Offshore wind 2023: New ambitions! New challenges?

For the offshore wind sector, especially in Europe, the year 2022 was dominated by a series of good news announcements. Many countries, governments and public institutions reviewed and increased their offshore wind ambitions and targets respectively. But is this news all positive? Change always result in additional work. This blog examines the new and potential tasks that will need to be addressed to enable the successful implementation of offshore wind capable of meeting the ambitious targets of a faster energy transition.

Country specific offshore wind target are driven by the motivation to reduce carbon emissions to tackle the global warming of our beloved planet. However, in 2022 new actions were taken motivated by a second rationale with a slightly more urgent cause, the invasion of Ukraine. The war and the associated energy crisis pushed governments to act faster to accelerate renewable energy capacity build-out. Even the once sceptical political parties suddenly claimed that dependency on fossil fuels may not be a long-term sustainable idea. For the offshore wind sector, these new ambitious targets could result in a major market shift with some considerable reframing of the previously existing market structure. This includes the fact that the global future predicted market demand is larger than the current and predicted supply. The energy transition is accelerating and there is a lot of positive factors to it, but the question is, could the new market situation be counterproductive to the growth of offshore wind? Can a potential shift to a supplier’s dominated market have a negative impact on the offshore energy build-out?

Status: Let's face the facts

If you’ve followed the recent debates in Europe and also globally, you would have seen that there is a lot of discussion about the offshore wind sector, both bottom fixed, e.g. traditional offshore wind, but also floating offshore wind, the required solution for deep water sites. Multiple conversations from different viewpoints means that it can be easy to get “lost in the hype”. Therefore, before we go ahead and look to the future, here is a short summary of the sector today.

Where are we in numbers?

The global offshore wind capacity in operation, referring to installed turbines that have already produced some electricity was reported by the World Forum Offshore (WFO) to be 57.6 GW1 at the end of 2022. Other sources2 report similar figures only differentiating in reporting dates and definition of operational status. As a side note it’s important to mention that in 2021, 16.9 GW offshore wind capacity was grid-connected in China. This made China the leading offshore wind market globally and put long-term leader UK in second position.

What does this mean?

These numbers need to be seen in the light of the global installed capacity of other renewable energy generation sources. At the end of 2021 the Global Wind Energy Council (GEWEC) reported a total of 837 GW3 global installed wind generation capacity Using this perspective, offshore wind has a stake of approximately 7% of the “wind sector” globally. Doesn’t sound too thrilling – does it?

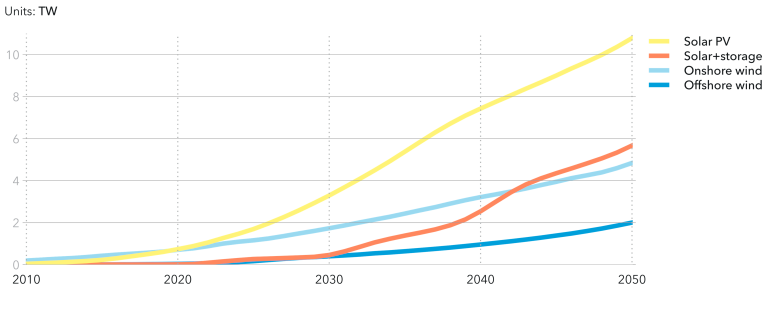

Solar energy globally was reported by the International Renewable Energy Agency (IRENA) to have 1,053 GW4 installed capacity. Again, proving that offshore wind capacity is the little sister of the renewables industry DNV’s Energy Transition Outlook comes to a similar conclusion, and the visualization of the current installed base also gives a clear perspective on the small role that offshore wind currently plays.

FIGURE 1: History and projection of world installed capacity from solar and wind [DNV’s ETO 2022]5

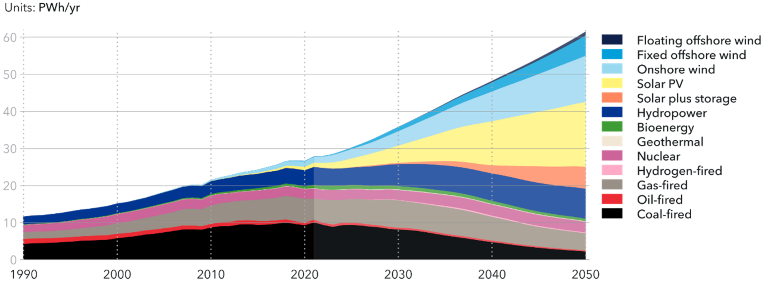

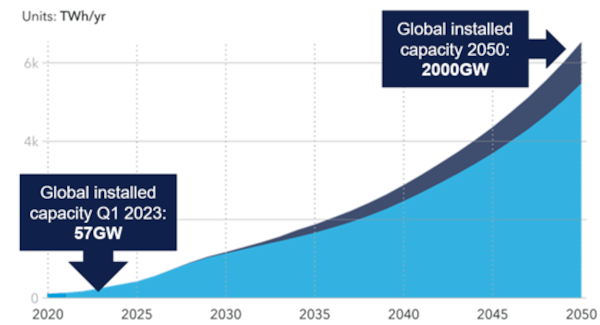

DNV’s Energy Transition Outlook concludes that by 2050 offshore wind will grow but compared to the other renewable sources it will still be small and must be seen as a ‘minor generation contributor’. However, the target of growing offshore wind to approximately 15% of the world’s electricity generation by 2050 still is an ambitious goal. In total numbers the global target for the offshore wind sector is 2,000 GW by 2050. When you consider that the current 57 GW (2022) is only 3% of the 2050 ambition 2,000 GW suddenly seems like a distant dream. Offshore wind capacity needs to grow 35-fold in the coming 27 years. These ambitions are displayed in the below figures based on energy produced per year per generation source.

FIGURE 2: World grid connected electricity generation by power station type [DNV’s ETO 2022]

FIGURE 3: Generation from grid connected capacity only [DNV’s ETO 2022 based on data from IEA 2022; Global Data (2022)]

What is happening in Europe?

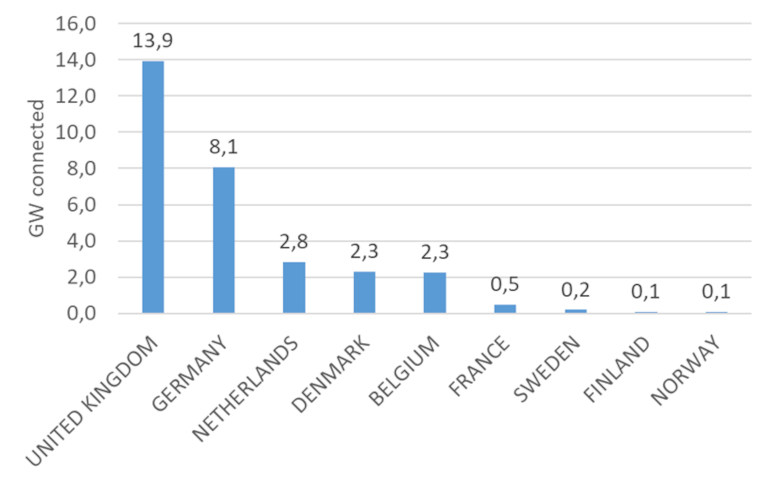

According to WindEurope’s latest statistics 30.3 GW6 of offshore wind energy was installed in Europe with the distribution given in the following graph:

FIGURE 4: Europe’s Offshore Wind Statistics, leading countries only [DNV based on WindEurope]

Demand

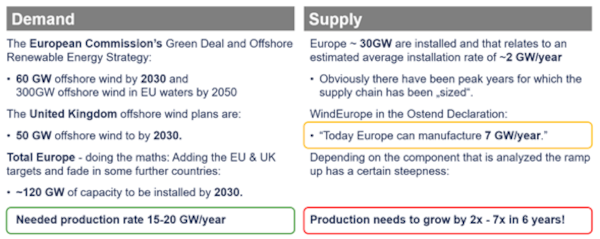

The new country targets are new however, assuming that the governmental targets will be implemented and executed close to ambition we can have a first look and interpretation. Let us focus on the European targets. We will limit our example by assuming that offshore wind turbines (Rotor Nacelle Assembly) will predominantly be sourced locally, splitting the global market into smaller geographical regions, e.g., Europe, Asia and Americas. For this article we will review and look at the local market in Europe that comprises the EU and also non-EU states like the UK.

European Commission

As part of the Green Deal and the new climate and energy ambitions the European Commission suggested several strategies. The most relevant for offshore wind is the Offshore Renewable Energy Strategy. That strategy paper outlines the roadmap to achieve 60 GW offshore wind by 2030, and 300 GW offshore wind in EU waters by 2050. The long-term plans may be speculative but the target of generating 60 GW of offshore wind by 2030 is also a big jump from the current approximately 16 GW installed and needs to be looked at. One could assume that the leading offshore wind countries will continue to play a major role, with Belgium, Denmark, Germany, and the Netherlands building at least half the capacity needed for the EU to reach its offshore wind targets.

United Kingdom

The United Kingdom’s plans are expected to support the EU’s ambitious targets and the UK has an ambition to increase offshore wind to 50 GW by 2030.

Doing the maths

By adding the EU and UK targets and accounting for further targets that are not yet fully included or visible the final ambition of the European countries come out at between 125 GW and 135 GW of capacity which needs to be built by 2030. In the Ostend Declaration7 of the Head of States a similar figure was stated with “at least 120 GW”, however as this was only referring to “North Sea States”, These numbers give an indication of the demand to come for offshore wind components.

Supply

Historic turbine supply was a roller coaster

The supply of offshore wind components has always been a very volatile market. The limited number of large assets in a global market with only a few specialized companies as the preferred suppliers has led to ups and downs when it comes to settling into a healthy supply chain. With the new targets these characteristics are now changing, and the market is shifting from over to under-supply, especially when looking at the European region and turbine supply in particular.

Until recently the offshore wind sector was dominated by the drive for cost reduction. The achievement of zero subsidy targets was a common goal for both the suppliers (predominantly the turbine supply) and the developers (predominantly the large utilities and energy companies). Meeting this joint goal was also a requirement in the ‘cost reduction formula’ with lower levelized cost of energy (LCOE) perceived as the best way to expand existing markets and to open new ones, with larger and new markets were seen as a solution to leverage scale effects, a meaningful lever to reduce cost. The expansion of markets up to this point had led to higher scale effects, synergies and other ingredients that facilitate rapid cost reduction. By committing to this joint target, the supply chain (specifically the turbine supply) decided to ‘follow’ the developers and reduce the prices while struggling to get costs down in parallel.

By 2015 most of the core large ‘offshore countries’ arrived in the zero subsidy grounds, the offshore wind energy sector was seen and promoted itself as a ‘mature’ renewable energy generation source to be applied large scale to substitute large conventional energy power plants. Great success!

With the new targets of several European countries (but also global ambitions of many regions) the demand for offshore wind related developments and the demand for equipment increased. Larger markets with increased and accelerated targets obviously require the supply chain to grow at the same rate to capture the market and to allow a healthy supply demand mechanism. However, the turbine supply for many years has been working on a much lower level and –as said above- a very volatile project driven level, which now requires a fast ramp up.

Specifically, the turbine supply chain has suffered under the cost reduction ambition in the past. The combination of a cost reduction target and the related demand for new larger technology (turbine capacity and size) led to very limited or to no scale effects on certain product lines.

This roller coaster has now led to a reluctancy to commit to upfront investments in new facilities and new technologies prior to ‘hard facts’ and ‘agreements with the purchaser’. This can slow down the needed capacity ramp-up and can harm the market with a serious period of “under supply”.

WindEurope in association with the Ostend Declaration discussions stated that “Today Europe can manufacture 7 GW of offshore wind a year.”8 DNV’s quantitative analysis for selected stakeholders in the industry recently revealed similar figures. Depending on the boundary conditions implied and market behaviours suggested, an under supply of 20%-50% is visible in the coming 5 years. Again, it needs to be said that this is not a long-term threat but a ‘normal’ market interaction, and the under supply will decrease over time until supply and demand swings into a balance again.

This under supply situation must nevertheless be seen as a turnaround of the market dynamics and will create a market where the demand is higher than the actual supply capacity leading to competition among the developers and energy companies, suggesting higher prices for the supply of turbines. An additional threat could be a diminishing quality level. Remember: this is all a projection and an interpretation – let’s hope for the best and the common sense and good will of all market players!!

Conclusion

The under supply situation of offshore wind components can be seen as a short-term challenge and the resolution is potentially available - so why n bring it up for discussion?

FIGURE 5: Potential Supply and Demand in a nutshell [DNV]

It is not the ups and downs of the prices and the levelized cost of energy respectively, but rather the threat that these new market dynamics may lead to. A shift in levelized cost of energy and electricity prices can irritate policy makers and make them re-think their ambitions. Offshore wind is an industry sector that is scrutinized by the public and by governments. Currently the whole energy transition is dominated by energy security and for offshore wind the achievements of the cost reduction journey are perceived beneficial by politicians. However, humans tend to be in possession of a short memory especially when this allows us to avoid a change from a convenient behaviour. What if we forget the threat of increasing gas and power prices? What if the renewable cost of energy goes up and this leads to higher bids in the coming offshore wind auctions? Will the offshore sector be able to maintain with the subsidy free promise? Or is there a danger that governments will be spooked by the cost of offshore wind energy once again? For example, if the ‘subsidy-free promise’ gets weaker?

In the light of the Ukraine war many European countries have reacted to the energy crisis by suggesting enhanced, accelerated and more ambitious renewable energy targets. These targets also suggest a strong enhancement of the target for offshore wind. DNV therefore assumes that the global supply chain will face high demand and that the previously seen employer market will turn rapidly into a supplier market. With turbine supply being dominated by a few strongly specialized, mature and established suppliers.

All this is obviously strongly dependent on the overall market volume, the timing, and the way several countries implement their targets into the actual spatial planning and grid development plans. Harmonization and standardization across borders not only for the “North Sea States” will be critical to allow a fast and sustainable production ramp up and a further industrialization of the sector. Alignment and transparent communications between the ‘North Sea States‘ will be key to allow a European development pipeline to build up and not to repeat a multi country roller-coaster experience. This alignment would also foster the global perception that Europe acts in alignment and has a common agenda when it comes to the energy transition.

Despite the challenges on the journey ahead, the ambitions for offshore wind will bring a never seen before opportunity to the sector and all involved stakeholders. We just need to make it happen!

These are of course predictions and related to uncertainty and it’s important to remember that there are many potential elements could change the picture. This is not a disclaimer but rather an opportunity to follow DNV to explore a few very interesting ‘what if- questions’ like we did in our HOW Conference recently or if you ask us to do so in a coming article.

- What if an Asian turbine supplier enters the European market?

- What if governments revisit their ambitions and reduce their targets?

- What if no new technology (e.g. 20+ MW turbine) gets introduced in Europe in the coming 5 years?

- What if the future ‘mega clusters’ lead to much higher wake effects than currently predicted?

- What if a potential game changer appears on the horizon in 2030?

Finally: What if the North Sea is not the end of the story – Europe also has the Baltic Sea which offers great potential!

To find out more about the challenges and opportunities in offshore wind but this time in the Baltic Sea, you can join our upcoming panel debate. With insights from:

- Karol Lasocki, Partner, DWF Poland

- Arkadiusz Sekściński, CEO, PGE Baltica

- Michal Gronert, Senior Engineer Offshore Wind, DNV

- Martijn Maandag, Director Due Diligence, DNV.

Click here to register to attend in person in Warsaw or the livestream from anywhere in the world.

REFERENCES

- WFO, Offshore Wind Report 2022 (Status 2023-04-17) https://wfo-global.org/wp-content/uploads/2023/03/WFO_Global-Offshore-Wind-Report-2022.pdf

- For example the GEWEC Offshore Wind Report 2022 (Status 2023-04-17) https://gwec.net/wp-content/uploads/2022/06/GWEC-Offshore-2022_update.pdf

- GWEC; Global Wind Report 2022 (Status 2023-04-17) https://gwec.net/wp-content/uploads/2022/04/Annual-Wind-Report-2022_screen_final_April.pdf

- IRENA Statistics 2023 (Status 2023-04-17) https://mc-cd8320d4-36a1-40ac-83cc-3389-cdn-endpoint.azureedge.net/-/media/Files/IRENA/Agency/Publication/2023/Mar/IRENA_RE_Capacity_Statistics_2023.pdf?rev=b357baf054584e589c8ab635140d0596

- DNV ETO 2022 - https://www.dnv.com/energy-transition-outlook/about.html

- WindEurope, Statistics (February 2022): https://windeurope.org/intelligence-platform/product/european-offshore-wind-farms-map-public/

- https://windeurope.org/wp-content/uploads/files/policy/position-papers/20230424-Ostend-Declaration-Leaders.pdf

- https://windeurope.org/newsroom/press-releases/eu-leaders-meet-in-ostend-to-agree-rapid-build-out-of-offshore-wind-in-the-north-seas/

5/16/2023 8:00:00 AM