Green refineries: Decarbonize, convert, or close?

There are many challenges associated with building a sustainable Energy Strategy or ESG roadmap or overall decarbonization framework for a refinery operation.

Refineries play a crucial role in the global economy as a producer of traditional transport fuels. However, as Net Zero mandates gather pace, refinery owners face some difficult and stark decisions, such as transition or face closure. As a result, a growing number are transitioning their assets toward a more sustainable future, developing decarbonization strategies and converting units to produce and process renewable fuels. By contrast, an increasing number have shut down their refinery operations entirely or converted the facility into a storage terminal. Either way, these decisions have major implications for stakeholders, the public, governments, and our future energy landscape.

Like many hard-to-abate sectors, traditional oil refineries and integrated energy companies are facing up to the challenges of addressing Paris commitments and reducing their greenhouse gas (GHG) emissions (which account for about 25-30% of global emissions). This is particularly complex for an industrial process whose bread and butter includes converting crude oil into refined transport fuels, such as gasoline, diesel, jet fuel, and fuel oil. Add to this the fact that oil and gas operations account for close to 15% of energy related GHG emissions globally, making the importance of tackling the refining sector (the largest buyer of crude oil) even more pressing in terms of removing carbon and fossil derived feedstocks. In this article, I will reflect on recent initiatives in the sector, drawing on the research findings of our own recently published Energy Transition Outlook (ETO) report and incorporating “whole systems” considerations.

Refineries diversifying

Over the past 12 months, we’ve observed a large increase in announcements by oil majors and refineries to outright close or convert their fossil fuel refineries and catalytic crackers into biofuels, base oils, and renewable diesel production facilities. According to the Energy Information Administration (EIA), we’ve also seen a sharp reduction in certain regional distillate product supplied (such as in the US West Coast) on the back of a growing application of biofuels and renewable diesel production displacing petroleum diesel (see chart below).

The context for this shift is interesting as refinery profit margins remain at near record levels globally off the back of the war in Ukraine and relatively low refined product inventories. As a result, many refiners are looking to invest a portion of these profits toward a sustainable future for their operations. With societal and investor momentum building for sustainability, we observe many petroleum companies looking to transition away from fossil fuels and towards the production of renewable diesel and sustainable aviation fuels (SAF) in particular. SAF is a lower carbon fuel derived from sustainable waste feedstocks (importantly not in competition with our food supply) that can be applied in existing aircraft engines as a ‘drop-in fuel’ blended with traditional jet fuel, reducing life cycle carbon emissions by as much as 80%. Many of the world’s leading airlines and cargo carriers are already using SAF as part of their commercial operations including BA, Lufthansa, Emirates, Delta, United, DHL, and UPS, among many others. This strategy is partially aided by government incentives (such as the US Inflation Reduction Act which extended the biomass-based diesel tax credits) and the fact that the economics are generally more favourable to convert existing refinery infrastructure rather than building a greenfield renewable refinery from scratch (often depending on refinery age and complexity).

At DNV, we see many refiners embracing the role of electrification in the refining process and optimizing energy efficiency (including carbon intensity of assets) throughout their operations, by generating power requirements through renewable energy and low carbon sources, such as wind turbines, solar panels, and hydro at or near site PPA, along with upgrading or replacing units, such as fossil fuel combustion among other tools. Electrification will be the key transition tool going forward. In addition, carbon capture needs to be ramped up where possible by splitting out the carbon emissions from processes, such as catalytic cracking before being piped and stored offshore, as well as broadening the application of low emissions hydrogen, such as producing hydrogen from natural gas and selling to local manufacturing/industrial businesses.

Policy considerations

Government backing will be required to support these solutions given the reported high-cost barrier to entry and infrastructure constraints with both technologies. Across Europe, we’ve recently seen a couple of high-profile conversions in Italy, Scotland, and Germany where we continue to note increasing demand for biofuels in the transport sector. Globally, we see a big rise in the market share of passenger electric vehicles (EVs) from about 8% today to 95% by 2050, according to our recently published ETO . A key policy consideration for a refinery is whether governments ramp up the cost of producing emissions and clamp down on a gradual enforcement of clean fuels. This would put pressure on refiners to develop a sustainable decarbonization strategy, including the calculation of emissions output and embracing the widespread electrification of transport. As users of refined products start calculating full life cycle emissions, they will look to market participants, such as commodity traders and refiners, to have data on the specific emission intensity of refined products accounted for the upstream, transport and refinery emissions. Immediate work is required to accurately quantify emissions intensity of products at refineries, with emissions reductions programmes set to follow this.

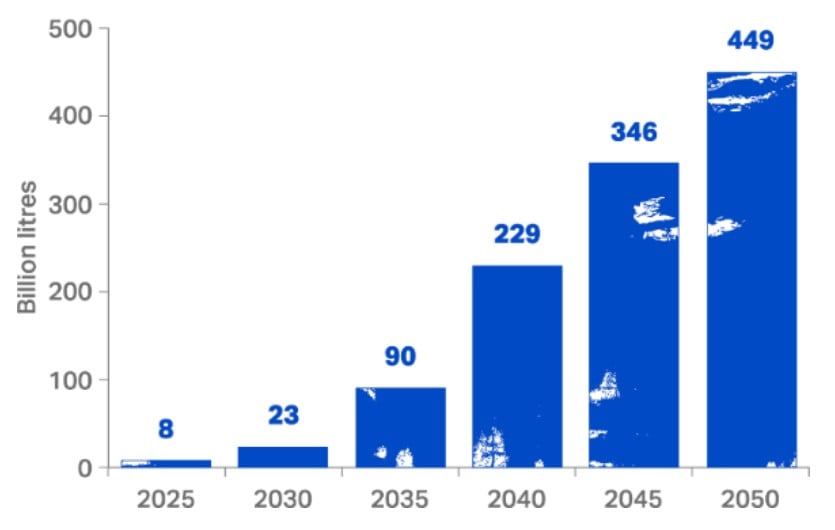

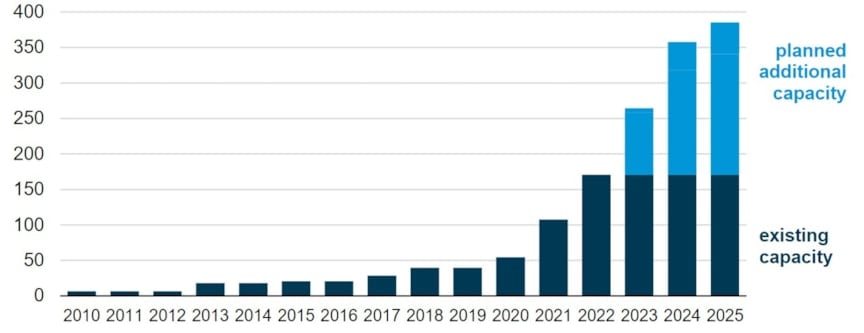

Going forward, this trend in refinery conversions is likely to continue apace with the quantities of refinery SAF and biofuel capacity likely to more than triple over the coming years, based on industry estimates. According to the International Air Transport Association (IATA), SAF production tripled in 2022 to 300 million litres y/y before doubling again in 2023 to 600 million litres, representing 0.2% of global jet fuel use. Of course, it won’t be plain sailing and a massive increase in SAF production is required globally to both meet demand and to truly make an impact in emissions reduction and Net Zero targets by 2050 (see right chart above).

Refinery conversion challenges

Converting an oil refinery has its own set of challenges, including cost and scaling, supply chain considerations, regulatory permitting, and availability of sufficiently qualified labour and technical qualifications. As a result, government policy has a pivotal role to play in providing the economic structure to convert into a green refinery, in addition to the availability and sustainability of necessary feedstocks (seed oils, vegetable oils, soybean, corn, agricultural waste etc) which is often subject to refinery location, transport logistics, economic cost, and weather factors. Otherwise, the risk of refinery closures will increase. To put the closures in context, since 2020 we’ve had a further 10 refinery closures across Europe (out of around 90) alone impacting more than one million barrels per day (b/d) in crude oil processing based off respective nameplate capacities. Alternatively, refineries can opt to shut down units and convert into a storage terminal only and we’ve seen a couple of recent examples particularly in the UK marketplace.

Pledging a decarbonization framework

There are many challenges associated with building a sustainable Energy Strategy or ESG roadmap or overall decarbonization framework for a refinery operation across scope 1, 2, and 3. It’s one thing pledging to reduce scope 1 and 2 emissions by 25% by 2030, and a very different challenge to design, implement, and feel comfortable with these ambitious targets.

Whether you are considering the closure, asset sale, conversion of units, feasibility of new technologies such as SAF, hydrogen, or CCS capability, or indeed designing a comprehensive decarbonization strategy requires technical and techno-economic understanding. DNV can provide a whole systems approach and navigate the evolving energy landscape to realizing your Net Zero ambitions. Commitments may fluctuate by year (2045 or 2050 in most cases), but the methodology and process remain consistent and robust. As Benjamin Franklin once said: “You may delay, but time will not.”

Written by Robert Maxwell with contributions by Phil Houston & Rafiek Versmissen

6/20/2024 7:00:00 AM