Why robust governance is the backbone of effective sustainability performance

Discover how strong governance underpins effective ESG performance, helping organizations shift from compliance to performance-driven impact.

Governance: The overlooked pillar of ESG

has encouraged companies to invest more in environmental and social initiatives. While the current regulatory landscape can be described as evolving, and in some cases even regressing, the surge of new requirements is driving businesses to take a more strategic approach when it comes to environmental, social and governance (ESG) performance. It’s no longer just about ticking compliance boxes; it’s about reshaping how businesses operate, report, and compete globally.

But while the “E” and the “S” often dominate the spotlight – think of emissions, biodiversity impacts, water use, labour rights and human rights – the “G” in ESG is frequently misunderstood or overlooked. Governance is more than board structure and shareholder rights; it defines how companies are managed, to what purpose, and who is empowered to make decisions. Without effective governance, even the best sustainability intentions can falter.

Understanding governance in ESG

Governance is often broadly defined as “the systems by which companies are directed and controlled.”[1]. Yet in the ESG context, its scope encompasses more than what is presented in this simple definition. Strong governance in relation to ESG also refers to:

- How sustainability is embedded into corporate decision-making, and who can make decisions.

- Whether senior leadership priorities align with ESG values.

- How authority and accountability are structured across the organization.

- What diverse stakeholder interests, including communities, suppliers, employees, and the environment, are considered.

In short, governance is what turns ESG ambitions into sustained action.

Why governance systems often fall short

DNV partners with companies to create performance-driven sustainability strategies and conduct governance effectiveness and compliance In our experience, governance systems often fall short of supporting broader sustainability strategies due to the following issues:

- Sustainability is not embedded: When sustainability is not integrated as a core business value, governance systems struggle to align with broader strategic goals. An effective ESG strategy embeds sustainability within the business strategy itself, and across multiple departments and functions, leading to a sense of shared responsibility.

- Limited stakeholder engagement: Governance efforts are weakened when employees are not meaningfully involved in decision-making, resulting in poor buy-in and siloed or unilateral .

- Weak data management: Without robust ESG data collection and analysis, organizations lack the insight needed for informed and data-driven decision-making, performance tracking, and accountability.

- Confusing documentation systems: Disjointed or overly complex document management systems makes it difficult for stakeholders to understand governance processes, responsibilities, and the value of governance benefits.

- Inadequate and ineffective training: Governance systems often fail due to ineffective, inadequate, or infrequent training, leaving staff uncertain about procedures, .

- Lack of structured change management: Effective governance implementation and change management requires an iterative and adaptive strategy. A structured approach, such as Plan-Do-Check-Act, supports continuous improvement, enabling organizations to refine systems, boost efficiency and drive sustainable performance.

What does good governance look like?

Many organizations have started their sustainable governance journey by establishing policies such as codes of conduct, human rights policies, anti-corruption and bribery policies, amongst others. However, policies alone are not enough, governance must go beyond what is written on paper. Effective governance is defined by how policies are implemented and integrated into business operations. Key aspects of strong governance include:

- Clear implementation mechanisms: Defined procedures, roles, and responsibilities that ensure policies are actively and effectively put into practice across the organization.

- Regulatory compliance: Policies should support companies to be compliant with legal and regulatory requirements.

- Internal and external impact: Governance frameworks should drive meaningful internal improvements and foster positive influence beyond the organization.

- Cultural alignment: A governance culture that elevates environmental and social issues in line with stakeholder expectations.

- Resilience-building: Governance that helps businesses anticipate, mitigate, and adapt to current and emerging social and environmental risks.

Governance is the mechanism by which environmental and social goals are embedded into the organizational structure. It requires continuous review and implementation of ESG-related policies and procedures. Good governance goes beyond the documented processes, it speaks to corporate culture and effective corporate management practices, ensuring that stakeholder concerns are integrated into both decision-making and risk management.

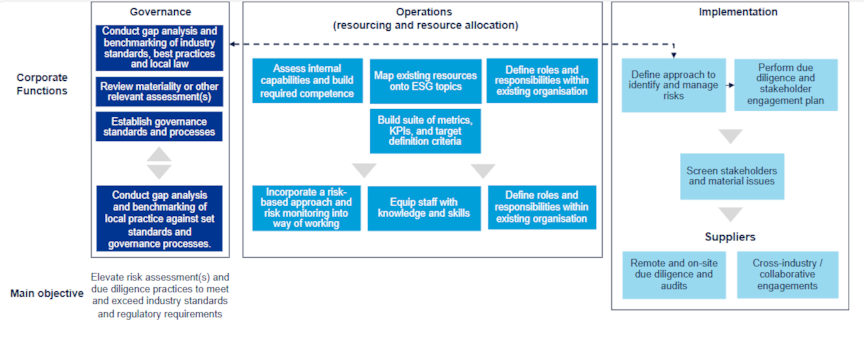

Figure 1. To build robust and scalable sustainable governance, companies must identify and respond to risks and opportunities through removing siloes, operational controls, and people-focused management systems. Further to this, building robust sustainability governance requires analysis of existing gaps in global, regional, and local contexts. Continuous review and improvement of governance processes and implementation is required for successful and sustainable operations. Embedding sustainability is not a linear process and requires constant review and implementation cycles across all levels of the business.

From compliance to performance

Robust governance systems and implementation allows companies to shift from a compliance-based mindset to a performance-driven approach. Companies can actively manage and mitigate environmental and social risks, whilst proactively addressing compliance and regulations, thereby allowing a business to leverage the opportunities provided by legislation and governance requirements to bring commercial benefits to companies whilst benefiting wider sustainability and business goals, such as:

- Holistic risk management: Address environmental and social risks comprehensively to ensure the “do no significant harm” principle is upheld across strategies and operations.

- Stronger understanding of the intersection of climate and human rights: Clarify the links between environment and human rights, enabling businesses to identify material risks and improve efficiency.

- Breaking down siloes: Integrate ESG across departments and functions to encourage cross-functional collaboration.

- Enhanced supply chain resilience: Manage reputational risks in the supply chain and improve supply chain continuity/stability (avoiding disruptions to production and supply).

- Attract responsible investment: Build a competitive edge by aligning with investor expectations around ESG performance.

- Driving collaboration: Enable collective alignment with international sustainability frameworks and fostering cross-industry partnerships.

- Building stakeholder trust: Strengthen relationships with consumers, suppliers, workers, and investors through transparent and value-driven governance.

How DNV can help

DNV provides comprehensive support for organizations seeking to evaluate and strengthen their ESG governance. With global reach and deep sector expertise, we deliver:

- Governance effectiveness reviews: Identify strengths, gaps, and improvement opportunities in ESG governance systems.

- Human rights due diligence assessments: For example, in the offshore energy sector, where we help mitigate risks related to forced labour.

- Quality, health, safety, and environmental governance reviews: Improve health and safety outcomes through data-driven insights and benchmarking.

- Fair remuneration and worker protection audits: Evaluate supplier and value chain compliance with international labour standards.

Whether you're just beginning your sustainable governance journey or seeking to improve existing structures, our experts can guide you toward effective, compliant, and performance-focused solutions.

Boardroom-focused executive training and ESG competence development

In collaboration with FutureBOARDS, DNV offers a platform for corporate leaders to learn and share experiences on how the ESG agenda influences board roles, composition, and work processes through our ESG for Boards program.

[1] What is corporate governance? | Overview | ICAEW

9/5/2025 9:13:00 AM