Hydrogen: State of play in the UK

Hydrogen can serve a valuable role in our future clean energy system and help achieve the legally enshrined Net Zero by 2050 target here in the UK. It offers flexibility to an increasingly constrained electricity grid, facilitates decarbonization of hard-to-abate applications, and delivers many of the benefits enjoyed by natural gas users today.

Analysis by the Committee on Climate Change (CCC) suggests a hybrid approach to electrification and hydrogen could result in the lowest overall system cost achievable to decarbonize, counteracting the devastating effect on global energy markets from the invasion of Ukraine. It is easy to see why investor appetite for hydrogen is heating up.

But hydrogen is not without its challenges. There remains fierce debate over the appropriate complement of technologies to deliver the energy transition. The UK Government has called on industry and academia to enrich the body of evidence surrounding clean energy to support robust decision-making. The result is a mix of competing views on the preferred penetration of hydrogen, its deployment across sectors, or indeed its role in the energy system altogether. But broad assumptions produce broad results, and unless there is clearer definition on where UK Plc should invest, the search for the ‘perfect’ solution will hinder great projects being realized.

So what is the UK’s market position? Technically speaking, the UK is well placed to produce, transport, store and utilize hydrogen. The geology and geography are there to support hydrogen value chains underpinned by CCUS. There are world-leading projects primed to deliver critical infrastructure and there is a stronger political will to transition, underpinned by the Climate Change Act and over three-quarters of local authorities and Universities declaring ‘climate emergencies’.

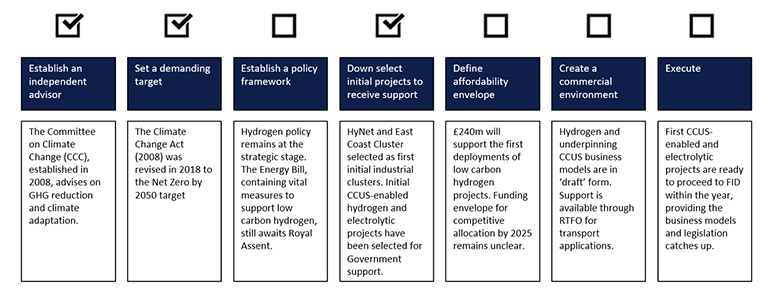

However, commercially, the UK remains unable to execute the first tranche of large-scale offerings to FID without an appropriate investment framework. This framework, if well designed, could address the risks and economics inherent in a nascent hydrogen market as it matures. Figure 1 illustrates the status of this framework.

Figure 1: Elements to creating a low carbon hydrogen market

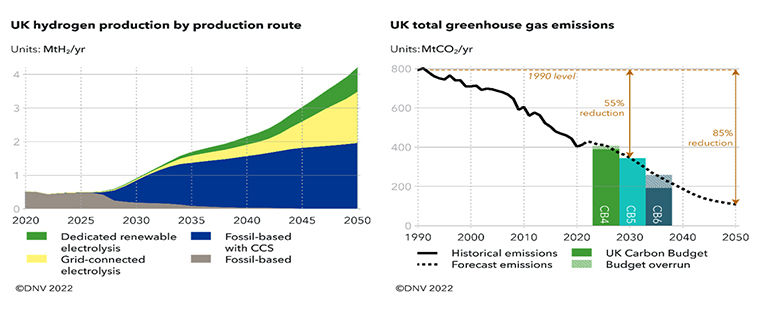

The UK now risks taking a back seat to the US, EU, and Canadian markets. DNV’s UK Energy Transition Outlook, which deems policy that has already passed through Parliament as credible, forecasts over 4Mt/yr of low carbon hydrogen will be produced by 2050. Whilst this marks a significant ramp up from production today, it falls short of the ambitions expressed by the UK Government and its independent advisor the CCC, owing to the lack of clarity (and stalling) of policy commitments surrounding hydrogen (see Figure 2). A prime example is the use of hydrogen in homes where a decision is not expected until 2026. DNV has therefore concluded that, amongst other shortcomings, the UK will not achieve the legally binding Net Zero by 2050 target, and in the nearer term, it’s Nationally Determined Contribution (NDC) for 2030 under the Paris Agreement.

Figure 2: Hydrogen production and UK greenhouse gas emissions forecast (DNV, 2022)

We are now at a tipping point. There is a real opportunity to deliver a strong pipeline of projects and achieve meaningful progress on our climate ambitions. The latest swathe of announcements contained within the Spring Budget, the Net Zero Independent Review, the Hydrogen Champion’s Recommendations Report and the Powering Up Britain Whitepaper reinforces DNV’s call for UK policymakers to act decisively, at a time where global investment in hydrogen is flowing to countries with greater ambition.

In order to catalyze this market and boost investment, the UK Government should seek to address the following areas as soon as possible, ably supported by industry leadership:

1. Policy Framework: The Energy Bill should be prioritized for Royal Assent as soon as possible, allowing vital measures such as the Hydrogen Levy to facilitate low carbon hydrogen deployment by 2026. Further legislation should affect delivery across the full hydrogen supply chain, with an appropriate balance between free market forces and regulation.

2. Affordability Envelope: With the first winners of the £240million Net Zero Hydrogen Fund announced, the UK Government should follow through on its intention to allocate funds to projects requiring business model support, strengthen plans to move to competitive allocation by 2025, and provide a clearly defined funding envelope and timeline for realizing a hydrogen economy in the UK. Aligned projects will follow.

3. Commercial Environment: Hydrogen projects require investible propositions. Next steps should include:

- Delivery of the low carbon hydrogen production business model to facilitate subsidy negotiations.

- Delivery of the storage and transportation business model to enable network planning (2025 is too late).

- Stimulation of hard to abate sectors through clarified positions on the use of hydrogen (for example on gas blending).

4. People: We need steel (or plastic!?) in the ground as soon as possible. FID decisions on large-scale hydrogen assets within the year are possible if existing Government and industry commitments are honoured. However, there remains a significant skills and jobs shortfall against the UK’s 10 GW of low carbon hydrogen capacity by 2030. Skilled labourers aren’t made overnight and other sectors will compete for talent. A comprehensive jobs and skills agenda is urgently needed.

5. UK Plc Investment: The climate is the crisis of the commons. Nobody owns it. Everybody uses it. So, who takes responsibility for its upkeep? Government subsidies will only take us so far. Now is the time for UK industry to commit long-term investment decisions that are compatible with a Net Zero business environment.

Ultimately, regardless of sector or vector, the consumer and taxpayer will front the bill of the energy transition. DNV believes the UK has the ability to make its own transition affordable (1% of GDP in fact), by owning the agenda and being a market-maker. There are some fantastic people in this space working tirelessly to do just that. I personally look forward to supporting government and industry in delivering policy and projects over the next 5-7 years, which in many ways will define the future of our society for future generations to come.

Just don’t ask the public to name the projects…remember what happened with Boaty McBoatface?

6/9/2023 8:00:00 AM