and 40% of copper (top producers: Chile and Peru). Brazil holds the world’s third-largest reserves of nickel and rare-earth elements.

- Climate risks include floods, storms, and drought driving water scarcity impacting industries like mining and hydropower. Infrastructure disruptions cost more than 1% of GDP on average across the region, and up to 2% annually in 60% of Central American countries (World Bank, 2022).

Pointers to the future

- Hydrocarbon producers balance net-zero goals with resource exploitation, one example being Brazil hosting COP30 for climate action while continuing oil and gas block tenders in 2024 and 2025, many in the Amazon. Yet it also advances offshore wind (Government of Brazil, 2025) and CCS frameworks, with Petrobras launching its first CCS pilot tender. Colombia also enters offshore wind, preparing its first auction in 2025.

- Import-dependent countries, such as Mexico – reliant on imported US gas to meet 80% of demand and over half its electricity – will gain fuel-cost savings from reaching the government’s 45% renewable electricity target by 2030 (22% in 2024) and is opening up to independent power producers (Goldwyn et al., 2025). Mexico also eyes opportunity in LNG export terminals on its Pacific coast, intended for Asian markets with US shale gas.

- Renewable electricity is expanding steadily in the region, such as the RELAC countries targeting 80% of generation by 2030 (Paredes et al., 2025). Chile surpassed 40% solar and wind generation in 2024, with related energy storage now standard. Brazil’s storage framework is imminent, and it is planning its first BESS auction in 2025. Storage adoption grows due to grid constraints, curtailment, and stability needs across the region.

- Promising hydrogen leaders in the region are Brazil, Chile, and Colombia, building on renewable electricity bases. Production ramp-up will involve international finance, such as the European Investment Bank in the Team Europe Renewable Hydrogen Funding Platform for Chile, though developments are still at early stages.

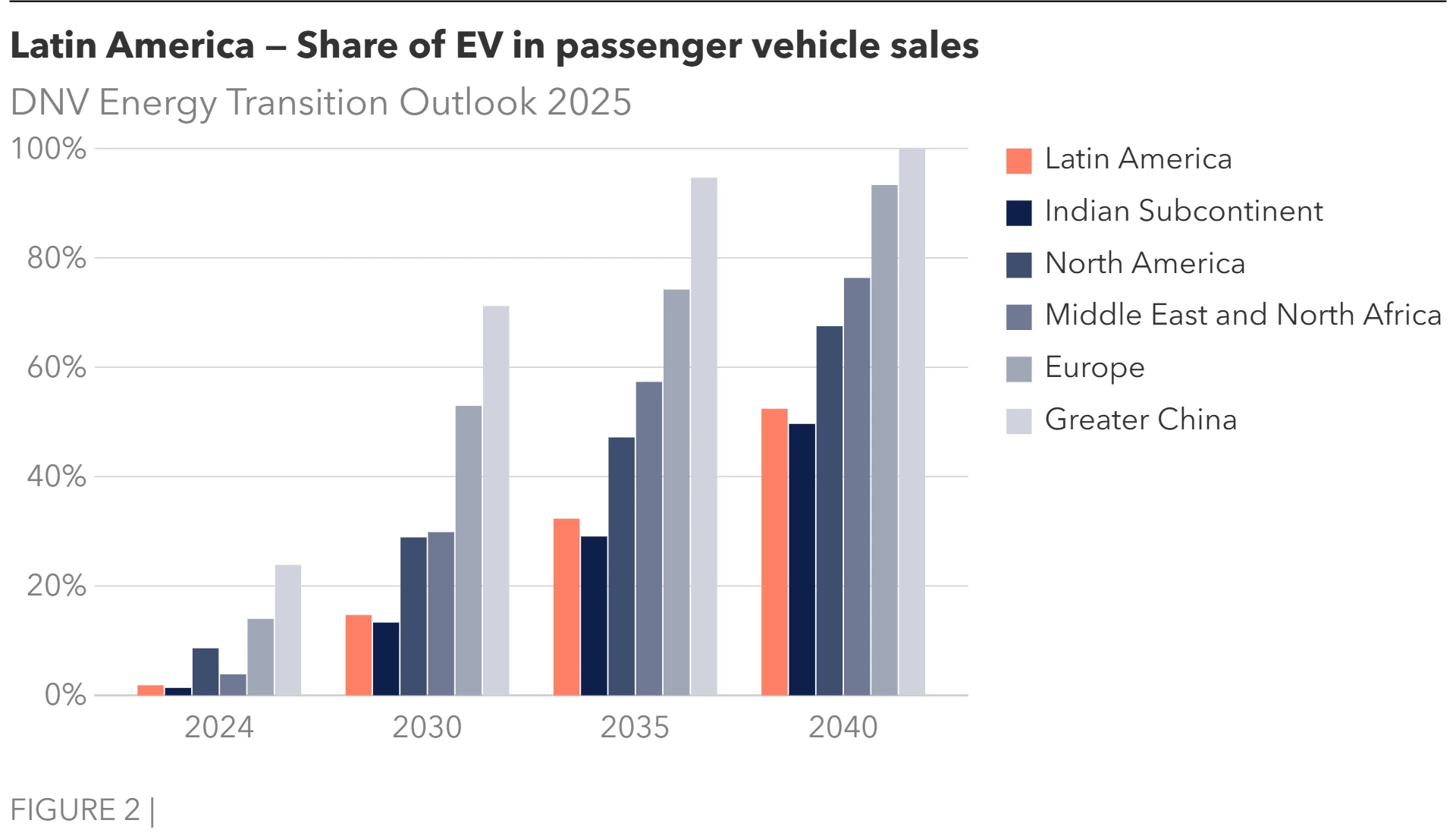

- Demand sectors, such as in buildings and transport, have hitherto uneven and evolving policies aimed at decarbonization and insufficiently reduce dependence on petroleum products.

The energy transition indicators

Primary energy consumption (EJ/yr)

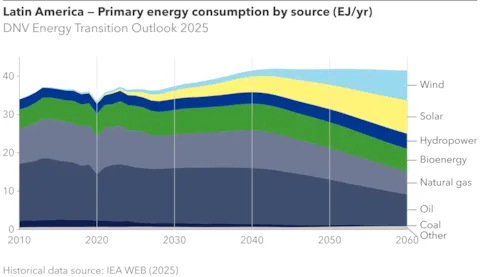

Latin America’s primary energy mix is dominated by fossil fuels today (70%). This is below the global average (80%), thanks to extensive use of bioenergy. Of all regions, it has the highest share of oil in primary energy consumption. It will hold this position through to 2060, placing deeper decarbonization goals at risk despite significant progress with renewable energy (effectively halving the share of oil in primary energy).

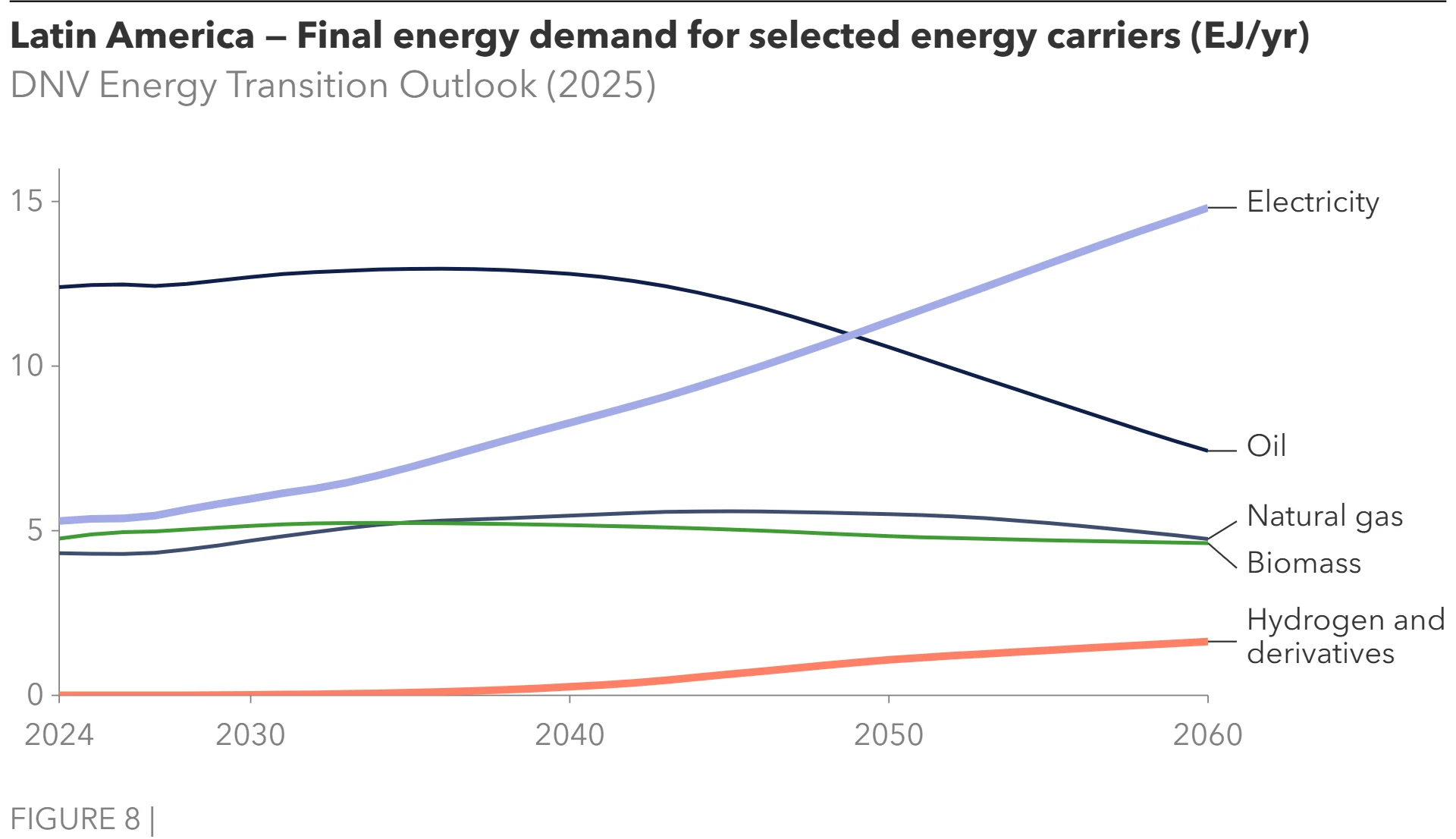

Final energy demand (EJ/yr)

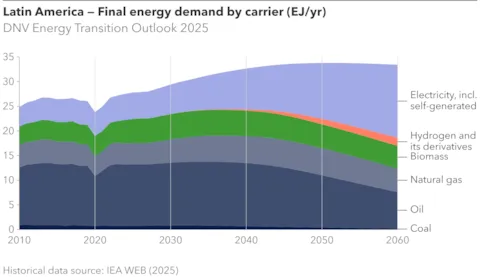

Driven by GDP increase, final energy demand will grow 20% by 2060. Fossil fuels, led by oil, currently dominate final energy demand, but their demand will continue to plateau in the next 15 years. Electricity will mostly meet new demand through 2040, before it starts displacing oil demand. Electricity and smaller amounts of hydrogen and its derivatives will together make up 50% of the fuel mix by 2060.

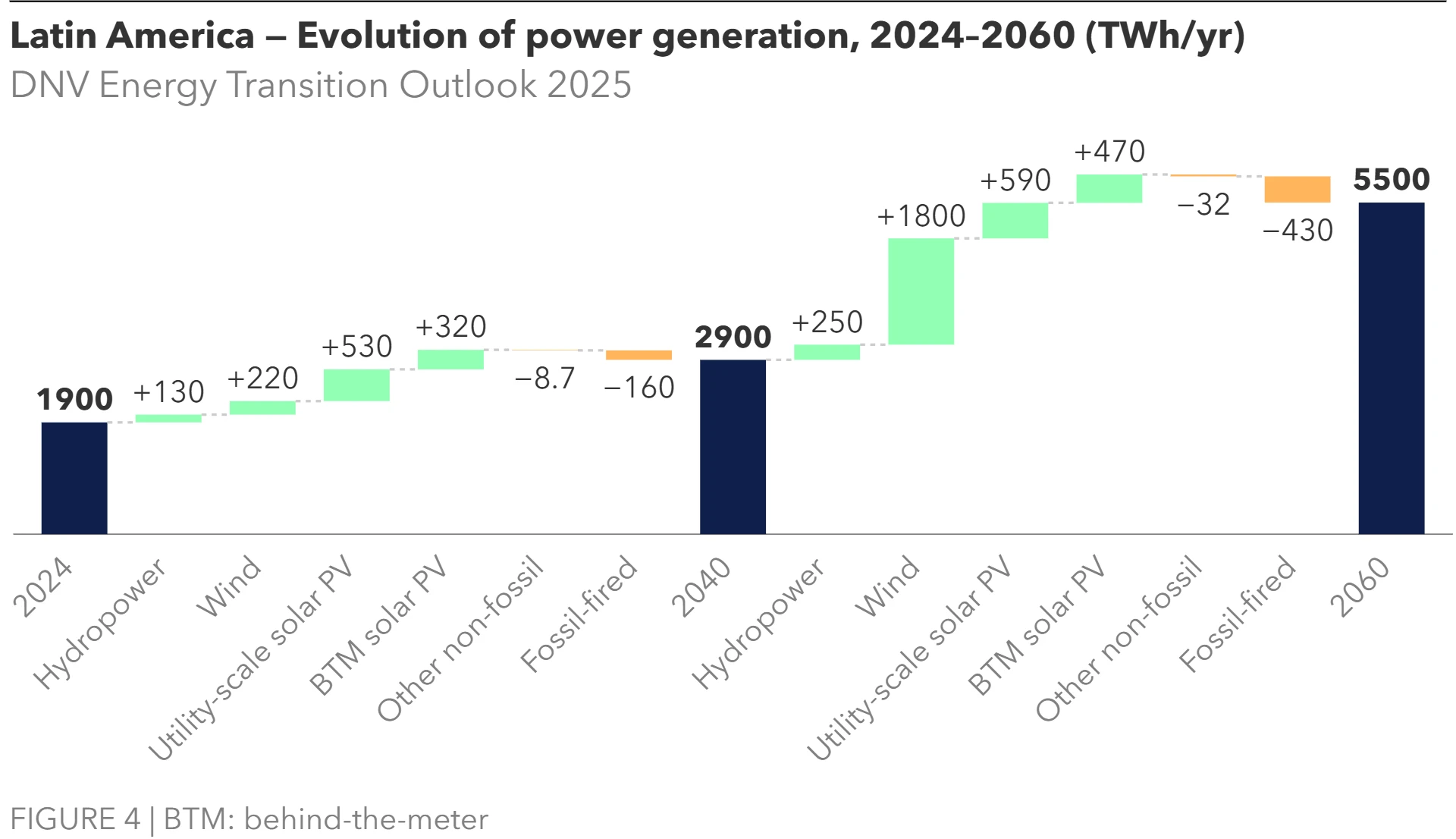

Electricity generation (PWh/yr)

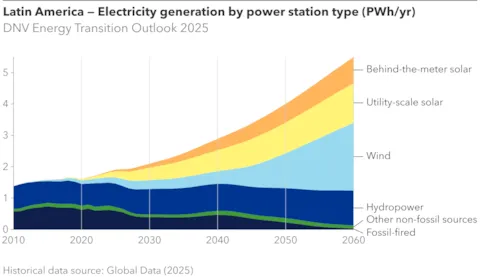

Latin America has the highest penetration of renewables among our Outlook regions and is set to continue leading this transition. Hydropower, currently 40% of the electricity mix, plays a predominant role in this. Additions of solar capacity, and later wind, will meet the growing demand. Total generation will rise 2.5-fold by 2060, by which time 99% of electricity will be from renewables.

Carbon dioxide emissions by sector (GtCO2/yr)

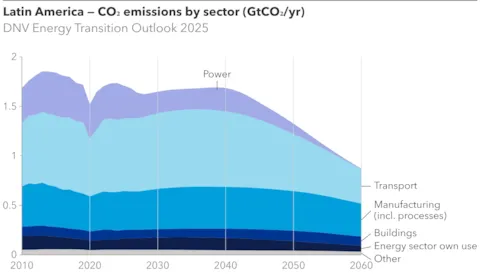

Carbon dioxide emissions in Latin America have already peaked in 2023. Reflecting the little changes in primary energy, emissions will remain almost stable to 2040. As oil is progressively replaced by renewable electricity, especially in transport, CO2 emissions will be halved by 2060. This will lead the region back to its 1990 emissions levels, and far from any net-zero targets.

Renewables and oil shape our forecast for Latin America

The global energy transition is a mosaic of regional and national pathways, each shaped by distinct resource access, economic structures, and policy priorities. Within this global context, Latin America presents a particularly complex and instructive case. The region is navigating a dual-track energy transition, characterized by the coexistence of two parallel and powerful systems: a resilient, mature hydrocarbon sector and a rapidly expanding clean energy ecosystem. This duality is not a temporary phase but a structural feature of its energy landscape for the coming decades.

For Latin America, the forecast needs to go beyond a simple narrative of old versus new energy. The future of energy in the region will not be defined by the rapid success of one system over the other, but by the complex, and at times contradictory, interplay between them.

Our assessment considers the region's unique economic and demographic trajectory, which sets it apart from both mature, low-growth economies and other high-growth emerging markets. Our analysis dives into four key features:

- The continuing role of the regional hydrocarbon sector, analysing the specific drivers of supply-side resilience in key producer nations and the structural obstacles to a rapid decline in oil demand.

- The expansion of the clean energy sector, focusing on Latin America’s established leadership in renewable power generation and the challenges and opportunities in emerging decarbonization pathways.

- The challenge of meeting substantial growth in total energy demand, a factor that fundamentally shapes the pace and nature of the transition and reinforces the dual-track reality.

- The policy and investment landscape, with a complex interplay of international finance, national strategies, and socio-economic hurdles that will ultimately govern the transition's speed.

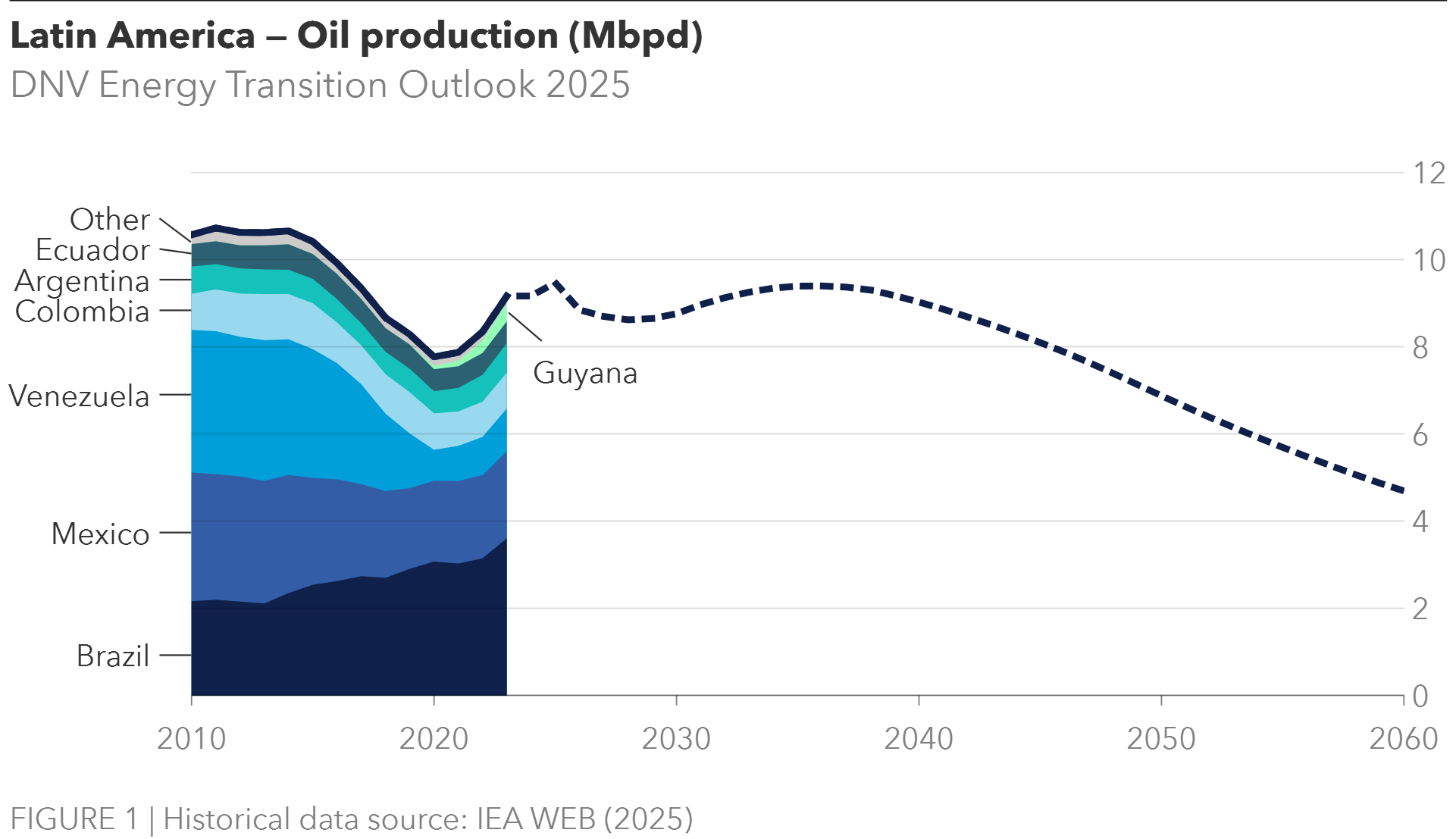

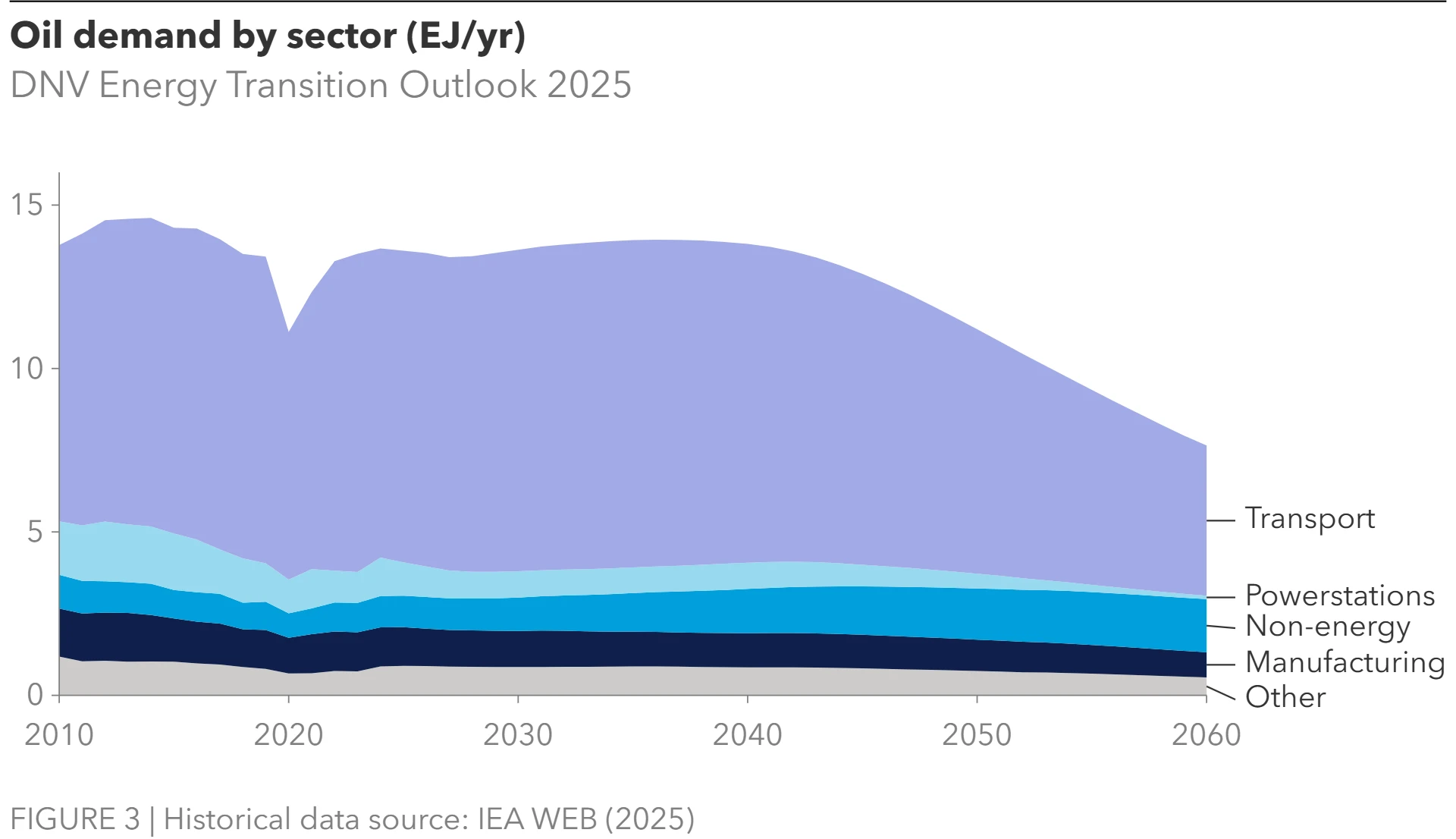

Oil’s lasting presence

Latin America’s hydrocarbon sector will demonstrate significant resilience through 2040. Regional oil and gas production is forecast to remain stable in the medium term before entering a gradual decline, in contrast to steeper declines in other regions. This persistence is anchored by two key factors. On the supply side are globally competitive oil production in Brazil and new unconventional gas developments in Argentina. On the demand side is structurally persistent oil consumption in the transport and industrial sectors where low-carbon alternatives are not yet scalable. Our forecast shows oil's share of the primary energy mix reducing from over 40% today to approximately 20% by 2060, a significant drop but one that leaves oil as a dominant energy source.

This supply-side resilience is a function of diverging national realities. The primary driver is Brazil, whose prolific pre-salt offshore fields are a globally significant source of non-OPEC production growth. These assets are economically robust, ensuring continued investment. In parallel, Argentina is rapidly expanding its unconventional natural gas production from the Vaca Muerta shale formation. This development is not only boosting domestic supply but has also prompted plans for LNG export terminals, positioning Argentina as a potential new global gas supplier. These growth stories contrast with the outlook in Mexico, which is managing mature, declining fields, and Venezuela, where production remains constrained. This varied landscape results in a relatively stable regional production forecast for the medium term. Natural gas consumption is forecast to grow in the medium term before declining post-2040, reinforcing the longevity of broader hydrocarbon infrastructure.

On the demand side, oil consumption is linked to sectors where displacement is a multi-decade challenge. The transport sector is the dominant consumer, and its transition is slowed by the slow turnover rate of the vast existing vehicle stock. Other factors include the high upfront cost of electric vehicles (EVs) for a majority of consumers, persistent fossil-fuel subsidies in key economies, and gaps in charging infrastructure. As a result, the region's EV adoption is forecast to lag leading markets like Europe and China. The strong biofuels industry, particularly in Brazil, also supports the longevity of the internal combustion engine fleet by providing a lower-carbon liquid fuel alternative.

Beyond road transport, demand in hard-to-electrify sectors like aviation and maritime shipping remains strong, with low-carbon alternatives not expected to reach scale before 2035. Non-energy is the only long-term growth sector for oil. In this sector, oil demand will grow 70% by 2060, reflecting a higher demand for asphalt and bitumen for infrastructure, and an increasing production of plastics and other petrochemicals.

World’s cleanest power generation

Latin America will solidify its position as a global leader in decarbonized electricity, with renewables set to generate nearly all (99%) of the region's power by 2060. This profound decarbonization of the grid, led by solar and wind, is a central and successful pillar of its transition.

The region's power sector is already a global benchmark, with renewables accounting for 63% of generation today, the highest of any region. The next phase will be even more dramatic. While hydropower will remain a crucial source of dispatchable energy, its share of the mix will decrease as solar and wind become the primary engines of growth. However, this transition is not without challenges. Increasing climate-driven drought poses a risk to hydropower reliability, highlighting the advantages of a more diversified renewable portfolio.

The forecast points to a system dominated by solar and wind, which together will account for over 70% of all electricity generated by 2050.

Utility-scale solar PV is set for the most significant growth in the short- and medium-term. This is driven by the exceptional solar resources in locations like Chile's Atacama Desert and falling technology costs. A critical element of this forecast is the rise of solar+storage configurations. These systems, which pair PV panels with co-located batteries, directly address the intermittency of solar power, extending its availability into the evening hours and providing greater grid stability. This hybrid model is forecast to be a key enabler of solar's expansion in Latin America.

Off-grid and behind-the-meter (BTM) solar PV will also develop significantly, representing 20% of all electricity production in the region by 2060. This segment will consistently represent around a half of the region’s solar capacity additions throughout our forecast period, the second highest share in the world behind grid-deprived Sub-Saharan Africa.

The region will leverage both its established onshore and nascent offshore wind resources. Onshore wind is already a mature industry, with strong and consistent wind patterns in areas like Patagonia and northeast Brazil supporting large-scale development. We forecast onshore wind to really take off from the 2040s and be the largest source of power generation by 2060. The forecast also anticipates a moderate emergence of offshore wind, particularly after 2030. Countries like Colombia, which held its first offshore wind auction in 2024, and Brazil, which is developing a regulatory framework, are poised to become early movers in this sector.

The clear competitive advantage of renewables will leave very little room for nuclear power generation. Beyond those currently operating in Brazil and Argentina, we forecast no new large-scale installations. The uptake of small modular reactors will be limited to a few gigawatts, and not before the end of the 2040s, when costs have gone down due to development in other regions.

Renewable integration requires resilient power grids. The lack of adequate transmission infrastructure is already leading to bottlenecks in some areas, with prices reaching zero at certain nodes of the respective electricity markets, limiting the profitability of renewable projects. This will be addressed, and our forecast foresees doubling of power line capacity in the region.

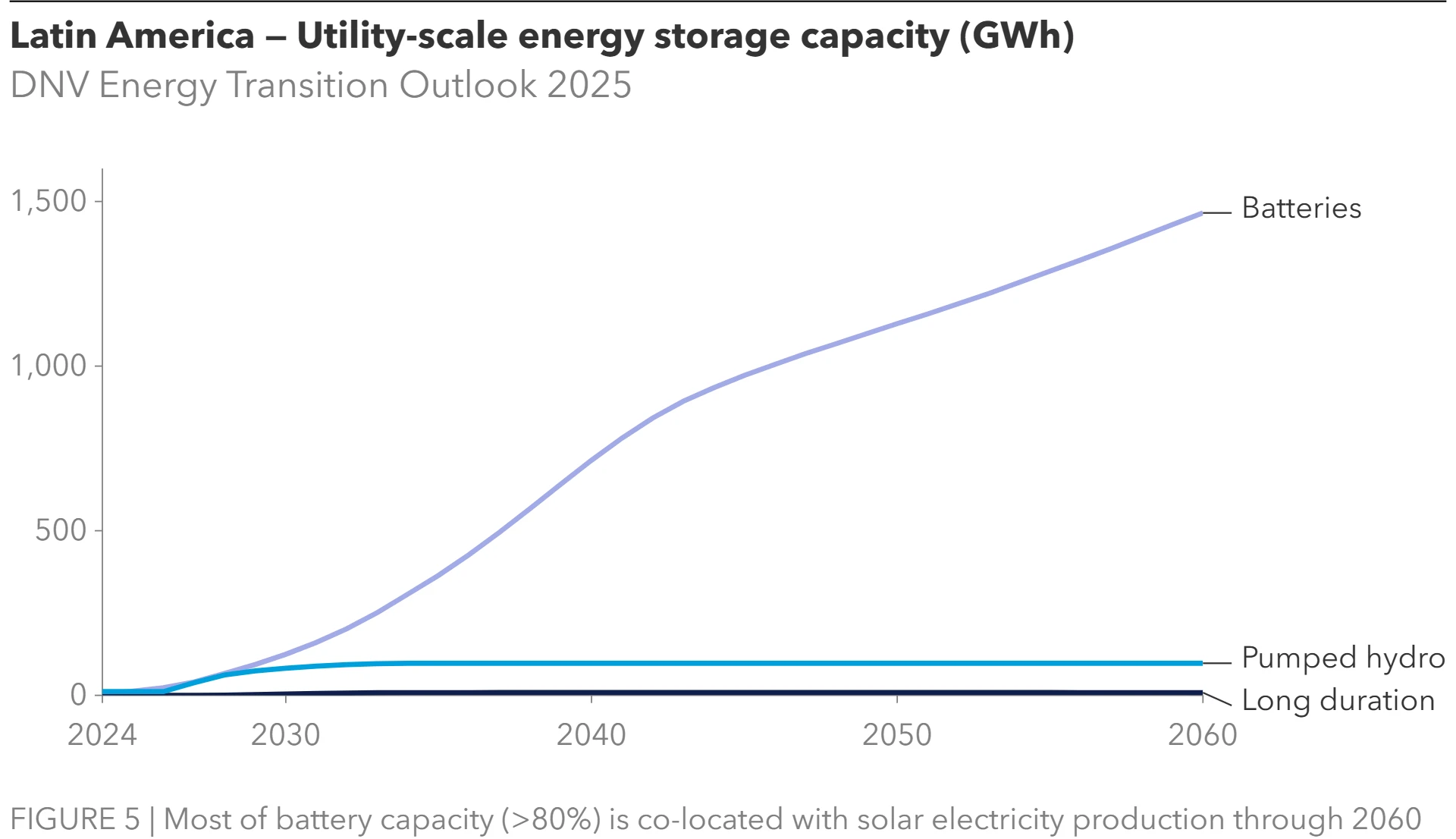

The integration of such high shares of variable renewables will rely on a massive expansion of energy storage. Battery storage will be a key tool to alleviate this congestion. Our forecast projects that utility-scale battery storage capacity will surge from a negligible 5 GWh in 2024 to 1,500 GWh by 2060. This rapid build-out is essential not just for storing excess energy but also for managing grid frequency, preventing the curtailment of renewable generation during sunny or windy periods, and ensuring a stable and reliable power supply.

Green hydrogen, an unmet potential

While Latin America's abundant renewable resources position it to be a highly competitive green hydrogen producer, its growth prospects face considerable challenges from global competition and a lack of developed policy frameworks.

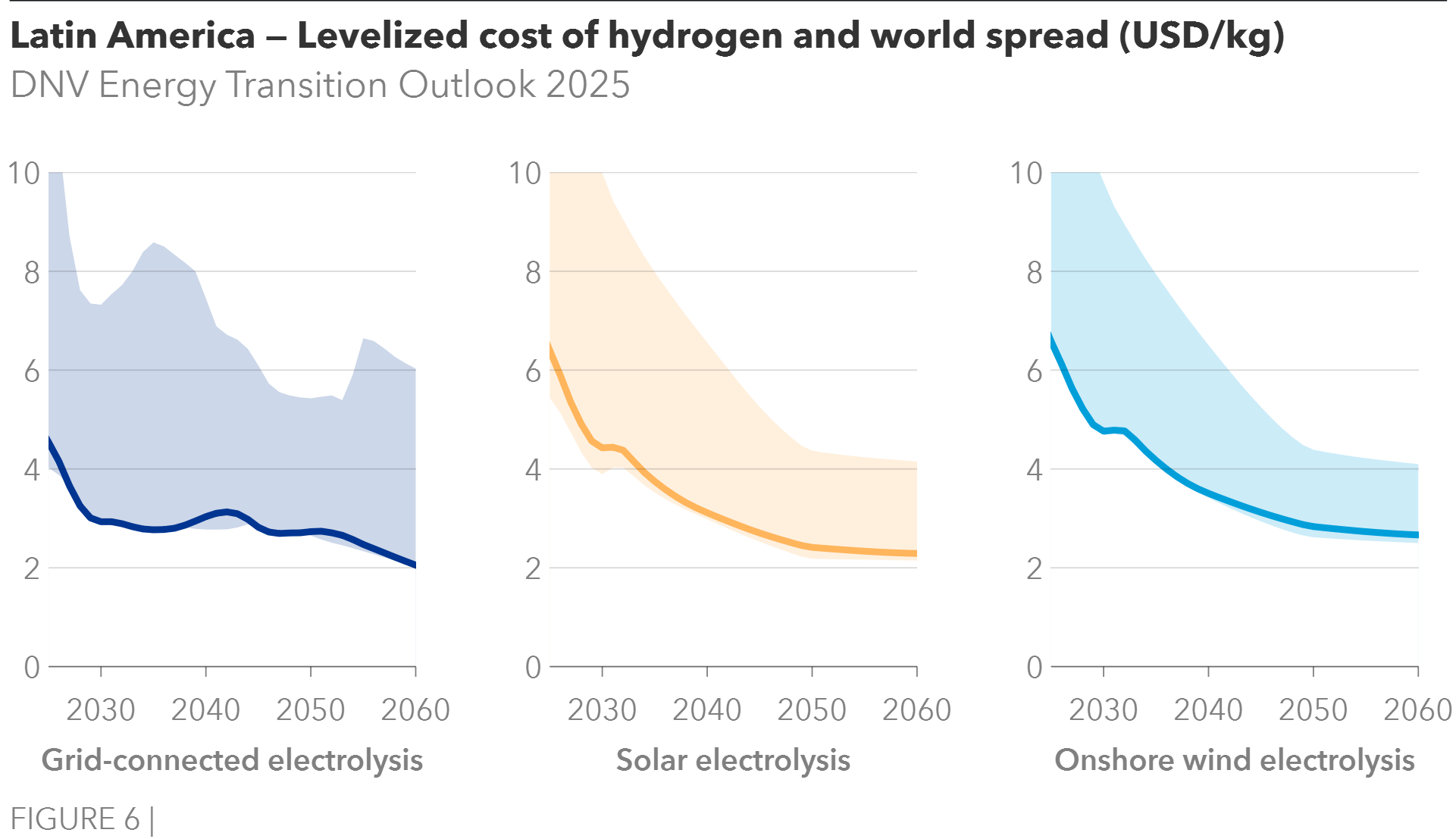

Potential for cost leadership

The region will achieve ones of the world's lowest levelized costs for electrolysis-based hydrogen. Costs will already be below 3 USD/kg in the 2030s and close to the sought-after 2 USD/kg, making the region’s hydrogen competitive with natural gas-based production. This cost-effectiveness, originating from high-capacity solar and promising wind resources, gives Latin America a significant production advantage. In key locations, like in Chile and Brazil, production costs have the potential to fall below 2 USD/kg earlier. This potential is attracting significant interest for large-scale project development aimed at the export market.

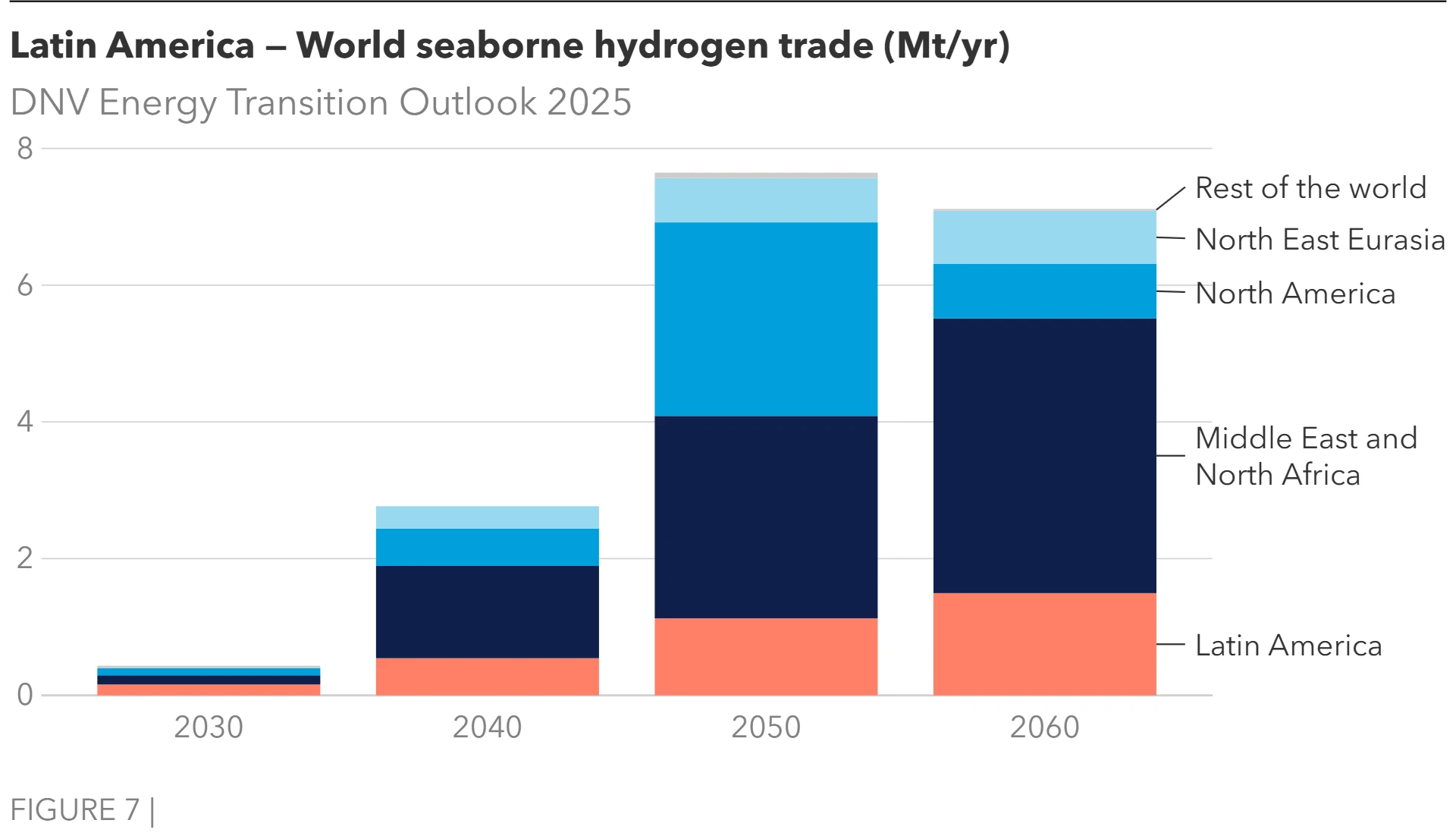

Global competition and market access

Despite this cost advantage, the region's path to becoming a major global supplier is constrained. Forecasts suggest Latin America will be an early mover, supplying a large share of global seaborne hydrogen trade in the 2030s, mostly to Europe. But exports will not ramp up significantly, and the region will represent less than 20% of seaborne trade in the 2050s. This is primarily due to intense competition from regions like North America or Middle East and North Africa, which already have advanced policy incentives and established infrastructure roadmaps.

Ammonia as an energy carrier is not forecast to be a major export market. Our forecast indicates that Latin America will even need to import around a half of its demand by 2060. Some production will be exported to North America, but exports to Europe and Asia are expected to be limited due to higher transportation costs and established supply chains from competing producers.

To capitalize on its potential, the region would have to establish supportive regulatory and financial frameworks. Without robust government action to de-risk investments and streamline project approvals, Latin America is forecast to become a marginal player despite its inherent resource advantages.

The challenge of meeting growing energy demand

A projected 20% growth in final energy demand in the next 20 years is the fundamental context shaping Latin America's transition. This growth is a key differentiator from mature economies and means the region's expanding renewable power must work to meet new demand first. This dynamic slows the absolute displacement of incumbent fossil fuels and reinforces the dual track that defines our forecast. Only when final energy demand plateaus in the 2040s can electricity and other decarbonized alternatives really start replacing oil in the fuel mix.

Unlike mature economies with flat or declining energy use, Latin America is a growth region. Its population is forecast to expand from 670 million to 750 million by 2060, and a 75% increase in GDP per capita will fuel significant increases in energy consumption.

Buildings will be the largest growth sector. Energy demand will increase by almost 70% by 2060, a 1.5% compound annual growth rate. Such an increase reflects the increased cooling demand and data centres installation, driven by a combined effect of rising living standards and growing population. This will be powered predominantly by electricity, of which 20% will be self-generated by BTM solar panels from the 2040s.

Demand for manufacturing will grow more moderately to 2060 (30%) due to a production increase in manufactured goods and base materials, driven by both a growth in population and GDP per capita. Both electricity and hydrogen shares of the mix will be slightly below the global average, highlighting the challenges to tap in the region’s potential.

This is usually referred as the 'decoupling challenge’: the need to grow the economy without growing emissions. This structural reality is a primary reason why the absolute consumption of fossil fuels is projected to decline more slowly than in low-growth regions, and why energy-related emissions do not decline before the 2040s.

Policy summary

A non-exhaustive list of sector policy initiatives, emphasizing the 2024 to 2025 period

|

Climate targets - Key countries Argentina, Brazil, Chile, Colombia, Mexico target net-zero emissions by 2050. |

||

|

Sector |

Policy details and example initiatives |

Mechanism(s) |

|

Power |

> Competitive bidding processes allocating 15-20-year power purchase agreements (PPAs) are prevalent to reach renewable electricity targets: Mexico aims for 45%, Argentina for 57%, Colombia for 70%, and Chile for 80% of power generation by 2030. Brazil targets 45% and Chile 60% of energy use to be renewable by 2030. > Mexico’s 2025 Energy Reform includes new rules for private investor participation and several provisions on renewables including geothermal. > In offshore wind, Brazil established its legal framework (Law No. 15,097/2025). Colombia received proposals for 69 offshore sites in its first bidding round which aims to allocate projects for 1 GW capacity under 15-years contracts for difference (CfD) scheme. Winning bids to be announced December 2025. > At national level, countries are implementing/considering policies for "behind-the-meter" (BTM) distributed generation and energy storage. |

Tenders/auctions

Regulatory framework

Market design, BTM frameworks |

|

> Energy storage frameworks are evolving to align with renewables penetration goals and handle variability. > Chile leads policy advancement with capacity remuneration and a storage mandate (2 GW by 2030, 6 GW by 2050) with most utility-scale solar PV paired with storage. Brazil plans to include batteries in a power reserve auction, adoption is hitherto driven by industrial and commercial consumers. Mexico mandates 30% BESS integration with renewable projects. Colombia’s promotes hybrid solar + BESS through its reliability charge. |

Tenders/auctions Capacity remuneration Mandates |

|

|

> Coal power is planned for phase-down in Brazil and phase-out in Chile by 2040. Retirement plans are supported by concessional finance. Several economies are working on ETS development and some have carbon taxes at low levels, taking steps to enhance schemes. |

International finance Low/limited carbon pricing |

|

|

> Nuclear expansion plans are under consideration for additional large-scale plant as well as SMRs, such as in Brazil, also contemplating SMRs where transmission infrastructure is lacking or uneconomical. |

Public budget Cooperation |

|

|

Grids |

> Plans focus on expanding transmission and distribution capacity to integrate renewables, ensure reliable supply, and overcome bottlenecks. Grids investments include a mix of private capital, state institutions, and multilateral development banks. |

Plan International finance |

|

Hydrogen |

> At national level, Colombia, and Chile have production targets. Brazil pledged around USD 1 billion to support the creation of clean hydrogen hubs (October 2024).12 hub projects were shortlisted (December 2024) and tax exemptions have been announced (2025), including 75% corporate income tax cuts to the export-focused Solatio's 3GW green hydrogen and ammonia facility planning final investment decision in 2025. Developments in Mexico are emerging, despite lack of hydrogen energy regulation. 17 projects are under development (Chambers and Partners, 2025) with investments over USD 21 billion, one of the largest projects financed by the Danish investment fund Copenhagen Infrastructure Partners, which seeks to produce green hydrogen and green ammonia. > There are national-level partnerships with the EU and Japan on investment in hydrogen and derivatives. |

International finance |

|

CCS/DAC |

> Brazil’s framework is evolving. The Fuels of the Future Law (Federal Law No. 14,993/2024, October 2024) regulates capture, transport, and storage. The National Agency of Petroleum, Gas, and Biofuels (ANP) is to oversee CCS activities and permits for geological storage. There is no direct government funding (capex support) specifically for CCS, but broader initiatives in low-carbon technologies could indirectly benefit CCS investments, e.g. funds to decarbonization and innovation under the neo-Industrialization policy (Nova Industria Brasil) to 2033. We expect Brazil’s CCS projects to focus on hydrocarbons – driven in part by international oil companies’ net-zero declarations – and bioenergy with carbon capture and storage (BECCS). |

Regulatory framework (Brazil)

Low/limited carbon pricing |

|

Transport |

> Brazil’s Nova Industria Brasil policy targets 50% biofuels in transport by 2033, using blending mandates to increase shares, currently 30% ethanol in gasoline and 15% biodiesel from August 2025. The Fuel of the Future Law (No.14,993/2024) expands biofuel policy to aviation via ProBioQAV), aiming for 10% emissions bust by 2037, and 1% reduction by 2027 from 2026 levels under ICAO’s CORSIA. Mexico’s 2025 Energy Reform mandates state-owned investment in biofuels, including sustainable aviation fuel. > Electromobility incentives include tariff and tax reductions. Mexico promotes EV manufacturing through accelerated depreciation and tax deductions. Chile targets zero-emission new car sales by 2035, joining Colombia, El Salvador, and Uruguay in the Zero Emission Vehicles Declaration for 2040. |

Mandates Government funding, R&D

Incentives |

|

Manufacturing |

> Brazil’s pledge (October 2024) to fund 12 low-carbon hydrogen hub projects aims to support industry decarbonization with use in industrial sectors, > PEMEX’s considers substitution of grey hydrogen with green, and a strategic alliance between state-owned electric utility CFE and PEMEX refineries is under consideration; CFE also testing blends in power plants. |

Government funding |

|

Buildings |

> Minimum energy performance standards are common for buildings and appliances. > Chile advances household retrofits, via its Heat and Cold Strategy, promoting heat pumps with electricity subsidies, though high upfront costs remains a barrier. > Rooftop solar policies, including net metering systems and distributed generation, are evolving and seeking to balance incentives with grid costs. Mexico solar rooftop initiative (2025) is accelerating installations driven by government subsidies and low-interest loans. > A May 2025 EU─OLADE MoU strengthens cooperation on energy transition, focusing on energy efficiency, renewables and fossil fuel phase-out. |

Standards

Market design

International partnerships |

References

Chambers and Partners (2025). Renewable Energy 2025, Mexico. September 25.

Goldwyn, D., Ochoa, C. (2025). ‘Mexico’s new electricity law could boost the country’s energy sector. But big questions remain’. Atlantic Council. March 11.

Government of Brazil (2025). President Lula signs law creating renewable energy generation from offshore wind turbines. January 10.

Monteiro, Thomas (2025). ‘Latin America: The new battleground for critical minerals’. Global Finance. March 5.

Paredes, J., Levy, A., González, Urquizo, M. (2025). Best practices in solar and wind energy forecasting in Latin America: Lessons learned and results from a pilot project.

World Bank, (2022). A roadmap for climate action in Latin America and the Caribbean 2021-2025.