Financing the energy transition: Solar sunrise in the Nordics?

Renewable energy capacity additions continue to beat new records and grew by 50% in 2023 compared to 2022 according to IEA. Last year one country in particular, China, commissioned as much solar photovoltaics (PV) in 2023 as the entire world did in 2022. How are the Nordic countries doing and what does the future hold for the Solar PV industry in the Nordics?

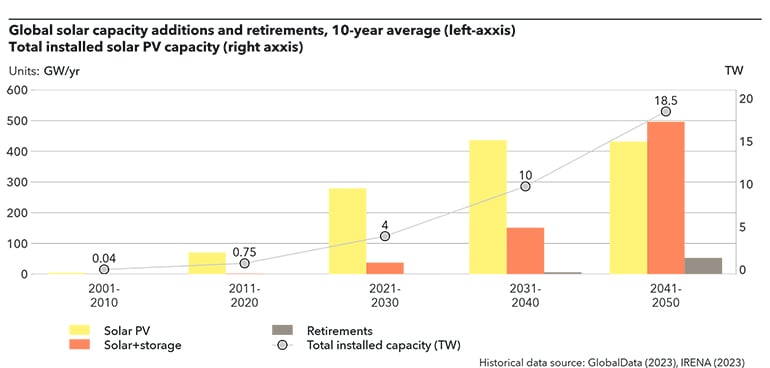

Globally, renewable energy capacity continues to grow each year. In 2023, around 500 GW of new capacity was added, where solar PV accounts for three-quarters of the total additions worldwide. DNV’s Energy Transition Outlook forecast solar PV to grow 13-fold to 2050 compared to 2022 levels, reaching 18 TW of total installed solar PV capacity. In 2050, 28% of this capacity will be in China, while Europe only will have 12% of the total installed capacity, however still quite sizable at 2.2 TW. Southern Europe with lots of sun will certainly attract a significant share of these installations, but how much of the capacity will be installed in the Nordics? That is the question we are going to address in this post.

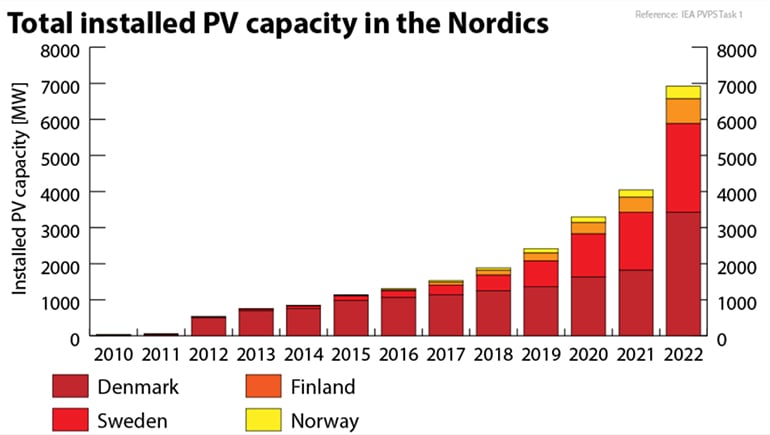

During the recent surge in solar PV installations, the Nordic countries – Sweden, Norway, Finland, and Denmark – have increasingly embraced solar PV technology, defying their northern geographical challenges. Some have utilized robust policies and innovative approaches, while others have been less ambitious and are falling behind compared to their neighbours.

Denmark

Denmark's approach to solar energy is strategic and forward-thinking, previously using support schemes but now operating on market conditions. The annual installed capacity in 2023 was dominated by utility scale PV systems at roughly 60%, followed by rooftop residential and industrial installations of 40%, and with a total installed solar PV capacity of 4.9 GW. The country is rapidly expanding its solar footprint and is expected to reach 11.7 GW by 2030 (Solar Power Europe, 2023), where most of these are expected at utility scale. The government supports solar PV installations through net metering schemes and tax exemptions, making solar energy a viable and attractive option. Denmark's commitment to integrated energy systems and smart grid technologies further enhances the potential of solar PV, integrating it seamlessly into the national energy mix. In 2023, solar PV provided 9% of the electricity into the Danish grid (Electricity Maps, 2024).

Sweden

In Sweden, solar PV installations have grown exponentially. As of 2023, the country had a total installed solar PV capacity of 4.1 GW. This surge is largely attributed to government initiatives such as investment support schemes, which cover up to 20% of the installation costs for solar PV systems. Additionally, the Swedish government offers tax deductions, further incentivizing the adoption of solar energy (Swedish Solar Energy Association, 2023). It is expected that this growth will continue and reach 7.3 GW in 2030 (Solar Power Europe, 2023). In 2023, solar PV provided 1% of the electricity into the Swedish grid (Electricity Maps, 2024).

Finland

Finland's journey in solar energy is characterized by steady progress. The country's installed solar PV capacity reached approximately 1 GW by the end of 2023 and numbers are expected to almost triple by 2030 (Solar Power Europe, 2023). The Finnish government's feed-in tariff scheme ensures a fixed price for solar-generated electricity, providing a reliable revenue stream for producers. Additionally, investment subsidies are available for renewable energy projects, including solar PV installations, further fostering the sector's growth (Finnish Ministry of Economic Affairs and Employment, 2024). In 2023, solar PV provided 1% of the electricity into the Finnish grid (Electricity Maps, 2024).

Norway

Norway, having had plenty of hydropower, only recently began to tap into solar energy. The Norwegian Water Resources and Energy Directorate (NVE, 2024) reported a total installed capacity of around 0.6 GW by the end of 2023. About half of the capacity is installed on households - the rest for industrial and commercial use, with a very limited Utility scale solar. Though modest compared to the other Nordic neighbours, the growth rate of solar PV installations is noteworthy, doubling for the last two years. The Enova support scheme plays a crucial role in this expansion, offering financial aid to households and businesses wishing to install solar PV systems, thereby reducing the initial investment barrier (Enova, 2024). However, with Enova funding being reduced from October 2023, it is unclear if the historic growth rates will continue. In our Energy Transition Outlook, we expect Norway to install a total of 3 GW by 2030. In contrast to some of the Nordic neighbours, Norway must combat snow and challenging soil conditions for utility scale installations. In order to accelerate the uptake, further support is necessary, as expressed by NVE and Statkraft. However, in our Energy Transition Outlook we find that solar PV is probably the only new power source in Norway able to add capacity in the coming years. Wind, hydropower or nuclear require extensive legal and licensing frameworks and they have much longer build times compared to solar PV.

At the COP28 conference in Dubai, participants agreed on tripling the world’s renewable energy capacity, aiming for about 11 TW by 2030. Our Energy Transition Outlook forecasts an increase to about 8 TW by 2030, more than double the current capacity, but still short of the goals set by the parties.

Solar PV technology stands out as the most promising avenue for substantial growth in renewable energy capacity leading up to 2030. This is due to its ability to scale up production in response to increasing demand, thanks to a robust supply chain and manufacturing capabilities. At the same time, wind energy, another significant contributor to additional renewable capacity, faces short-term challenges in expanding its manufacturing output and supply chain quickly enough to exceed existing growth plans.

In the Nordic countries, accelerating the deployment of solar PV could be the quickest way to increase power-generation capacity short-term. Additionally, consumers are willing to invest a significant portion of the initial costs of rooftop solar installations, which no other power generation type can compete with. This also leads to a reduced demand for extensive transmission and distribution capacity, which takes time to develop.

Although the amount of sunlight decreases the further north you get, especially during winter, solar PV can still play a vital role in the Nordic energy mix. When integrated with other reliable energy sources like hydropower, nuclear, and complementary variable wind energy, solar PV can substantially enhance the overall energy production and security of the Nordic grid.

References:

Solar Power Europe 2023, EU Market Outlook for Solar power 2023-2027

Electricity Maps 2024, available at: https://app.electricitymaps.com/

Swedish Solar Energy Association 2024, available at: https://svensksolenergi.se/

Finnish Ministry of Economic Affairs and Employment 2024, available at: https://tem.fi/en/feed-in-tariff-for-renewable-energy

NVE 2024, available at: https://www.nve.no/energi/energisystem/solkraft/oversikt-over-solkraft-i-norge/

Enova 2024, available at: https://www.enova.no/privat/alle-energitiltak/solenergi/

2/6/2024 8:00:00 AM