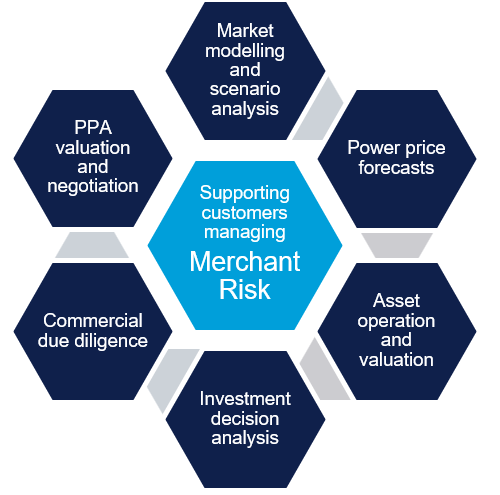

Our advisory team assists you along the entire value chain, supporting you in managing merchant risk for your investments, assets, business, and services. Below is an overview of DNV’s market valuation services and areas of expertise. It provides a market-based assessment of the value of assets and services for investors, developers, generators, consumers, network operators, policymakers, and regulators.

Market modelling and scenario analysis

DNV utilizes advanced market modelling tools tailored for the energy system and the power sector. Using client data and modelling specifications, DNV can set up, validate, and run market models to support:

- Capacity and retirement planning

- Renewable integration

- Energy demand modelling

- System costs analysis

- Decarbonization analysis

- Energy strategy and policy analysis

Power price forecasts (PPF)

DNV provides deep insights into power price trends and risk factors, helping clients make confident energy investment decisions across Europe and Latin America.

We produce power price forecasts (PPFs) of up to 30 years, along with country-specific wind and solar PV capture rates. These forecasts are based on pan-European power market simulations and detailed, multi-nodal country-based models tailored for Latin America, reflecting the envisioned developments of each national market.

To address the complexity of power markets, DNV applies a proprietary state-of-the-art multi-layer methodology. This combines fundamental power market modelling for economic dispatch and supervised machine learning solutions to reproduce bidding strategies and behaviours of market players.

Key offerings include:

- Wholesale power price development

- Ancillary services price development

- Capacity market price development

- Commodity price development

- Electricity demand development

- Generation by technology for selected countries

- Insight into market drivers and sensitivities

- Customized scenarios and modelling

Asset valuation

DNV’s asset valuation services combine expertise across energy technologies, markets, systems, and economics to support confident investment and operational decisions.

Key offerings include:

- Hourly operating patterns, revenues, and operating costs from dispatch

- Intrinsic and option revenue value of a generation, storage, or demand response asset

- Technical and economic feasibility and investment analysis

- Benchmarking and validation of results of a customer dispatch model

DNV applies asset valuation to all assets operating in the electricity market. The output, such as hourly operating profiles and revenues from economic dispatch, can be integrated into financial models to assess the investment potential and economics of projects.

Investment decision analysis and transaction support

DNV helps you make confident investment decisions by providing expert analysis and transaction support along the energy value chain.

Key offerings include:

- Investment decision analysis: Market trend analysis, target selection, investment modelling, investment advisory

- Transaction support: Buy and sell-side due diligence, governmental funding support, incentive scheme analysis

- Portfolio analysis and risk management: Valuation assessments, risk updates

- Cost-benefit analysis (CBA): CBA analysis for power and gas projects

Commercial due diligence

DNV provides commercial due diligence (CDD) services to support transactions in the energy sector. We deliver Red Flag and Standard CDD reports, offering analysis and insights across key areas, including:

- Power market overview and price forecasts

- Power market and regulatory framework

- Market players and competitive landscape

- Market exposure, commercial contracts, and financing

- Validation of financial model assumptions in virtual data room (VDR)

- Summary of risk ranking items and suggested mitigation measures, aligned with the sponsor and financial advisor

Our services cover a wide range of power system assets, including thermal generation, combined heat and power plants, solar PV, onshore and offshore wind, battery energy storage systems, and power-to-gas.

Power purchase agreement valuation and negotiation

With extensive experience in wind and solar PV, DNV provides expert support in the valuation and negotiation of power purchase agreements (PPAs), helping you make informed and confident decisions.

Key offerings include:

- PPA pricing for producers and purchasers

- PPA risk assessment (volume, price, regulatory) for producers and purchasers

- Benchmarking analysis of PPA contracts

- Negotiation and procurement support

Ready to get started?

Get in touch with our team of experts to learn more about how we can work together.