Battery recycling in Europe

Securing supply chain resilience?

As Europe accelerates towards a low-carbon future, the demand for EVs and batteries is skyrocketing. But with this growth comes a challenge: securing a reliable supply of essential minerals for battery production. Can Europe break free from its dependence on China and other countries for battery materials? One of the answers lies in recycling.

As a senior energy researcher in DNV’s Energy Transition Outlook team, Adrien conducts research on manufacturing, heavy industries, and the circular economy. He holds a PhD in chemistry and has worked in the tyre recycling industry for several years.

Decarbonizing Europe needs batteries

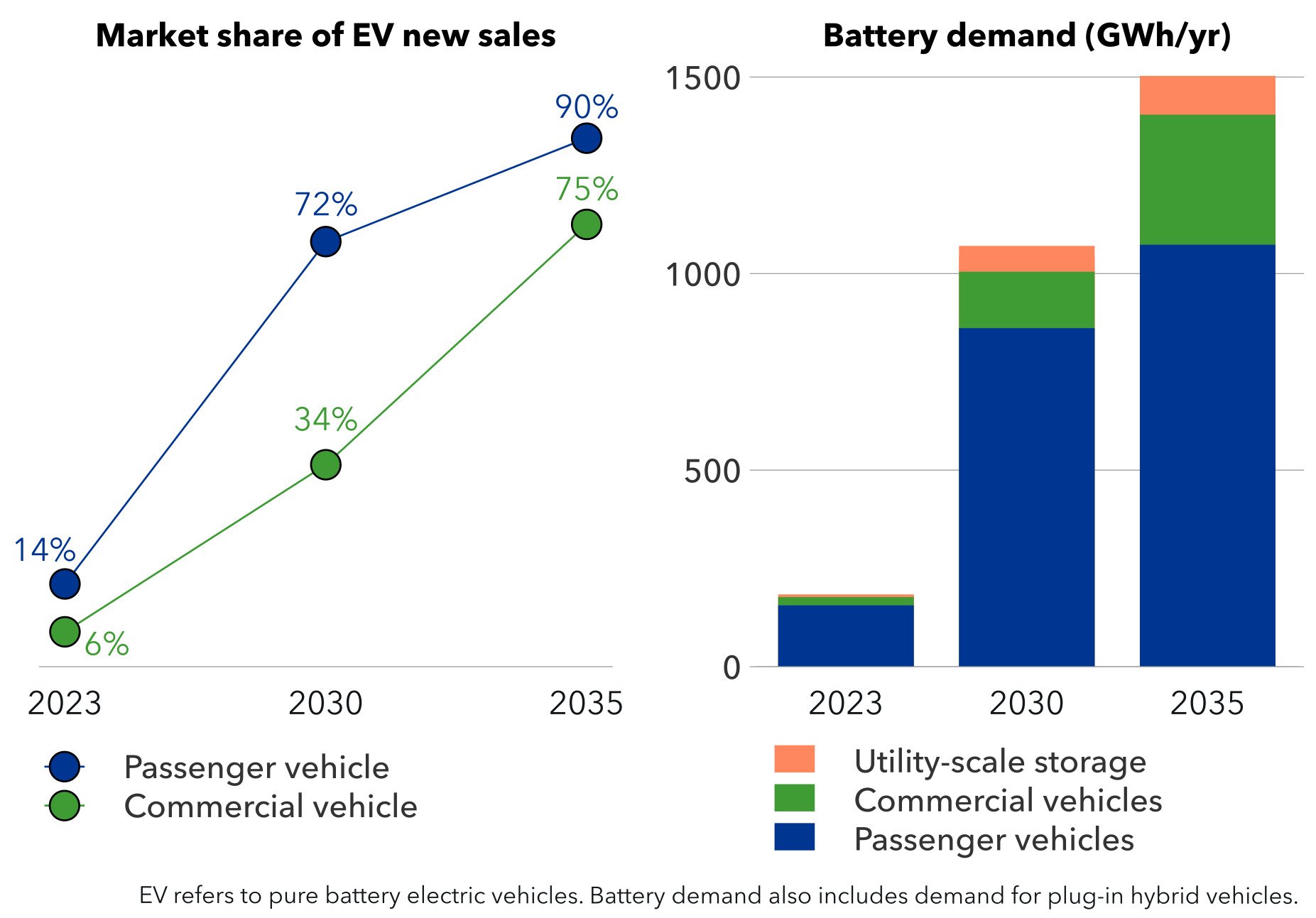

The fast uptake of EVs globally is one of the key features we highlight in DNV’s Energy Transition Outlook. Despite the current slowdown, we forecast EV sales to continue their growth in Europe in the medium to longer term. EVs are key to the EU decarbonization strategy, with the planned ban on combustion engines sales by 2035. From 14% in 2023, EVs will represent more than 70% of passenger vehicles sales by the end of this decade. Commercial vehicles sales will also follow the same trend, delayed by a few years.

The steep decline of battery costs (down 14% last year and expected to decline by at least 10% per year to 2030) makes bigger battery packs more affordable and is one of the key reasons behind this growth. Bigger batteries increase the range of EVs and steadily dissipate range anxiety for European consumers – currently one of the obstacles to EV uptake. As a result, we forecast that the average passenger car battery size will grow from 60 kWh in 2023 to 90 kWh in the late 2030s. It is likely to plateau at that level, providing an average 700 km range. Together with an increased uptake of commercial EVs, this will lead to annual European battery demand increasing five-fold between 2023 and 2030.

Batteries with similar chemistries to those used in EVs (i.e. Li-ion) are also essential for future grids to balance variable renewable supply and demand, either as standalone or integrated with solar PV plants. While they represent around 3% of yearly European demand for high-capacity batteries today, their share is forecast to grow to 6% by 2030 and 10% by 2040.

Dependence on China

There are fears that Europe might trade its dependency on oil and gas to a dependency on battery or even car manufacturing. Not only are there important differences between fuel and hardware imports, such fears are sometimes overstated: 60% of EV battery demand is currently covered by domestic production in the EU. What commentary often misses, however, is that battery production is one of the last steps in the supply chain. Earlier supply chain steps are currently dominated by a handful of countries, with China being by far the single biggest actor. The country not only dominates manufacturing (70% of global output), it also has almost total control over the production of some battery components, like graphite anodes (97%)1.

The upstream of the supply chain is the sharp end: demand for some essential minerals is increasing, with cobalt, nickel, and lithium currently attracting most attention from forecasters who point to difficulties in securing supply to match the exponential demand growth. This has led to significant swings in commodity price in recent years, and competition between companies and countries to address supply bottlenecks.

Europe’s quest for material independence

Lawmakers in Europe are acutely aware of the upstream squeeze and are advancing plans to build a regional battery supply chain. Battery “gigafactories” are currently under construction or planned in Europe and are attracting attention2. Much less advanced are regional upstream and midstream elements (mining and refining). Several projects are under way3, but long permitting times coupled with a general pushback against new mining projects in Europe will automatically create a gap between domestic demand and supply.

The necessity of mining is often cited as a drawback of the transition to EVs – big spades replacing big oil. But unlike fossil fuels, there is no material loss during the battery lifetime, and all minerals can theoretically be recovered via a recycling process. As a result, recycling is seen as an essential complement to the lack of mined resources in Europe.

The EU has included aspects of recycling in several of its recent regulations: the Critical Minerals Act sets that recycling should cover 15% of strategic raw materials consumption by 2030, while from 2027, according to the more specific EU battery regulations, the recycled content will have to be stated in the future battery passport. As described below, specific targets are also set for some critical materials.

A complex recycling process

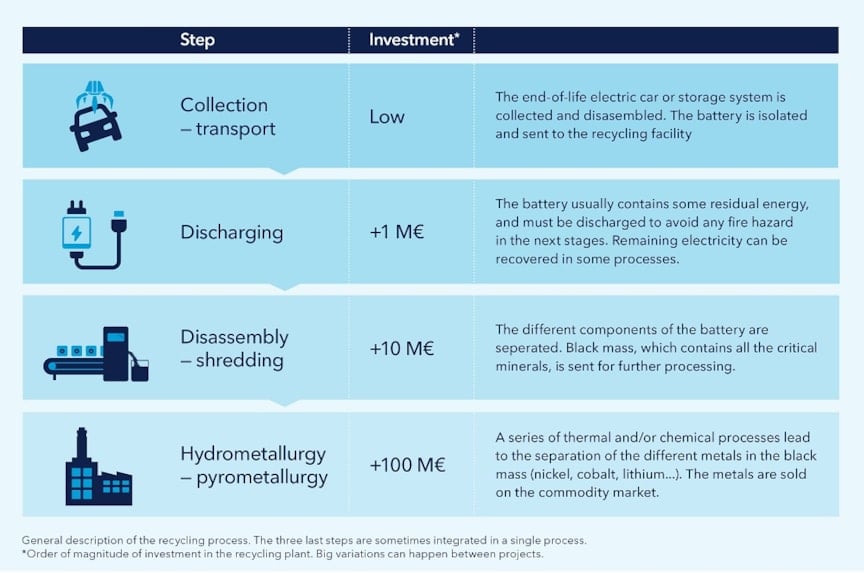

Understanding whether these targets are achievable requires an analysis of the recycling process and the business model of EV battery recycling. The process can be decomposed in four different stages, requiring successively increasing investments:

Recycling is not an easy task. Batteries tend to be designed for optimal performance, not recycling. Moreover, developments in manufacturing are rapid and manufacturers are constantly introducing new designs, with a focus on improved performance and safety. Recyclability is a secondary consideration – at least for now. The ‘black mass’ recyclate contains several metals that need to be separated, which presents a greater challenge than conventional metal recycling, especially given that the input material is not clean.

Recycling also an energy-intensive process, both for the transport of used batteries and especially the last-stage hydro/pyro process being the most energy-intensive. However, energy requirements are far below those for mining and refining, and according to some studies, recycling has the potential to decrease CO2 emissions by 75–80% compared with virgin material4,5.

Cheaper batteries – Less attractive recycling

Material recycling is always a trade-off between costs and values of the recycled content. And while the cost for recycling a ton of battery is relatively predictable, there can be large variations in terms revenues gained from recovered metals and minerals.

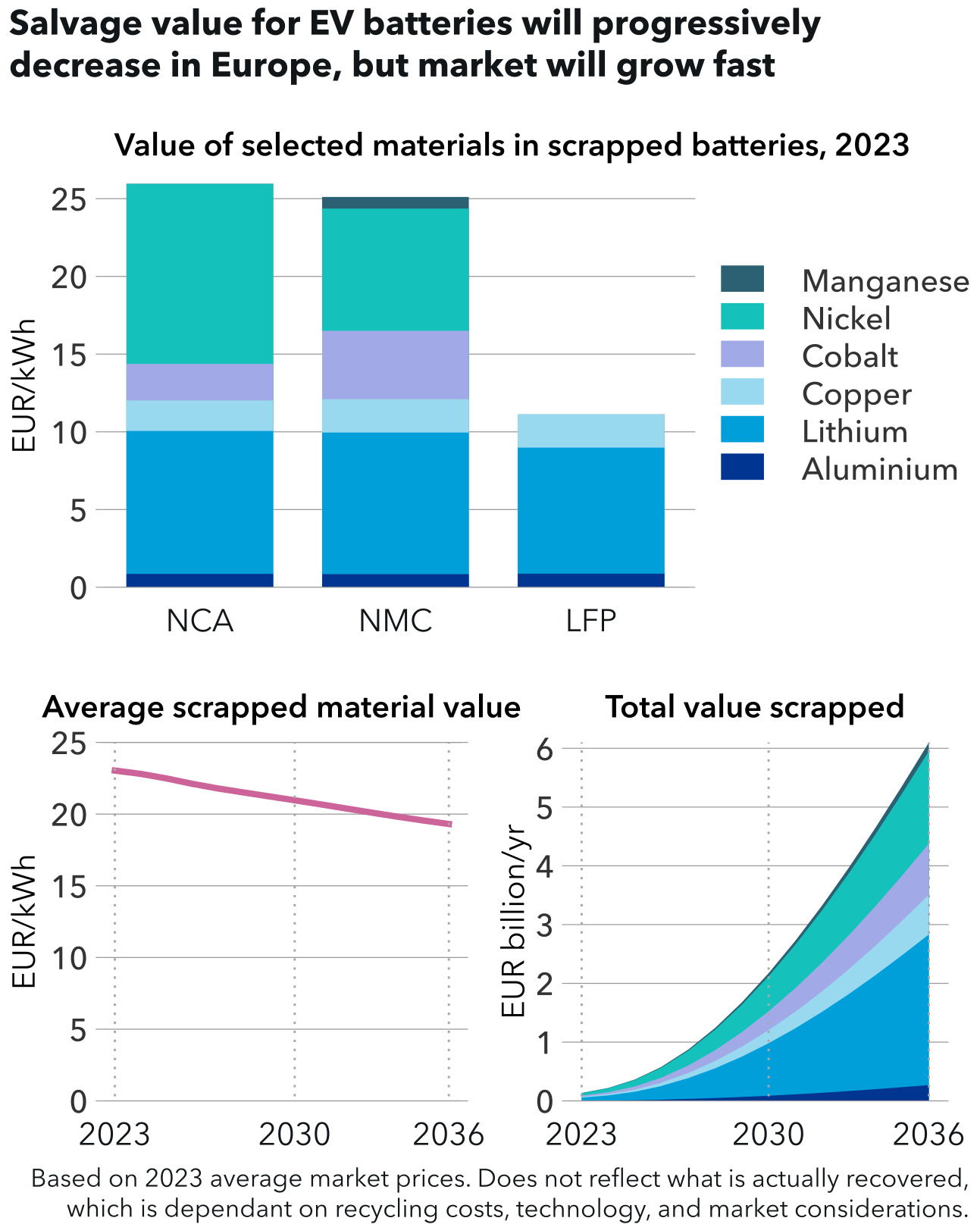

The number one factor is battery chemistry. In Europe, EVs sold in the last few years have mostly been equipped with nickel- and cobalt-rich batteries (NMC and NCA). Although market prices have been fluctuating, these two metals represent most of the recovered value for these batteries. Lithium-iron-phosphate batteries (LFP), the dominant chemistry in China, are also beginning to represent an increasing share of the market in Europe. LFP batteries contains much less valuable materials, which makes them cheaper but also less attractive for recycling. This is reflected on the market, where black mass from NMC and LFP are traded at very different prices6.

The cost/revenue trade-off also means that recovery rates differ across the various minerals. While more than 90% of nickel and cobalt are usually recovered, lithium is either scrapped or recovered with a low yield. That is why only NMC and NCA are currently recycled in Europe. Higher recovery rates are typically achieved in China, where recycling costs are lower for a combination of reasons (e.g. governmental targets, environmental regulation, labour cost, economies of scale).

Sodium-ion batteries, which could take an increasing market share in the late 2020s, would yield less revenues and present low incentives for recycling, given the relative abundance of sodium relative to lithium. A further consideration is that batteries are becoming more materials-efficient, meaning that the concentration of critical minerals is also progressively decreasing.

Overall, the forecast decline in battery manufacturing cost will be accompanied by a decline in potential recyclable value from evolving chemistries. But like for most waste streams, recycling is not primary performed for its profitability. Environmental impact is the main motivation: batteries contain hazardous chemicals and cannot be sent to landfill. And in the specific case of EV batteries, the urge to secure access to critical materials will also push the EU to strictly enforce recycling, through proven schemes (e.g. producer’s responsibility).

Better efficiencies and economies of scale in the recycling industry are currently leading to a decline in gate fees (money received by recyclers). It is still uncertain if the expected lower revenues will slow down or even reverse this trend. Any increase in gates fees would have to be passed on the customer, dampening the cost reduction of EVs to some extent – and thus heightening the need for governments to consider prolonged incentives for EV uptake.

Set inflow – unknown market

What materials will be available for recycling in the next decade is theoretically already known, as most EVs that are put on the market now will be scrapped in the late 2030s. The uncertainty lies in the future market.

Material demand for future European batteries is one of these unknowns. As the growing share of LFP batteries and the decreasing amount of cobalt exemplify, the market has proven its adaptability in the past few years. Prices and availability in the next decades are difficult to forecast; growing geopolitical tensions could reshape supply chains and force battery manufacturers in Europe to select battery technologies not on performance, but by material availability.

Another major unknown is the future trade of recycled materials. Black mass is currently massively exported out of Europe to Asia, where most processing (most hydrometallurgical) capacity is installed. Investments are still flowing rapidly, especially in China, which might experience recycling overcapacity in the short-term. That can lead to a strong competition for European black mass, disincentivize the development of European hydro- and pyrometallurgical plants and eventually leading to critical material leakage out of the region.

The importance of a closed loop for EVs

Leakage can also take place before the end-of-life. In a best-case scenario, all vehicles that reach their end-of-life on the European market would go through a recycling process. But the reality is different. Currently, only two thirds of cars are scrapped through regular channels in Europe7, and 800,000 used cars per year are exported outside of the EU. The EU is currently revising its “End-of-life vehicles Regulation”, with one of the goals being to reduce material dependency with higher recycling.

This regulation might however have a side effect. While exporting old polluting fossil vehicles is a source of extra pollution in lower-income countries8, exporting used EVs might on the contrary accelerate decarbonization in these countries where new EVs will not be an option for large parts of the population. So, although it will prevent material leakage and secure the disposal of batteries, an EV export restriction might block a trickle-down effect and slow down global EV uptake, especially in Africa.

Second use: a game changer?

The use of scrapped EV batteries for stationary storage is also an option. For a regulatory perspective, reuse of batteries is often considered better than material recovery. But repurposing old batteries is also a challenging task, as batteries are not designed for that purpose in the first place. It is a relatively labour-intensive work, and large-scale production of a standardized product is difficult, with end-of-life batteries coming in different formats, electrical properties, and performances. Unprofessional installation of second-life batteries can also present severe fire and other hazards.

Reuse will consequently be driven by market and safety considerations. New systems based on LFP batteries are already providing a cheaper and scalable alternative. Older batteries, especially cobalt-based ones, are also attractive to recyclers. They usually contain a higher concentration of critical minerals than the newer ones, which also means that more new capacity can be manufactured from the recovered materials. For all these reasons, we expect second use to represent a marginal outcome of end-of-life EV batteries in Europe.

A small but growing share for recycled material

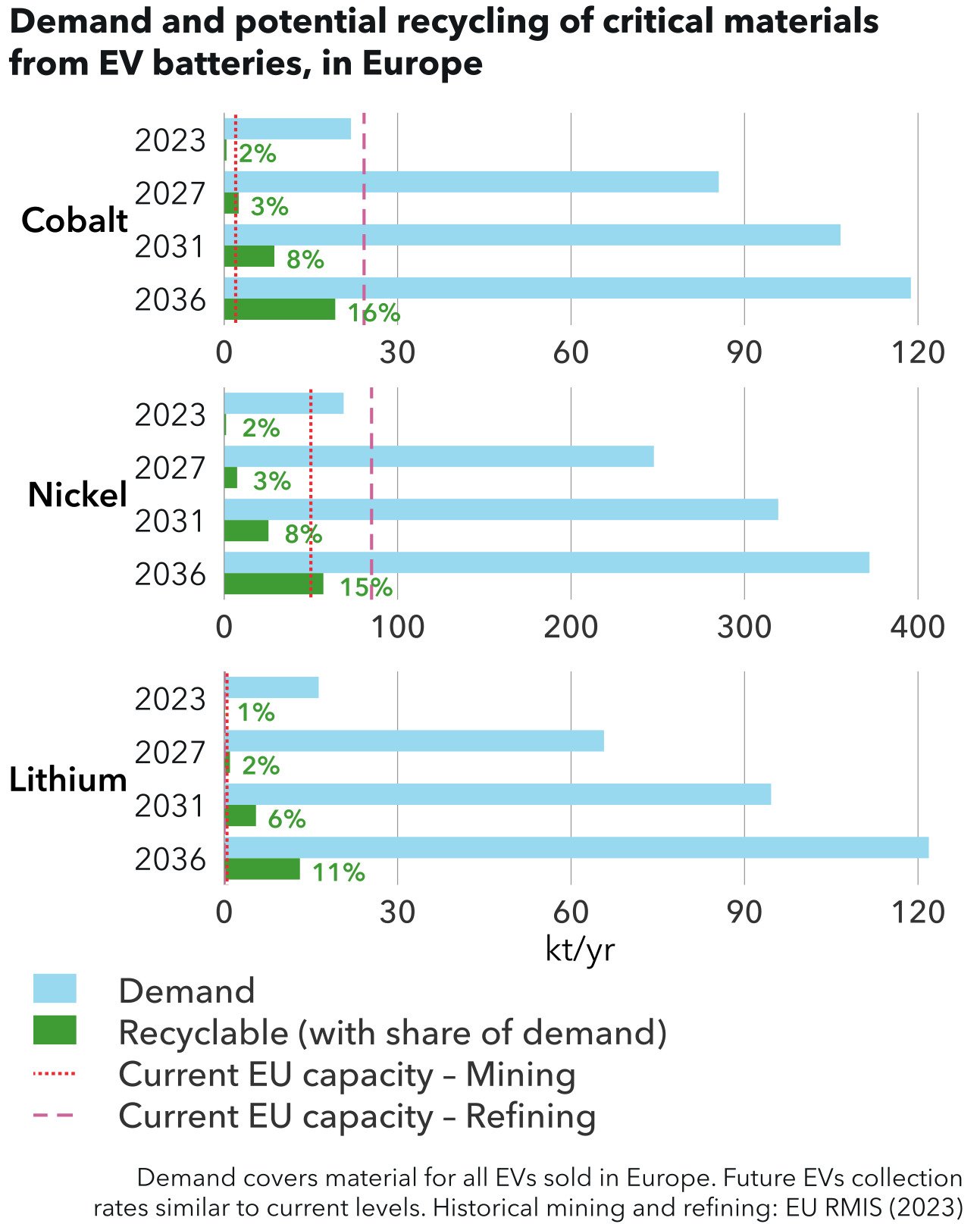

With our current assumptions, which include decreasing mineral intensity and the uptake of new chemistries, recycling can cover an increasing share of European EV batteries material demand for cobalt, nickel and lithium. But most of the input will still need to be mined, as demand is growing exponentially.

By 2036, assuming the targeted recovery rates of 95% for collected batteries is met, around 20 kt/yr of cobalt and 60 kt/yr of nickel could be recovered from recycling. Europe battery plants will continue to manufacture NMC batteries, and the mining potential for these two metals is low in Europe, hence the importance of maximizing their recovery.

For lithium, assuming the targeted recovery rate of 80% for collected batteries is met, 13 kt/yr could be recovered (70 kt/yr lithium carbonate equivalent) by 2036, the equivalent of the output of four average size mines. However, this can be seen as a high value, as the high recovery rate is still seen as an ambitious target, and our assumption also includes the recycling of LFP batteries.

| EU goals | Cobalt | Nickel | Lithium |

| 2031 | 16% | 6% | 6% |

| 2036 | 26% | 15% | 12% |

Assessing the reality of EU goals will depend on the share of batteries manufactured in Europe, and whether recycled materials sourced outside EU are accepted. If all production were to take place in Europe, cobalt and lithium recovered from EV only would not be sufficient to meet the targets, and would have to be supplemented in part by recycling from other sources. Nickel could, on the other hand, meet the targets from EV recycling only.

For the moment, recycled materials are sold at the same price as virgin ones. However, if quotas are not met, a premium could arise, as manufacturers would need to comply with regulations to achieve the all-important battery passport certification. This could create an additional incentive for recycling.

Pre-consumer scrap will be the main input in the short- and medium-term

There is a chicken-and-egg conundrum facing battery recycling: capacity will not be added if the volumes to recycle remain small, as indeed they will remain in the short-term. However, recycling is not just about end-of-life batteries (usually referred as post-consumer scrap). Battery manufacturing also produce pre-consumer scrap that can be recycled (whole batteries, modules, or cells), and this waste stream is far from inconsequential. For a new plant, up to 50% of the production can be discarded in the first weeks or months, with this rate progressively declining to a few percent.

Therefore, the pre-consumer waste stream is much larger than post-consumer in the short term, and, for the moment, recycling capacity is invariably co-located with manufacturing. Pre-consumer demand is the main driver for today’s investments, and such co-location explains the Asian domination (China/South Korea) in battery recycling.

Conclusion

As we have seen, building a complete recycling ecosystem should be an essential part of Europe’s strategy for independent and resilient battery supply chains, alongside with inevitable new mining projects. Around 100 kt/yr of lithium, nickel and cobalt combine could be recovered by the mid-2030s, covering up to a sixth of the European demand for EV battery production, bringing EU goals within reach.

Our forecast is of course subject to considerable uncertainty given the nature of foreign competition and other market forces at play. One of the decisive factors is the future size of the battery industry in Europe; only a continued expansion can kickstart a sizeable scaleup of recycling capacity from production scrap in this decade, and lay down the foundation for a growing domestic market for materials from end-of-life batteries.

Realizing the full potential of battery recycling will thus require substantial support across the supply chain. Time is of the essence: Europe cannot afford to miss the start of this new global technology race.

Acknowledgments

Although this article represents DNV view only, the author would like to thank Amanda Gran (Hydrovolt), Helge Refsum (Hydrovolt), Jacob Emil Tønnesen (Hydro), Ibrija Musfique (Hydro) and Tero Hollander (Fortum) for their valuable insights into the battery recycling industry.

REFERENCES

- IEA (2024) – Batteries and Secure Energy Transitions

- Mobility Portal (2023) – Europe will open 250 battery factories by 2033. What are the confirmed projects?

- S&P Global (2023) – New lithium mining, refining projects set to strengthen Europe's battery supply chains

- Bloomberg (2024) – Battery Recycling Shatters the Myth of EV Battery Waste

- Hydrovolt (2024) – Hydrovolt sets new industry standard for its main recycled product

- Mysteel (2023) – Daily: Prices of recycled lithium-ion battery black mass

- European Commission – End-of-life vehicles Regulation

- Newman et al. (2024) – Offshoring emissions through used vehicle exports