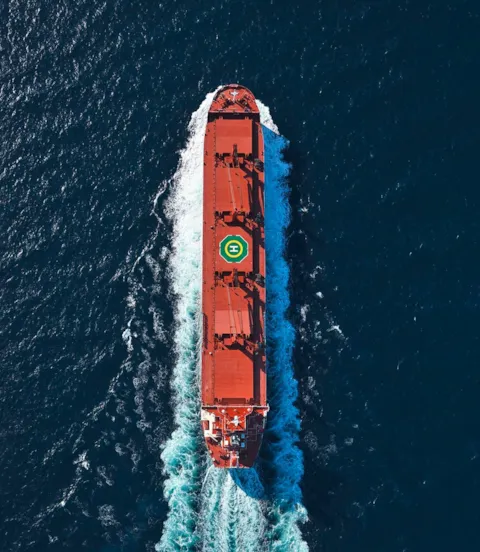

Belships uses ESG reporting to optimize future fleet

Belships has collaborated with DNV to leverage Environmental, Social and Governance (ESG) reporting as a tool to help them optimize their fleet in keeping with tightening emissions requirements and shifting market demands.

The shipowner introduced ESG reporting in 2018. In the maritime world, like other industries, ESG reporting covers topics such as recycling, greenhouse gas emissions, other air pollutants, ecological impacts, business ethics, employee health and safety, as well as accident and safety management. In many cases the E is the most measurable part of ESG in shipping and where pressure is applied from other stakeholders.

“The overall goal was to reduce our carbon footprint. The process started with DNV performing an assessment of our existing fleet and helping us to align operations with the indexes in ESG reporting,” says Belships’ CEO Lars Christian Skarsgård.

“Today our fleet consists mainly of very modern ultramax vessels. Fleet modernization and optimization have accelerated decarbonization and improved Belships’ ability to meet stakeholder expectations on ESG reporting. Expert advice from DNV has proven highly valuable throughout the process,” Skarsgård says.

Using environmental regulations to their advantage

In addition to documenting compliance with ESG, Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Index (CII) requirements, DNV advised Belships on various areas of improvement. “The main focus was on operational measures to optimize vessel performance, like antifouling programmes and engine tuning to reduce emissions and operational costs,” says Morten Løvstad, Business Director – Bulk Carriers at DNV.

“We also advised on technical measures involving retrofitting where this may be appropriate. This allowed them to selectively phase out old ships that would not be able to meet upcoming requirements without significant investments,” says Løvstad. Combined, the initiatives serve to improve the competitiveness of Belships’ fleet and allow them to achieve better resale value for ships going forward, he relates.

“Belships have a technically modern and young fleet. This allows them to perform at a high level today and meet tomorrow’s emissions requirements, but they need to document their position to be able to take advantage of it,” Løvstad says. “This requires an objective evaluation. Expert third-party verification carries more weight when a company is stating its case to customers and partners.”

The pros and cons of limiting engine power

“Overall, I think the biggest consequence of stricter emissions regulations might be on fleet utilization,” Skarsgård says, noting that older ships will have to reduce speed in order to meet new Engine Power Limitation (EPL) requirements. “This is not a real problem if the reduction is minor, but in some cases, speed may need to be significantly reduced as a consequence of the required EPL, and this would have a significant impact on vessel competitiveness, he says.

Securing flexibility to meet future bulk needs

Skarsgård reports that Belships has secured flexible financing for the next 10 years. “I see it as a good thing for the environment that we are flexible. This allows us to sell older vessels and modernize our fleet, but also to retrofit where this is the most effective option for meeting commercial and environmental requirements,” he says.

“We are striving for continuous improvement, and DNV has been helpful with advice on retrofitting, operational improvements including voyage optimization and improved maintenance routines,” Skarsgård adds. “We will move older tonnage and continue to improve our newer ships based on their advice.”

While Belships is optimistic about the green shift, they aim to be realistic as well, he confirms. “Even if the fleet is well equipped today, we count on being able to adapt and change our position as needed.”

Embracing changes in dry bulk

“Our plan is to be active and agile in meeting future requirements. We are optimistic for the adaptability of shipping and markets, but also for our dedicated segment. Dry bulk has always been resilient, even with historically small margins, and I believe this will continue to be the case in response to stricter regulations,” says Skarsgård.

Signs of the rapid development taking place in shipping are already to be seen in segments like the Norwegian coastal trade, he says: “Change has already started to happen there, and that’s a good precursor for the deep-sea trade, so we are following closely.”

“We don’t believe we have all the answers, and we can’t know what the next 10 to 15 years will bring,” Skarsgård sums up. “Our response is to prioritize flexibility and continue to build a modern, sustainable fleet that we measure and adapt according to relevant ESG parameters.”

Erik Mathias Sørhaug

Business Development Director CO2 Shipping

- Igor Kardasov – Shutterstock.com Belships

- Igor Kardasov – Shutterstock.com