Transport in Transition

Our current global transportation system already accounts for 25% of worldwide greenhouse gas emissions. Over the next three decades, the global vehicle fleet will double from 1.2 billion to 2 billion vehicles, passenger flights will rise by 130%, and sea cargo ton-miles, the equivalent of shipping one ton of product, one mile, will grow by 35%.

Can we manage this growth while cutting emissions?

The short answer is that a significant portion of transportation will decarbonize, resulting in a 40% reduction in emissions by mid-century (DNV, 2023). However, despite this progress, transportation's relative contribution to global emissions will increase to one-third by 2050. This highlights the urgent need for the transportation sector to accelerate its decarbonization efforts.

While the transition of the transport sector is ongoing and presents a certain complexity, it has significant implications for the finance industry and raises several key questions and challenges regarding the financing of this transition.

One of the primary questions is the scale of investment required to transition the transport sector to cleaner energy sources. This includes the cost of building electric vehicle (EV) infrastructure, upgrading public transportation, and supporting the development and adoption of alternative fuels such as hydrogen and biofuels. Financing the transition also depends on consumer behavior. Will consumers adopt EVs quickly? Will they use public transportation more frequently? Financial institutions need to consider how these shifts in behavior affect their investments. And who will pay for all of this?

Transport in Transition Insights

At its core, decarbonizing transport is primarily a fuel challenge. Emissions are dispersed through the exhaust systems of more than one billion vehicles, airplanes, and ships and these emissions cannot be effectively captured.

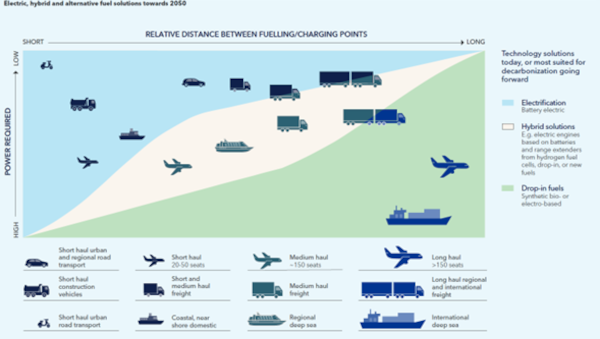

The path to achieving decarbonization is evident: electrify what can be electrified; what cannot be electrified in the near-term should transition to sustainable advanced biofuels; and get ready for the widespread adoption of hydrogen-based new fuels, which should extend from local and regional systems to a global system starting in 2035. Electrification will become the more cost-effective option, as hydrogen and sustainable biofuels cannot compete with oil purely on a cost basis. Consequently, they require distinct policy measures to facilitate their widespread adoption.

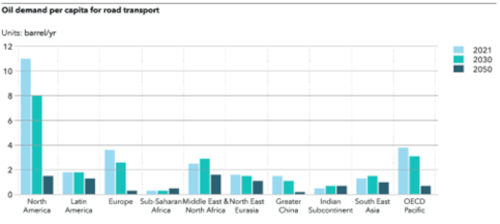

By 2050, oil will still represent 50% of the global transport sector energy demand

In 2022, the transport sector accounted for 62% of the world's total oil consumption. Out of this, approximately 80% was allocated to powering road vehicles, while the remaining portion was distributed relatively evenly between aviation and maritime usage. Despite the increasing adoption of electricity, sustainable aviation fuels (SAF), hydrogen, and ammonia across road, aviation, and maritime transport, the transport sector will continue to be the leading consumer of oil. By 2050, oil will still represent 50% of the global transport sector energy demand, underscoring its persistent significance, and mainly because of the following reasons:

- Cost Competitiveness: Oil is currently cost-effective due to its widespread production and availability

- High Energy Density: Gasoline, diesel, and kerosene have energy densities over three times higher than liquid ammonia and liquid hydrogen

- Infrastructure: The existing transportation infrastructure, including tankers, pipelines, refineries, and gas stations, is heavily oriented towards oil-based fuels

- Processing for Transport: Oil transportation requires no significant pre- or post-processing, unlike hydrogen and e-fuels

- Storage: Crude oil can be stored almost indefinitely with minimal loss in tanks or barrels.

Electricity will meet one third of energy demand in road transport but power nearly 80% of the global vehicle fleet by 2050

Over the coming decades, electricity is expected to gradually become the primary energy source for road transportation. Direct electrification in the maritime and aviation sectors will continue to have limitations; in these areas, hybrid propulsion systems will assume a more prominent role in achieving electrification. Electricity’s share in transport will grow from 1% today to 4% in 2030 and will be 23% in 2050. By then, electricity will meet one third of energy demand in road transport but power nearly 80% of the global vehicle fleet. However, electricity has been forecasted to only power 2% of aviation and just 4% of maritime transport by 2050.

From a perspective of financing this transition, we forecast that in the long term, governments will need to replace lost revenue from fossil fuel taxes. They might consider alternative taxation like mileage-based charges, which could reduce the advantages of electric vehicles. However, instead of hindering the EV transition, regulators should explore entirely new revenue sources that acknowledge the neutral externalities of EVs and the significant system-wide and multiple benefits of vehicle-to-grid (V2G) and vehicle-to-everything (V2X) technologies. It's likely that taxing for road maintenance and addressing particulate matter from tire wear would be viewed as equitable by all stakeholders. At the same time, V2X technologies hold potential to not only become an integral part of grid balancing activities, but also provide additional income to EV owners.

To decarbonize sectors like aviation and maritime, advanced second-generation biofuels must primarily come from non-edible sources like waste and residues

Biofuels are widely used in transportation, as they help reduce local pollution, energy dependency, and potentially global emissions. This role is set to expand further with biofuels employed both in pure form and blended with conventional fuels. With the exception of the Middle East and North Africa, regions worldwide have biofuel mandates or preferential treatment, highlighting the influence of public policy on fuel choices.

In 2022, biofuels constituted about 4% of global transport energy demand, mainly in road transport. First-generation biofuels, primarily biodiesel and ethanol derived from edible crops like corn, sugarcane, and soybeans, dominate production. Despite being renewable and emission-reducing, they face sustainability challenges, drawing criticism for energy crop farming and forestry use.

However, the utilization of first-generation biofuels is expected to decline as the industry shifts toward second- and third-generation biofuels, avoiding food competition and utilizing waste materials or non-arable land. Furthermore, the growing adoption of electric vehicles will also reduce the need for first-generation biofuels. Market forces are indeed steering the industry, including aviation and maritime, toward second-generation biofuels to address sustainability issues.

To decarbonize sectors like aviation and maritime, advanced second-generation biofuels must primarily come from non-edible sources like waste and residues. The upcoming decade will witness intense competition for non-food feedstock in North America and Europe due to regulatory frameworks promoting traditional and advanced biofuels. This competition will spur the exploration of new feedstock sources.

Hydrogen and its derivatives are still in the development phase and won't be readily available on a large scale until the 2030s

Normally, hydrogen presents substantial challenges in terms of cost, complexity, efficiency, and safety when compared to the direct use of electricity. Nevertheless, in hard-to-electrify transport sectors, hydrogen and its derivatives like ammonia, e-methanol, and e-kerosene emerge as leading low-carbon options. However, it's important to note that they are still in the development phase and won't be readily available on a large scale until the 2030s. Until that time, biofuels will play a significant role.

Presently, hydrogen markets are predominantly limited to production near major industrial consumers. Open commodity markets for hydrogen are virtually non-existent, except for markets related to hydrogen derivatives like ammonia and methanol. At present, hydrogen is primarily generated from natural gas and coal without carbon capture and storage (CCS). To make hydrogen a practical choice in the transportation sector, it must undergo decarbonization.

In the maritime sector, adoption will start in the mid-2020s but will require a decade for noticeable scaling. Initially, some smaller vessels will use pure hydrogen, but the majority of hydrogen utilization in maritime will come in the form of hydrogen derivatives, as explained below. We forecast an uptake of 6.4 EJ/yr by 2050. In the aviation sector, the growth of hydrogen and hydrogen derivatives will commence in the early 2030s, reaching approximately 3.9 EJ/yr by the mid-century. As for the road sector, hydrogen's uptake will be minimal until the mid-2030s, then gradually increase to 2 EJ/yr by 2050, primarily in the form of pure hydrogen without derivatives. Adoption will be driven mainly by large long-distance trucks, while smaller trucks, buses, and passenger vehicles will have only marginal use of hydrogen.

To gain deeper insights into the financial challenges and opportunities in the transition of the transport sector, you're invited to join our hybrid breakfast event for the finance community on September 28 2023.

9/12/2023 9:00:00 AM