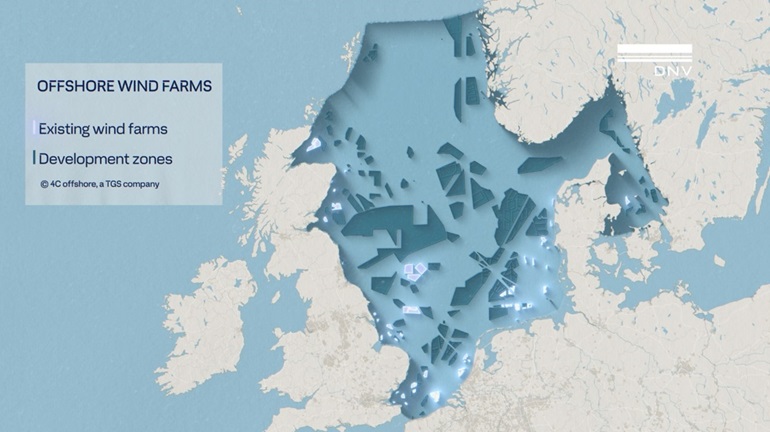

Opportunities for Industrialization and Standardization in the North Sea offshore wind market

Joint Industry Project - Call for partners

This joint industry project has kicked off the specific cost modelling work for the full chain, but it is not too late to become a partner, please get in touch to join.

Rising to the challenge of accelerating wind farm development

The wind industry has been experiencing rapid technological advancements over the past 10-15 years. These developments are driven by competitive, macro-economic, and regulatory factors, often referred to as the "arms race" in the wind industry. This fierce competition aims to bring larger turbines to market with seemingly lower Levelized Cost of Energy (LCoE), even before the innovation costs of previous platform versions and installation ships have been recouped.

The rationale for upscaling wind turbines has been straightforward. From a developer and owner's perspective, fewer larger wind turbines mean fewer cable connections, reduced installation, operation, and maintenance activities, and diminished wake effects between turbines within a farm. The trade-off is that each wind turbine becomes more expensive and necessitates larger vessels with greater capacity and taller cranes for installation and maintenance.

The rationale for upscaling wind turbines has been straightforward. From a developer and owner's perspective, fewer larger wind turbines mean fewer cable connections, reduced installation, operation, and maintenance activities, and diminished wake effects between turbines within a farm. The trade-off is that each wind turbine becomes more expensive and necessitates larger vessels with greater capacity and taller cranes for installation and maintenance.

So far, this trend has consistently reduced the LCoE. However, as the cost benefits of increasing turbine size begin to plateau, exploring alternative strategies may prove more impactful.

The rapid pace of wind turbine development has not allowed sufficient time to enhance products and equipment, thereby obstructing the full potential of standardization and industrialization - processes that hold significant promise for further reducing costs and improving quality.

Given the need for cost reduction in wind energy, if turbine upscaling can no longer drive it, where would these cost savings come from? Here are some ideas:

- Evolution rather than revolution: Evolve and refine existing designs, tools, and methods

- Commitment to standardization: Limit wind turbine component sizes and masses, and other aspects of wind farm design, for a reasonable number of years to allow the supply chain to industrialize at all levels, including vessels, ports, cranes, etc.

- Industrialization: Increase production volume and automate processes to enhance quality and reliability

- Improved quality and reliability: Improved performance and decrease risk premiums from investors and insurers.

.

JIP Phase 1 Objective

Starting in September 2025, the objective of the first phase of the JIP is to: “Investigate the impact on North Sea offshore wind induztrialisation and standardization by periodically stabilizing wind turbine capacity and stay within the limits of the current supply chain.”

The benefits of this JIP are to:

- Quantify the benefits of periodically pausing wind turbine growth to unlock supply chain efficiencies, lower LCoE, and boost overall industry output

- Deliver insights for making strategic decisions towards industrialization -- critical for meeting North Sea offshore wind targets and wider enablement of the energy transition

- Catalyse a shift toward supply chain alignment and changing the approach to turbine development to foster a more resilient and predictable offshore wind industry.

The investigation focus is to see what the impact is of periodically pausing the rat-race for bigger wind turbines and find out what the impact will be on the much-needed industrialization and standardization.

The study will further consider the following supply chain constraints:

- Maximum Hub Height: 170 m

- Maximum Spudcan to Hook Height: 270 m

- Maximum Rotor and Nacelle Component Lifting Mass: 1500 mt

- Maximum Monopile Mass and Diameter: 2500 mt, 11 m

- Maximum Quay Bearing Capacity and Port Channel Depth: 30 mt/m2, 12 m

These constraints represent best-estimate upper limits at which a sufficient number of supply chain actors can currently support North Sea offshore wind development—or could reasonably be mobilised to do so within the next decade.

Respecting these supply chain constraints and temporarily pausing further wind turbine growth for the next five, 10, or 15 years could be a strategic approach to drive industrialization and standardization to accelerate installation rates, enhance quality, and rebuild confidence, profitability, and resilience across the North Sea wind supply chain.

The aim of this first JIP phase, is to conduct numerical analysis to investigate this strategy by utilizing DNV's expertise in offshore wind engineering and cost modelling, along with feedback and data from JIP partners. Benefits will be evaluated on their impact on North Sea average LCoE and installation rates. Environmental impact aspects will also be considered where feasible.

The impact of standardizing wind farm sizes will be investigated for differing capacities of 500 MW, 750 MW, 1 GW, 1.5 GW, and 2 GW. The benefit of different lengths of standardization period will also be assessed. Future phases of this JIP may model further aspects of Industrialization and standardization.

JIP Deliverables

The JIP process and results will be captured in documentation that can be used by JIP partners at different levels of internal discussions, from detailed engineering to board-level discussions. Additional summary documentation will be generated that can be shared externally to guide discussion with the broader industry and its stakeholders..

The JIP process and results will be captured in documentation that can be used by JIP partners at different levels of internal discussions, from detailed engineering to board-level discussions. Additional summary documentation will be generated that can be shared externally to guide discussion with the broader industry and its stakeholders..

Industry Participation

DNV has initiated this JIP by a Steering Group of established, credible industry representatives from the European offshore wind value chain: including representation from wind turbine manufacturers, developers, vessel and installation suppliers, foundation suppliers, and marshalling port authorities.

The following companies have joined this joint industry project:

- EEW Special Pipe Constructions GmbH

- Fred Olsen Windcarrier ASA

- Groningen Seaports N.V.

- Iemants N.V.

- Jan de Nul N.V.

- Ørsted Wind Power A/S

- RWE Offshore Wind GmbH

- Van Oord Offshore Wind B.V.

- Vattenfall Vindkraft A/S

- Vestas Wind Systems A/S

The JIP is now open for broader participation, facilitating the co-sharing of budget costs and providing a seat in the steering committee. If you are a key player in the offshore wind supply chain and interested in joining this JIP, please get in contact with DNV.