Commercial term analysis for solar virtual power purchase agreement in the UK

Identified key elements for a long-term virtual Power Purchasing Agreement

The challenge

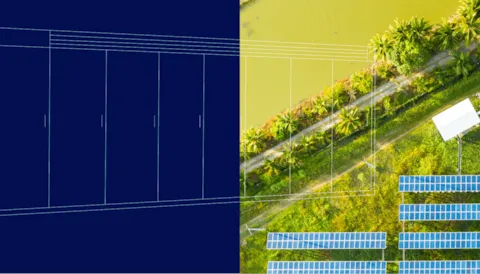

Alight Energy, a developer of solar projects, decided to maximize the value of its assets via a new type of revenue stream: a corporate PPA. When the Swedish developer won a contract for its first solar farm built near the off-taker's plant in the UK, their team lacked experience in long-term virtual PPA (Power Purchase Agreement) negotiations in the UK and sought professional advice.

Our solution

DNV's cPPA team used their experience gained in other contract negotiations to prepare a best practice guide for the UK. DNV and the client exchanged opinions and views with suppliers operating in the UK, to identify critical terms and solutions most suitable for the developer. DNV identified terms and formulas to quantify risk exposure for the developer and shared how to manage and calculate liquidated damage, volume forecast for Pay as Produced solar production and protection mechanisms in case of negative wholesale prices.

Impact

Through its industrial knowledge and strong relationship with suppliers as potential off takers, DNV identified key elements for a long-term virtual Power Purchasing Agreement.

The guide was used to produce the final contract terms and helped the developer to identify solutions for risk associated with volume and price management.