Enterprise Risk Management

A capable Enterprise Risk Management (ERM) framework enables utilities to better understand and evaluate asset health, facilitating the decision-making process around the allocation of investment required to mitigate asset risk. In this blog post, Troy Weyant provides insight into ERM and considerations for assessing your business processes and evaluating risk models and integrity management software.

Troy is a Product Manager for DNV’s Pipeline Ecosystem and is based in our Mechanicsburg, Pennsylvania office, where he provides management of design, testing, and implementation for our Synergi Pipeline product line.

Enterprise asset risk management – A pathway to continual improvement

Today, utilities are facing increasing pressure to manage the risk of all assets with a comprehensive common methodology and framework. With increasing demands for a balance of cost and risk reduction optimization and compliance requirements, utilities face issues such as:

- Struggles with managing risk mitigation investment

Figure 1: Integrity management program maturity assessment: A process of continual improvement

- Implementation and compliance with standards such as the American Petroleum Institute (API) 1173

- Cost-benefit assessment across the asset portfolio

- Consistent assessment and normalization of risk and unknowns in data accuracy and completeness

- Ability to measure performance improvement and define Key Performance Indicators (KPIs)

All of the challenges listed above translate into an urgent need for a capable ERM framework, which can allow utilities to have a better understanding of and visibility of asset health – which can, in turn, facilitate appropriate decisions around the allocation of investment required to mitigate asset risk.

As shown in Figure 1, this is a process of continual improvement, sometimes developed over multi-year projects. Operators need to self-assess their current business processes, infrastructure, and integrity management plans. From there, performing a gap analysis will identify areas where changes and improvements can be made.

Characteristics of current systems

Current risk management systems and processes may share some characteristics like those listed below. Some may be in place in your company and exhibit a number of limitations that prevent accurate, complete, and consistent assessment of risk, not only within a single asset class but more broadly across multiple asset classes which, together, comprise a company’s portfolio.

- Assessment methods may use separate relative models with dissimilar assessment methodologies to evaluate risk across Distribution, Transmission, and Underground Storage.

- Distribution and Transmission Integrity Management Program (DIMP) and (TIMP) teams may outgrow their current relative risk models, and compliance requirements have become more difficult to address this issue.

- Operators’ maturing pipeline safety culture is trending towards risk-based prioritization of capital spending.

- Software platforms are not flexible enough to support multiple asset types, multiple user-configurable models and may not identify or manage uncertainty in data.

Consider a better framework for risk criteria

Risk assessment is becoming increasingly more complex and must manage uncertainty in the data provided. There is a range (usually referred to as a matrix), in which risk results are expressed, and these are typically split into levels calling for different types of response, as shown in Figure 2. Unfortunately, different decision-makers use different terminology for each level, as well as different breakpoint values that divide them.

Ultimately, the numerical criteria’ values represent the organization’s judgment as to what risk is acceptable. This can be guided but not determined by technical advice.

Figure 2: Risk levels and scoring across asset types

A key requirement for an enterprise risk platform is representing risk levels and scoring consistently across asset types like the example shown here. Additionally, risk or its threat and consequence components can be displayed to suit different organizational groups where the models use consistent units such as dollars ($). These efforts require a common set of risk models to prioritize spending in a defensible manner.

Considerations for an ERM solution

When assessing your business processes and evaluating risk models and integrity management software, users should consider the following characteristics, which help to support a more broad and consistent enterprise management solution.

Risk models

Risk models should provide:

- A flexible modelling framework capable of assessing multiple asset types.

- Risk expressed in absolute terms (that is, dollars versus unitless values) and consistent units of measure (FoF versus PoF), ($/incident).

- Models that assess common threats and consequence categories across all assets with a consistent evaluation framework.

- Models that allow for easy expansion for future growth.

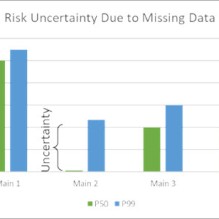

- Figure 3: Risk uncertainty due to missing data

- Probabilistic Risk Assessment (PRA) models to inherently address the uncertainty associated with missing data making them the ideal choice for use with enterprise assets where incomplete data sets and records are common.

Models, such as the DNV PRA model, can quickly and easily identify the current risk drivers across the system leading to targeted preventative and mitigative measure selection. This, paired with a measure of uncertainty level in the calculations, helps engineers make more informed decisions on where to perform work and where to improve data collection and quality.

Software platform

Software platforms should provide:

- Support for multiple, user-configurable risk and analytic models and asset types.

- Common cohesive software platform between industry verticals – transmission, distribution, storage, and so on.

- Scalable web-based software that offers cloud versus on-premise options: a solution that is accessible when you need it and where you need it.

- Ability to map and combine data from multiple internal and external data sources.

- Native integration with enterprise GIS and flexibility to allow mapping to evolve data models.

- Drill-down access to data and results with the ability to perform what-if scenarios for on-the-fly decision making.

Figure 4: DNV's Synergi Pipeline platform: Transmission PRA Risk Model

Find out more

With increasing pressure to manage the risk of all assets with a comprehensive common methodology and framework, the time has never been better to consider an ERM solution, assess your business processes, and evaluate risk models and integrity management software. To find out more about Enterprise Risk Management based on DNV’s PRA Risk models and Synergi Pipeline platform, leave a comment on the right-hand side or write to us at digital@dnv.com.

Author: Troy Weyant

1/4/2021 11:33:27 AM