The region consists of Mainland China, Hong Kong, Macau and Taiwan.

| 2024 | 2060 | |

| Population | 1454 million | 1230 million |

| GDP* | USD 36.8 trillion | USD 67 trillion |

| GDP/person | USD 25 307 | USD 54 768 |

| Energy use | 177.4 EJ | 145.7 EJ |

| Energy use/person | 122 GJ | 118 GJ |

| Energy-related CO2 emissions | 13 Gt | 2.5Gt |

| Energy-related CO2 emissions/person | 9.0 tonnes | 2.0 tonnes |

*All GDP figures in the report are based on 2017 purchasing power parity and in 2023 international USD

China mainland account for xx% of region energy use

Current Situation

Fossil fuels

in primary energy supply in 2024

Import reliance

Japan and South Korea both rely on over 95% foreign fossil-fuel sources

Renewable sources

in power generation

Losses (USD)

in Australia due to back-to-back disasters in H1 2025 alone

- Fossil fuels supplied 86% of Greater China region primary energy in 2024, fuelling 61% of electricity generation, with coal alone accounting for 54% of electricity supply. Fossil-fuel import dependence is 73% for oil and 61% for gas. China is the world's largest importer of both commodities.

- Renewable energy sources made up 36% of regional power generation in 2024 and by far dominated China’s 429 GW capacity additions with 277 GW solar and 79 GW wind (Wang, 2025). For 2025, the government’s 200 GW capacity target (NEA, 2025) is a low ambition, considering the 210 GW solar and 50 GW wind added in H1 2025 (Renewable-Energy-Industry, 2025), and solar PV alone being on track to deploy 380 GW (Shaw, 2025)

- Cleantech's role in the economy is significant. Globally, China accounts for a third of clean energy investments (IEA, 2025). Cleantech contributed more than 10% of China’s GDP in 2024 (Myllyvirta et al., 2025). China’s EV exports grow 19% in the first five months of 2025 (Leung, 2025).

- Climate risks include drought, typhoons, flooding and sea-level rise. Economic losses from floods in the provinces of Guangdong, Guangxi, and Fujian were USD 15.6 billion in 2024 (Ware et al., 2024)

Pointers to the future

- China upholds Paris Agreement commitments and will update its nationally determined contribution (NDC) before COP30, covering all economic sectors and greenhouse gases (2025). President Xi announced China’s target for a 7% to 10% reduction from peak levels by 2035 at the UN Climate Summit in September (China Daily, 2025). Decarbonization policy is shifting towards ‘dual carbon control’ (total emissions and emissions intensity). Carbon pricing will expand to include steel, cement, and aluminium smelting industries in the national emissions trading system (ETS) by 2025, and all industries and aviation by 2027 ().

- The Energy Law 2025 reinforces the carbon peak and neutrality goals while bolstering energy security. Renewable energy development and use remain central, mandating renewable consumption targets enabled by green electricity certificates, and placing coal in a supporting role (NEA, 2024).

- The August 2024 Opinions on Accelerating the Comprehensive Green Transformation of Economic and Social Development outline the course of economy-wide transformation, emphasizing low-carbon upgrades to traditional industries, developing strategic emerging sectors, and increasing the share of low-carbon industries in the economy (Government of China, 2024).

- Renewable electricity deployment will continue at record pace with the raised ambition to increase wind and solar capacity to 3.6 TW by 2035. With growing variability in generation and curtailment issues, policies are evolving from capacity expansion to system integration where energy storage, nuclear, and hydrogen are elevated priorities, underpinned by accelerated grid investment. These priorities are expected to feature prominently in the 15th Five-Year Plan (2026–2030), expected in March 2026.

– With China dominating global renewables markets, and with significant industrial overcapacity resulting in depressed prices, China is driving clean energy adoption worldwide. It is shifting cleantech exports to emerging markets () in response to trade tensions.

The Energy Transition Indicators

Primary energy consumption (EJ/yr)

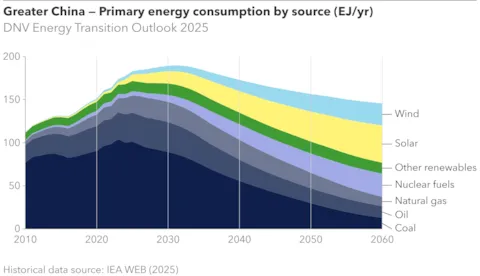

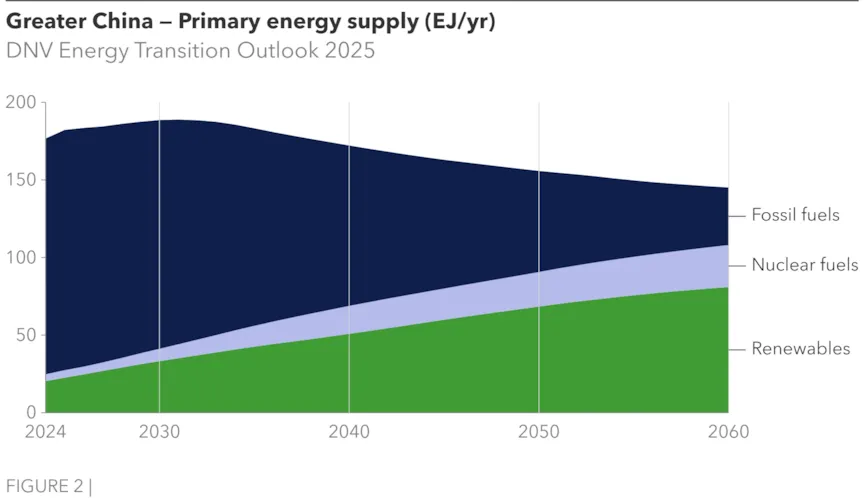

China (GCHN) continues to increase its energy consumption over the next five years, followed by a 23% decrease up to 2060. Fossil fuels’ 86% share in today’s supply mix will shrink to 26% by 2060 as renewables and nuclear power grow significantly. Especially strong growth in solar PV power will see this supply 30% of total energy in 2060. Coal dominates today with a 56% share, but this decreases sharply to 9% in 2060.

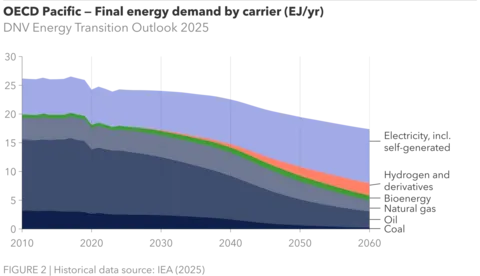

Final energy demand (EJ/yr)

Electricity will double its share from 27% now to 55% in 2060. All fossil fuel shares will shrink substantially but will still cover 26% of energy demand in 2060, which by then will be almost evenly split between natural gas, oil, and coal. Hydrogen’s role becomes increasingly visible with it covering 1% of energy demand in 2040, increasing to 5% in 2060.

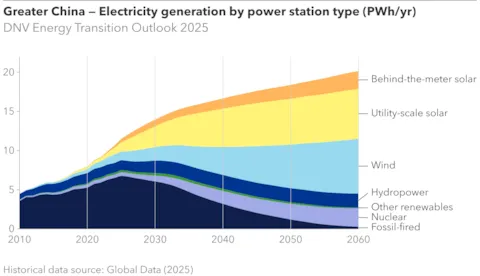

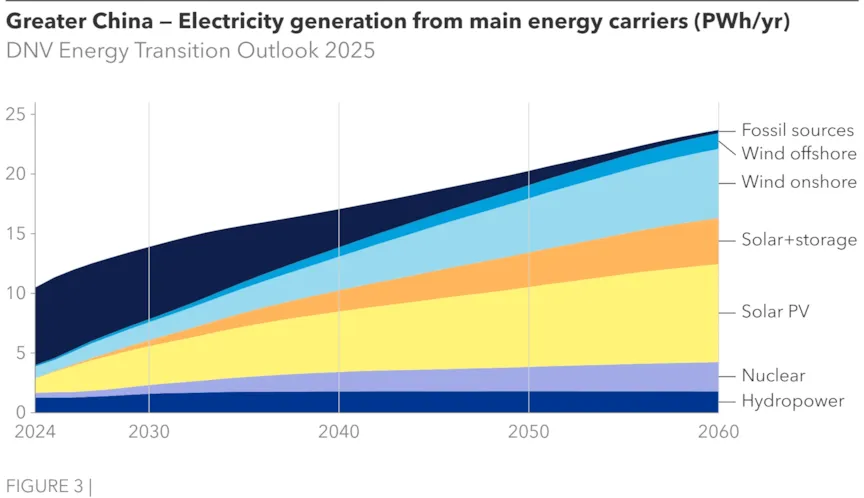

Electricity generation (PWh/yr)

Electricity generation in this region will have undergone the full transition by 2060, only 1% remains generated from fossil fuels. The last 10 years have seen wind and solar grow from minuscule numbers to an 8% share each in 2024. The impressive growth rate will continue with solar ending at 50% of total generation in 2060, and wind 30%. Nuclear will surpass hydropower in 2045 and continue to grow to a 10% share by 2060.

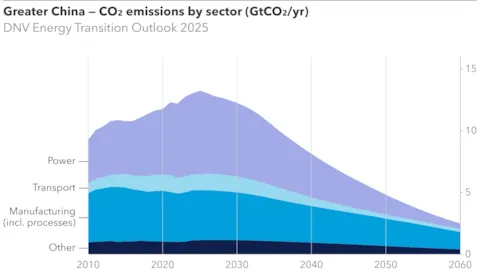

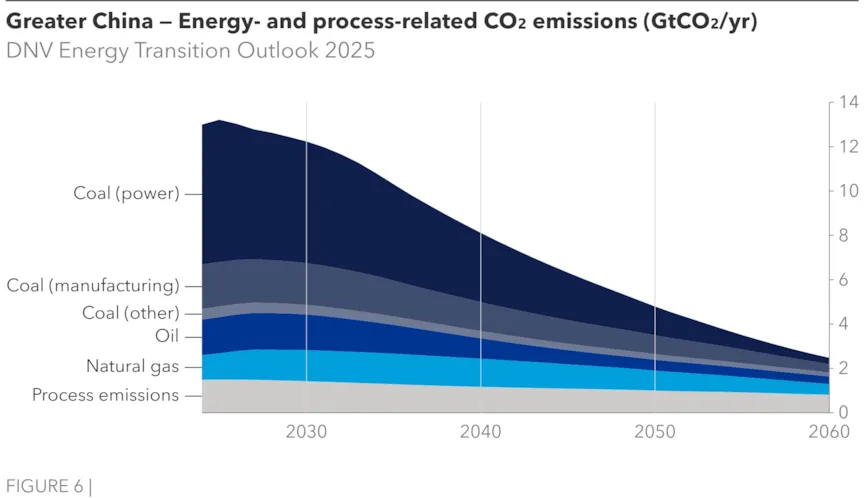

Carbon dioxide emissions by sector (GtCO2/yr)

Energy-related emission reductions will accelerate from the early 2030s, resulting in such emissions declining 81% between 2024 and 2060. Reduced coal consumption is the biggest contributor to this as coal contributes two-thirds of the emissions in 2024 but only one third of the reduced emissions in 2060. Manufacturing struggles with hard-to-decarbonize industries and will be responsible for more than half the energy-related emissions in 2060, followed by the power sector (20%) and transport (10%).

Forecast

With 26% of the global population, Greater China today emits 34% of the global energy-related emissions, and is responsible for 65% of global coal consumption. Steady planning and execution for the green transition move the region’s share of global emissions to 17% by 2060. The ongoing electrification reduces vulnerabilities to energy imports. However, energy security remains an issue because there will be a continued need for imports, especially for natural gas and oil, which will still meet 19% of energy demand in 2060. Primary energy supply will undergo a remarkable transition as the share of fossil fuels reduces from 86% to 25% following the renewables acceleration that ensures a120% increase in electricity generation over the period. The change in supply is mirrored by demand electrification. The modern manufacturing sector provides electrical equipment both for primary energy supply from renewables and demand-side consumption, both for the region and for the rest of the world. The cleantech manufacturing industry has developed robustly to now contribute 10% of GDP (Myllyvirta et al, 2025). China has become the world’s most important region for supplying equipment for both supply (renewables) and demand (cleantech solutions). Consistent policies underpin the overarching dual goals on energy intensity and steer the march to reduce emissions. Manufacturing, power, and transport (aviation and maritime) will struggle to eliminate their remaining emissions, indicating that additional effort will be needed to reach the goal of carbon neutrality by 2060..

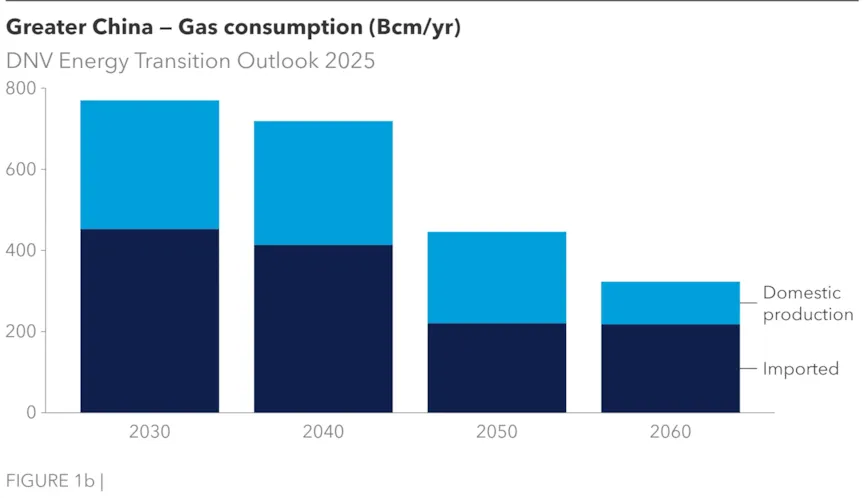

Increased attention on energy security measures

Greater global geopolitical instability increases focus on energy security in in this region, as it does elsewhere. The ongoing electrification reduces vulnerability to energy imports but there will be a continued need for imports, especially natural gas and oil. Oil and gas consumption keep increasing in the next five years. This, combined with the ongoing reduction in domestic oil production and a post-2040 decline in gas production, makes it tougher to achieve energy independence in these commodities. The share of imported natural gas will stay close to 60% of domestic consumption until the 2050s, then increase to 67% near 2060. The recent China-Russia dialogue on a new gas pipeline is an initiative intended to diversify China’s gas imports and reduce reliance on the US and Middle East. Oil imports will remain around 75% of consumption until the late 2040s then reach 85% to 90% by 2060. That said, import volumes of both oil and gas will be halved between 2030 and 2060, ending the period at 12 EJ and 5 EJ, respectively. Together, oil and gas imports in 2060 will supply 11% to12% of total primary energy, compared to nearly 20% in 2035.

Figure 1A and 1B: Import dependency oil and gas.

In energy terms, annual coal imports slip below 1 EJ (3,4 Mt) after 2045. While this remains a considerable amount, it might be replaced by own coal resources within the region (China) and is therefore not considered a critical theme regarding energy security directly. For industry, there could be an issue with dependency on imports of high-quality coal for metal production and other manufacturing processes.

The capacity growth of both renewables and nuclear is very high throughout the period. In parallel the grid is built out for maximizing the usability of the electricity as the main demands are far away from the main regions with wind and solar capacity and production. Through this we find that from now on, most probably, all additional electricity generation will be provided by non-fossils, meaning that the electricity generation from fossils will not grow, neither in relative nor in absolute terms. The disclaimer being available coal power capacity in case electricity demand grows faster than renewables generation

Figure 2: The rise of renewables in the primary energy supply

Fossil fuels

Coal is the biggest fossil energy carrier in the region and will remain so until after 2050. In 2024, it was responsible for 68% of the emissions and supplied 56% of the total primary energy. In 2025, we see a strong continued increase in renewable power and reduced demand from heavy manufacturing industry. We find it highly probable that the peak annual coal consumption is already history.

As there are net capacity additions of coal power in the next few years, coal consumption may rebound if, for some reason, demand increases strongly in the next couple of years. However, we believe that the new consistent measures introduced by Chinese authorities will more than outweigh such a rebound.

- Coal is now considered to be peak load, not baseline load (NDRC,2024). Following this, payments for capacity limitations on coal-fired power have been introduced. Coal is also referred to for grid stability (NDRC/NEA, 2025) but our opinion is that such a role would not add much to coal-fired power production. The capacity additions over the last years have not brought substantial increase in coal power generation.

- A new energy law (State Council of China, 2024) is increasing efficiency requirements both for new (20%) and existing (10%) coal power plants by the end of 2027. This alone might be enough to remove the Chinese dependency on power-related coal imports.

Oil consumption will grow marginally in the next five years. From then on, oil consumption will continue to reduce continuously as electrification grows, starting with huge reductions in oil demand for road transport. Oil’s share in primary energy use will shrink from 19% to 9%, thereby equalling the supply of coal in 2060.

Natural gas will remain the minor fossil energy source throughout the period. Volumes will stay stable until 2045 before consumption is halved over the 15 final years of the period. Natural gas is primarily providing energy for buildings and manufacturing.

Biomass

Biomass has a stable share of around 4% of the primary energy supply throughout the period.

Energy supplied as power

Coal used for power generation in 2024 in Greater China contributes 23% of the total global energy-related emissions, with coal-to-power alone responsible today for 50% of emissions in Greater China. Our results show an 86% reduction of coal for power by 2050. This happens without a substantial decrease in installed capacity, giving an average capacity factor of only 9% in 2050. Alternatively, it is possible to foresee more forced shutdowns among the most polluting units. Fossil energy sources combined will be dwarfed by renewables in electricity generation before 2030. The role of fossil fuels continues to shrink; they will support just 1% of electricity generation in 2060.

The renewables acceleration ensures a120% increase in electricity generation over the period. Solar’s share will be 26% in 2030 and deliver more than half of the electricity in 2060. In 2035, half of the solar capacity additions will be solar+storage, a share growing thereafter, thus extending the usability of solar throughout a 24-hour cycle. Energy storage is currently limited, but to avoid renewable energy curtailment, we are likely to see strong growth of storage in the coming years, mostly in the form of solar+storage.

Wind will grow six-fold in the period and increase its share steadily from 10% to 30%, still with four-fifths of this being onshore wind. There will be floating offshore wind additions throughout the period, but this technology will account for only 1% of total electricity generation by 2060. Hydropower will increase 60% in the next 10 years, then stabilize.

Nuclear is also dominated by this region, with more than 100 reactors in operation in China alone. Nuclear will grow its share in power supply from today’s 4% to 10% in 2040, maintaining the higher share amid growing electricity demand up to 2060, which also means a six-fold increase in electricity delivered. The growth from 2040 will be evenly split between small modular reactors (SMRs) and large-scale nuclear plants. Nuclear will have substantial thermal losses in electricity generation and as a consequence the primary energy supply share will be higher than nuclear’s share in electricity supply.

Figure 3: The rise of renewables in the electricity supply

Demand – road transport and buildings lead the green transition

China is emerging as an ‘electrostate’: electricity’s share in meeting its total energy demand will double from 27% today to 55% in 2060, the same mid-century level as in Europe and OECD Pacific. Electrification comes with noticeable efficiency gains and contributes strongly to curbing energy demand by 20% between 2030 and 2060. Electrification also brings an opportunity to export electricity production technology like solar, wind, batteries and electric vehicles (EVs) to the rest of the world, and hence for China to expand its global footprint.

The 120% increase in regional electricity generation between 2030 and 2060 is an important facilitator for strong, fast electrification in sectors where demand can be met with electricity. By 2050, fossil energy sources combined will provide only 6% of the electricity in the region. That said, as the transition accelerates and continues through the 2050s, fossil fuels will still have a 27% share in the regional energy demand by 2060.

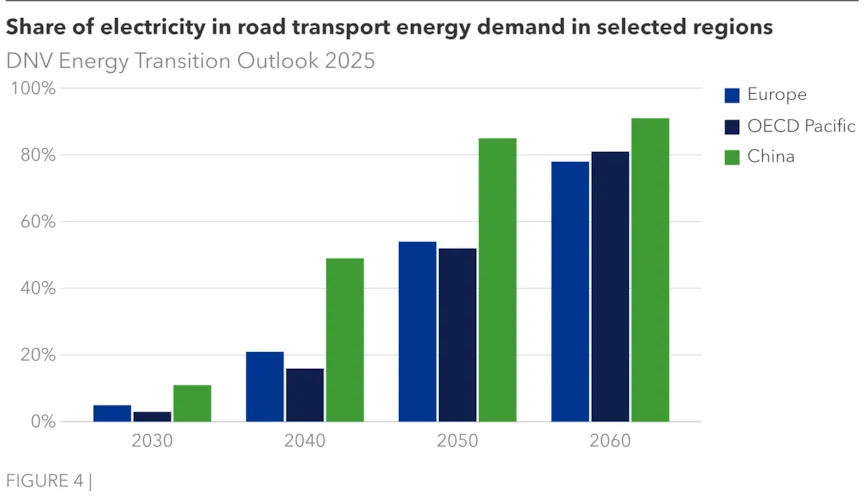

Transport

Road transport will see a 58% reduction in energy demand over our forecasting period. This is the result of a transition already underway: in 2025, more basic electric vehicles than internal combustion engine vehicles will be sold. There will be a tripling of fast chargers installed for EVs between 2030 and 2040 (reaching 10 million chargers) as part of the infrastructure investments to support this change. Efficiencies from electrification will result in an especially strong reduction in energy demand between 2030 and 2045, and practically all new vehicles sold will be EVs from the late 2030s, more than 73 million vehicles annually. By 2050, 98% of all vehicles will be electric. Greater China’s speed of transition in road transport will dwarf that in all other regions (see figure/table). Half of the energy demand will already be served by electricity in 2040. Road transport’s energy demand will remain the largest within transport subsectors.

Figure 4: The three fastest regions on transition to electricity in road transport (electricity as % of total road transport energy demand)

Aviation air travel demand (number of person trips) will double by 2050. Its energy demand will more than double by 2060, by which time it will be almost as large as for road transport. Today, 100% of the demand is covered by oil. Alternatives will emerge in our forecasting period, the first being biodiesel with an increasing share of the aviation diesel blend. From 2040, hydrogen and e-fuels occur in the energy mix, but oil in all its forms used in aviation fuel will still meet 55% of the subsector’s energy demand. The growth in aviation energy demand means that oil consumption will not decrease but rather increase 18% by 2060. This remaining volume (3 EJ) is part of the region’s remaining emissions in 2060. In our model Greater China has been allocated its share of international aviation in the energy use and emissions forecasts.

Maritime transport energy demand is today covered by fossil energy sources oil and natural gas, strongly dominated by oil’s 92% share. The subsector’s energy demand will peak in 2030 and afterwards shrink 31% over the next 30 years. By 2030, biomass will have taken a small 4% share, and this grows to 26% by 2060. Ammonia will become visible by 2035 and grows to a 21% share in 2060. After 2040, gas will overtake oil and together they will still meet two-thirds of the sector’s energy demand. The fossil share will decline to 25% by 2060. Electricity will meet 28% of the energy demand in 2060, half of it delivered in the form of e-fuels and most of the remainder being self-generated on the ship through solar PV and wind-assisted propulsion systems (WAPS). In our model Greater China has been allocated its share of global shipping in the energy use and emissions forecasts.

Buildings

Energy demand in buildings will grow slowly to 2045, thereafter slowly reducing to reach 23% above today’s level in 2060. With a doubling of the GDP per capita, this increase might seem modest, but the population will decline by 15% over the period, and the rate of urbanization is already at 70% today and will increase at a slower speed than we have seen up to now.

This sector also benefits from electrification and technology shifts. Gas boilers with unavoidable combustion losses are replaced by direct electric heating (good) and heat pumps (even better) that increase efficiency.

The energy delivery from gas boilers will be reduced from one third to one tenth of the demand. The boilers will be replaced by a growing number of heat pumps – 35 million households have these today and 180 million will by 2060. This technology switch impacts on several demand segments in the buildings sector. Energy demand for space heating will reduce 20% due to the increased prevalence of heat pumps. Energy demand for water heating will be almost halved as increased volumes of hot water can be provided with more efficient energy input. Cooking demand will be reduced by 60% following a switch from traditional cooking to modern technologies. Cooling will be the traditional segment using more power as purchasing power growth outstrips the efficiency gains, resulting in a doubling of energy demand. Power for data centres will grow from a low share of 1% of buildings sector energy demand today to 10% in 2060.

In total, electricity will meet more than three-quarters (77%) of energy demand for buildings in 2060, compared to less than 40% now. Electricity from behind the meter will have a stable 7% share of the electricity consumed throughout the period.

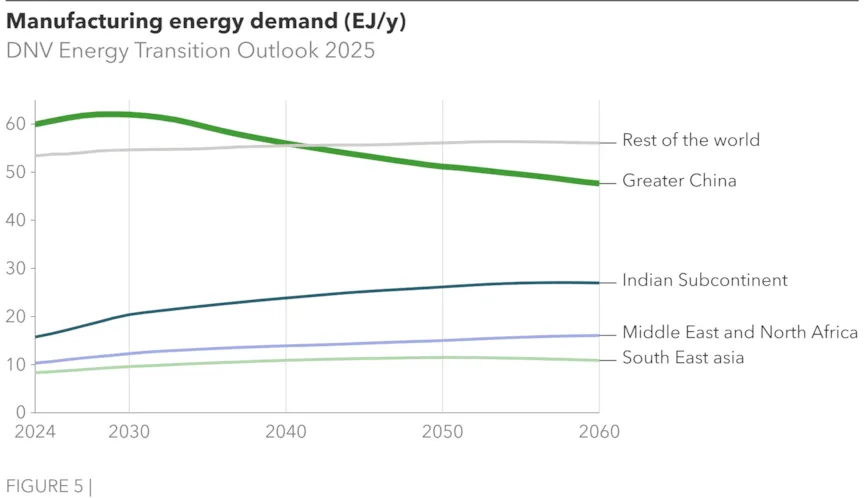

Manufacturing

Manufacturing today accounts for half the energy demand in the region compared with a global average of 32%. This will not change much until 2060, when the share will be a little lower (46%) but the global average still at 32%. This reflects China’s position as the global manufacturing hub both today and in the decades to come.

The share of fossil energy sources in meeting manufacturing energy demand in the region will shrink from 58% to 25% between 2024 and 2060. Looking closer, we see a different picture for coal because manufacturing is, and will remain, its main consumer outside the power sector. Throughout the period, 80% to 90% of the coal that is not going to power generation will be consumed in manufacturing, and by 2060 this will be a remaining demand of 7 EJ. This is explained by the challenges in the hard-to-decarbonize sectors where coal cannot be fully displaced, and manufacturing will be the sector contributing most remaining emissions in 2060.

Figure 5: Evolution of manufacturing’s energy mix for GCHN and global.

Greater China’s role in the global transition

China is well positioned for the green transition following its build-up of a modern manufacturing sector in which cleantech alone now contributes 10% of GDP (Helsinki, CREC). High-quality growth continues to be key in building the sector further; nuclear, energy storage (batteries, etc.), and hydrogen are hot topics in the energy sector. Artificial Intelligence (AI) will be an important tool in the sector’s continuing development and growth, and we find that AI will account for 10% of the Greater China region’s electricity demand in 2060. Export restrictions are seen – for example, battery production technologies (NYT, 2025) and export of rare earth minerals.

As geopolitical tensions emerge, exports are not reducing as trade finds new routes and destinations. The US (11%) and the EU (13%) are only 24% of China’s total export market (GACC,2025). Hence, although China wants to maintain relations with both, it is not very dependent on exports to them. Recent figures show export increases to emerging and developing economies, where market potential is huge (NYT, 2025).

China’s Belt and Road Initiative, started in 2013, catalyses and boosts connectivity and cooperation across continents through construction and investment. Its present activity level (construction values and investments) is the highest yet throughout its lifetime (Griffith, 2025) and contributes to accessing host countries’ markets, third-country markets, and raw material inputs. Activities include projects across continents (Net Zero Industrial Policy Lab, 2025): examples include Indonesia (nickel-rich battery-material projects and new solar lines), Morocco (cathodes and green hydrogen for EU supply chains) and Gulf states in the Middle East (solar module and electrolyser manufacturing).

Full speed ahead

Today, coal is the most important contributor in the energy mix in the region. Policy initiatives are implemented to reduce its influence but the picture is not fully clear on how fast and deep these will play out. For example, coal power plants are still being built while one incentive will pay utilities for not using coal power plants (Qin et al, 2025). We believe that the coordinated efforts will produce quick results, and our results show a modest reduction from peak coal emissions right away, with accelerated phase-out of coal from 2035.

Another facet of coal is that many communities depend heavily on the jobs linked to it, three million in Shanxi alone (Financial Times, 2025) and the energy transition will require measures in coal regions to ensure work and employment.

The bigger picture shows that the regulatory regime in China is developing consistently with set goals as transparent targets. Glimpses of the 15th Five-Year Plan (2026–2030), to be released late October 2025 and formally adopted in March 2026, indicate a continued journey aiming at these goals by regulatory and other policy measures aimed at solar PV and coal power markets, manufacturing, and other targets. Their 2030 goal on peak emissions is an intermediate goal, and this will be reached as described above.

China’s recent NDC pledge to 2035 included intentions of capacity building of wind and solar to 3.6 TW by 2035 (Taiyang News, 2025), Our forecast projects 3.4 TW installed for the same year. The pledge confirms an upgraded floor target from China and is an example that China could have capacity to accelerate its transition further.

Comparing the DNV forecast for the Greater China region with official Chinese emission reduction goals, we find that the main target of peaking CO2 emissions before 2030 will be met. On China’s commitment to reducing carbon intensity of GDP by 65% between 2005 and 2030, our forecast (considering energy and industrial process-related CO2 emissions after CCS and DAC) suggests a reduction of 59% in carbon intensity of the economy by 2030 for the region.

Nevertheless, the most important goal in China is carbon neutrality by 2060. Our model covers only energy and process-related carbon dioxide, and finds that there will be remaining emissions, mostly from hard-to-decarbonize subsectors in manufacturing and transport (aviation and maritime). Additional measures could change this. For manufacturing, among other things, it remains to be seen how carbon capture and storage (CCS) policies will develop in the longer term with the benefit of experience from existing CCS pilots. For aviation and maritime transport, the numbers include the region’s share of international transport emissions – 55% and 62%, respectively – in the remaining emissions for those segments.

Policy summary

A non-exhaustive list of sector policy initiatives, emphasizing the 2024 to 2025 period

|

Climate targets - Key countries China is committed to peaking carbon emissions by 2030, 7-10% reduction in GHGs by 2035 from peak levels and achieving carbon neutrality by 2060. |

||

|

Sector |

Policy details and example initiatives |

Mechanism(s) |

|

Power |

> Renewable energy expansion specified in Energy Law 2025 including infrastructures. > Transitioning from fixed subsidies to bidding system since June 2025. > Plans to integrate over 200 GW of new wind and solar annually from 2025 to 2027 and aims for 3.6 TW solar and wind by 2035, with approximately 150 GW from offshore wind. |

Targets Tradable green certificates Competitive tenders / auctions (CfDs) Government funding, less mature technologies |

|

> Flexibility and storage technologies are integral to the new power system. The Special Action Plan for Large-Scale Construction of New Energy Storage (2025-2027) aims for over 180 GW of new energy storage by 2027. > Provincial authority requirement on developers for storage co-located with new renewables. |

Requirements Market-based deployment with participation in wholesale and ancillary service markets, improved capacity-pricing mechanism |

|

|

> Coal is given a guarantee and systemic role in the energy supply system in the Energy Law. |

Capacity payments |

|

|

> Nuclear expansion includes plans to reach 200 GW capacity by 2035, from around 60 GW in 2024, and to account for 10 % of generation in 2030 and at least 15% in 2050. > Nuclear is seen as a key export sector. |

Low-cost loans (People’s Bank of China) Favourable feed-in tariffs

|

|

|

Grids |

> Large-scale infrastructure expansion by State Grid Corporation to ready grid for large-scale renewable integration, planning close to USD 90bn (CNY 650bn) investments in 2025 up from USD 84bn (CNY 600bn) in 2024. > The National Energy Administration (NEA) issued the Action Plan for High-Quality Distribution Grid Development (2024–2027) to prepare the distribution grid for renewables and new market participants . |

State-owned enterprise investments Direction on regional governments to align with national goals |

|

Hydrogen |

> Advancement from demonstration to commercialization with the National Energy Administration’ Notice Organizing and Conducting Pilot Work on Hydrogen Energy in the Energy Sector for a nationwide hydrogen pilot rollout to push commercial deployment by mid-2028 (June 2025). |

Sector-specific plans and support State-owned enterprises investments with low-cost loans (People’s Bank of China). Government funding |

|

CCS/DAC |

> Updated carbon capture road map underlines CCUS as crucial technology for carbon neutrality, envisions deployment in energy and industrial sectors, EOR, and emphasizes DAC technology development (December 2024). > Updated Coal Action Plan aims to cut coal power emissions per kWh with 50% by 2027, close to natural gas plant levels, with achievement through co-firing of at least 10% biomass or green ammonia or using CCS technologies. |

Government funding to R&D, pilots, clusters Low-cost loans (People’s Bank of China) Mandates on SOE for full-chain development Emission limits Carbon pricing |

|

Transport |

> In road transport, remaining purchase subsidy is a ‘trade in’ of older ICEs/EVs for new energy vehicle. NEV aspirational sales target for 60% of all new vehicle sales by 2030. The hydrogen rollout initiative (see above) prioritizes hydrogen use and development of fuel cell electric vehicles. > In aviation, the SAF pilot programme launch, Application Requirements for Green and Low-carbon Advanced Technology Demonstration Projects, promotes fuels production (September 2024). Aviation will be included in the national ETS by 2027. Current blend target is 2% by 2025, increasing to 15% by 2030, applying to both domestic and international flights. SAF targets are based on soft guidance; post 2025, mandates and punitive measures like the RefuelEU Aviation regulation are expected. |

Subsidy Target

Government funding, R&D, pilots

Carbon pricing Mandates |

|

Manufacturing |

> 15th Five-Year Plan (2026-2030) to focus on dual carbon control (intensity and quantity). > Notice on Launching the Construction of Zero-Carbon Industrial Parks (June 2025) plans to reshape industrial energy systems and develop models for decarbonization of industrial zones. > Guiding Opinions on Vigorously Implementing the Renewable Energy Substitution Initiative (October 2025) fosters systemic demand, renewable energy consumption across industries. > Hydrogen use is prioritized as part of piloting roll-out initiative (see above) > The national ETS expands in 2025 to cover steel, cement, and aluminium smelting sectors. > The government established the China Resources Recycling Group to streamline recycling across key sectors, including scrap steel, EV batteries, plastics, non-ferrous metals, and retired renewable energy infrastructure (October 2024). |

Targets and sectoral guidelines

Renewable energy consumption targets, renewable certificates as proof by 2030

Government funding, R&D, pilots Carbon pricing Recycling targets and related sectors classified as encouraged industries |

|

Buildings |

> Select cities bans natural gas heating networks and have mandatory requirements on buildings heat supply. All localities must have coal-substitution projects in urban planning. > The 2024-2025 Action Plan for Energy Saving and Carbon Reduction in the building sector , emphasizes energy efficiency upgrades and carbon reduction. > The Notice on the Action Plan for Promoting High-Quality Development of the Heat Pump Industry was issued (April 2025) to assist energy conservation and carbon reduction. > Complementary policies emphasize fuel switch, clean energy integration, use of surplus heat in district heating networks. |

Bans/mandates Standards

|

References

China Daily (2025). Xi announces China's 2035 Nationally Determined Contributions to beef up climate response. https://www.chinadaily.com.cn/a/202509/25/WS68d43ad1a3108622abca2b5d.html

Financial Times: Financial Times: Why the world cannot quit coal - Financial Times. 18 June 2025 https://www.ft.com/content/f6cc8bbc-9e45-4062-b216-37875b75d3cc

Government of China (2025). Xi Jinping's remarks at the Climate and Just Transition Leaders' Summit. https://www.gov.cn/yaowen/liebiao/202504/content_7020623.htm

Government of China (2024). Opinions of the Central Committee of the Communist Party of China and the State Council on Accelerating the Comprehensive Green Transformation of Economic and Social Development. July 31. https://www.gov.cn/zhengce/202408/content_6967663.htm

IEA (2025). World Energy Investment 2025. IEA, Paris. https://www.iea.org/reports/world-energy-investment-2025/executive-summary

GACC: China's Total Export & Import Values by Country/Region, December 2024 (in USD). 13 January 2025. http://english.customs.gov.cn/Statics/80ab1a29-cd9a-4fca-b8ca-8e373ef88308.html

Griffith University: China Belt and Road Initiative (BRI) Investment Report 2025 H1. 17 July 2025 https://blogs.griffith.edu.au/asiainsights/china-belt-and-road-initiative-bri-investment-report-2025/

Leung, Adrian (2025). ‘China’s EV exports grow 19% in the first five months of 2025, led by Chery, MG, and Geely’. CarNews China, June 9. https://carnewschina.com/2025/06/09/chinas-ev-exports-grow-19-in-the-first-five-months-of-2025-led-by-chery-mg-and-geely/

Made in China: China’s 15th 5-year plan. What we know so far. 28 July 2025. https://insights.made-in-china.com/China-s-15th-Five-Year-Plan-What-We-Know-So Far_naPtTmOKuElB.html#:~:text=The%2015th%20Five-Year%20Plan%2C%20which%20will%20cover%20the,plenum%20expected%20to%20take%20place%20in%20the%20fall

MEE ─ Ministry of Ecology and Environment of the People’s Republic of China (2025). Notice on the issuance of the "Work Plan for the National Carbon Emission Trading Market Covering the Steel, Cement and Aluminum Smelting Industries". March 21. https://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202503/t20250326_1104736.html

Mooney, A., Isenberg, D. (2025). ‘China’s clean tech exports to emerging markets surged in 2024, data shows’. Financial Times. April 28. https://www.ft.com/content/55dc188a-c023-42b6-86a7-e823a527b061

Myllyvirta, L., Qin, Q., Qin, C. (2025). Analysis: Clean energy contributed a record 10% of China’s GDP in 2024. CREA. https://energyandcleanair.org/analysis-clean-energy-contributed-a-record-10-of-chinas-gdp-in-2024

National Development and Reform Commission (NDRC): Guiding Opinions on Promoting Renewable Energy Substitution. October 30, 2024. https://www.ndrc.gov.cn/xxgk/zcfb/tz/202410/t20241030_1394119.html

National Development and Reform Commission (NDRC) and National Energy Administration: Power System Regulation Capacity Optimization Action Plan (2025–2027). January 2025 https://www.ndrc.gov.cn/xwdt/tzgg/202501/P020250106572482271813.pdf

NEA ─ National Energy Administration (2025). Policy interpretation of the "2025 Energy Work Guiding Opinions. https://www.nea.gov.cn/20250227/105a07a9be2c4727b7fe12c11c7b84cf/c.html

NEA (2024). Energy Law of the People's Republic of China. https://www.nea.gov.cn/2024-11/09/c_1310787187.htm

Net Zero Policy Lab: China’s Green Leap Outward: The rapid scale- up of overseas Chinese clean-tech manufacturing investments. September 9 2025. https://www.netzeropolicylab.com/china-green-leap?utm_source=substack&utm_medium=email

New York Times: China Puts New Restrictions on E.V. Battery Manufacturing Technology - The New York Times. 15 July 2025. https://www.nytimes.com/2025/07/15/business/china-electric-vehicle-battery-manufacturing.html

New York Times: China’s Exports to Africa Are Soaring as Trade to U.S. Plunges. Sep 8 2025. https://www.nytimes.com/2025/09/08/business/china-exports-africa.html

Qin Q, Shearer C.: When coal wont step aside. 13 Feb 2025. https://energyandcleanair.org/publication/when-coal-wont-step-aside-the-challenge-of-scaling-clean-energy-in-china/

Qin, Yan (2025). This is BIG news for China #Carbon market. https://www.linkedin.com/posts/yan-qin-b167842b_carbon-industry-aviation-ugcPost-7343308913494110210-hIMj

Renewable-Energy-Industry (2025). China Becomes the First Country in the World to Surpass 1,000 GW of Solar Power Capacity. https://www.renewable-energy-industry.com/news/world/article-7018-china-becomes-the-first-country-in-the-world-to-surpass-1000-gw-of-solar-power-capacity

Shaw, Vincent (2025) ‘China on track to deploy 380 GW of PV in 2025’. PV Magazine. https://www.pv-magazine.com/2025/07/10/china-on-track-to-deploy-380-gw-of-pv-in-2025

State Council of China: The 2024–2025 Energy Conservation and Carbon Reduction Action Plan. May 2024. https://www.gov.cn/zhengce/content/202405/content_6954322.htm

Taiyang News: China Announces 3.6 TW AC Solar & Wind Target For 2035. https://taiyangnews.info/markets/china-announces-36-tw-ac-solar-wind-energy-target

Wang, Caroline (2025) China hit new record of solar and wind power capacity additions in 2024. Monthly China Energy Update | February 2025. https://climateenergyfinance.org/wp-content/uploads/2025/02/MONTHLY-CHINA-ENERGY-UPDATE-Feb-2025.pdf

Ware, J., Pearce, O. (2024) Counting the Cost 2024: A year of climate breakdown. https://reliefweb.int/report/world/counting-cost-2024-year-climate-breakdown