DNV’s robust technical due diligence enabled the solar developer to secure nearly USD 100 million in financing to support the construction and long-term operation of all five agrivoltaics projects.

Note: DNV takes our customer’s confidentiality seriously. We know that our services can become part of their competitive edge. We do not always share our customer’s names, but the examples we share of work done are always real.

Agrivoltaics is an exciting clean energy solution that offers American farmers the possibility of a new cash crop: solar power. It is forecast to become a USD 9.3 billion marketplace by 2031, growing at a compound annual growth rate (CAGR) of 10.1% in that timeframe from USD 3.6 billion a year in 2022.

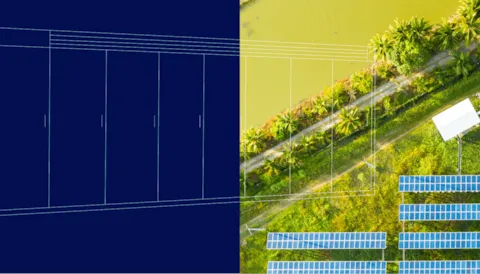

To understand agrivoltaics, imagine a forest canopy. The solar panels form an upper layer of the forest. The panels capture and convert sunlight into clean energy, and the plants and animals underneath still get the necessary amount of sunlight to grow and thrive. It's a win-win, providing more clean power to the grid and increased agricultural yields.

One solar developer and certified B Corp is making a name for itself as a pioneering first mover and industry leader in Agrivoltaics. In fact, their first Agrivoltaic project is now producing a mix of fruit and more than 5,000 megawatt-hours of renewable power annually.

Challenge

In 2023, the solar developer identified five exciting agrivoltaics projects. Four of the projects are designed to allow for uninterrupted farming operations beneath the solar arrays, while the fifth site will create new grazing pasture. Each site will feature a varied selection of crops, pollinator habitats, and livestock grazing operations. Altogether, the five projects will deliver enough clean energy to the grid to power more than 2,500 households.

To progress with the projects, the developer needed to secure financing. This required providing an air-tight technical assessment to investors showing that the projects are technically and economically feasible. They selected DNV as the Independent Engineer to provide the technical due diligence.

Bringing our 160 years of expertise to the customer

Last year, DNV provided advisory services including technical due diligence for more than 800 GW of battery energy storage, solar, power grid, and wind projects in the U.S. and Canada.

For the solar developer, we brought together solar and storage experts, technology, permitting and energy assessment team. Our scope of technical due diligence included technology evaluation of major equipment, energy production assessments, engineering design and project contract reviews, confirming for environmental compliance and permitting and performing in-person site visits for construction milestone certification.

| Permitting & the environment |

Assessment of permits and environmental studies, including environmental surveys, wildlife studies, wetland and water studies, cultural/historic resource reports, to ensure compliance with county, state and federal requirements |

| Technology |

Assessment of the PV components including modules, inverters and racking, including review of the specifications for the components, product warranties to confirm they are in accordance with accepted industry practice and a brief overview of each manufacturer. |

| Engineering design |

Engineering design reviews to verify that the electrical and civil designs were completed in accordance with standard industry practice. |

| Agreements |

Assessment of the Engineering, Procurement and Construction Agreement, which included a review of the project schedule, scope of work, pricing, QA/QC, warranties/guarantees, guaranteed milestones and commissioning, performance testing requirements.

DNV reviewed the operations and maintenance agreements to verify pricing, scope of work and staffing/response time provisions.

Interconnection status, cost and schedule and conformance with industry and regulatory standards.

|

| Financial model |

Reviewed the technical inputs of the Project Financial Model to assess reasonableness of revenue projections, CapEx and OpEx budgets, and expenses associated with interconnection. |

Results

DNV’s robust technical due diligence enabled the solar developer to secure nearly USD 100 million in financing to support the construction and long-term operation of all five agrivoltaics projects. To date, four out of five projects have finished construction.